“The Food Plaza business is basically all the food services. We see an opportunity there. The Food Plaza business helps in making the brick and mortar business stronger and similarly the Align Retail business which is again a subsidiary manages all the staples business. We also believe that that’s another area that has immense potential and opportunity to make the brick and mortar business stronger and stronger. And then, we have also started up a pharmacy business which again the whole principle is it complements well with the brick and mortar business and hence we are also paying attention to that side of the business.”

-Neville Noronha, CEO & MD

Stock Data

| Ticker | DMART |

| Industry | Retail |

| Exchange | NSE |

Share Price

| Last 5 Days | 2.7% |

| Last 1 Month | 4.3% |

| Last 6 Months | 12% |

Business Basics

Avenue Supermarts Limited, known by its retail brand name “DMart,” is a thriving player in the Indian retail industry. The company’s business fundamentals are built upon a commitment to customer-centric retailing, operational efficiency, and a value-driven approach. At the core of Avenue Supermarts’ business strategy is its chain of retail stores, DMart, which focuses on providing a wide array of quality products at competitive prices. The company offers a comprehensive range of items including groceries, fresh produce, apparel, household essentials, kitchenware, and more. This diverse product portfolio caters to the everyday needs of consumers, making DMart a one-stop shopping destination.

The company places a strong emphasis on supply chain management, inventory control, and cost optimization. This operational discipline allows DMart to maintain a lean and efficient retail model, which is reflected in its ability to offer competitive pricing to customers. Avenue Supermarts places great importance on maintaining a lean and debt-free balance sheet, ensuring financial stability and resilience. The company’s growth strategy includes prudent investments in store expansion, technology adoption, and employee development.

Q1 FY24 Financial Performance

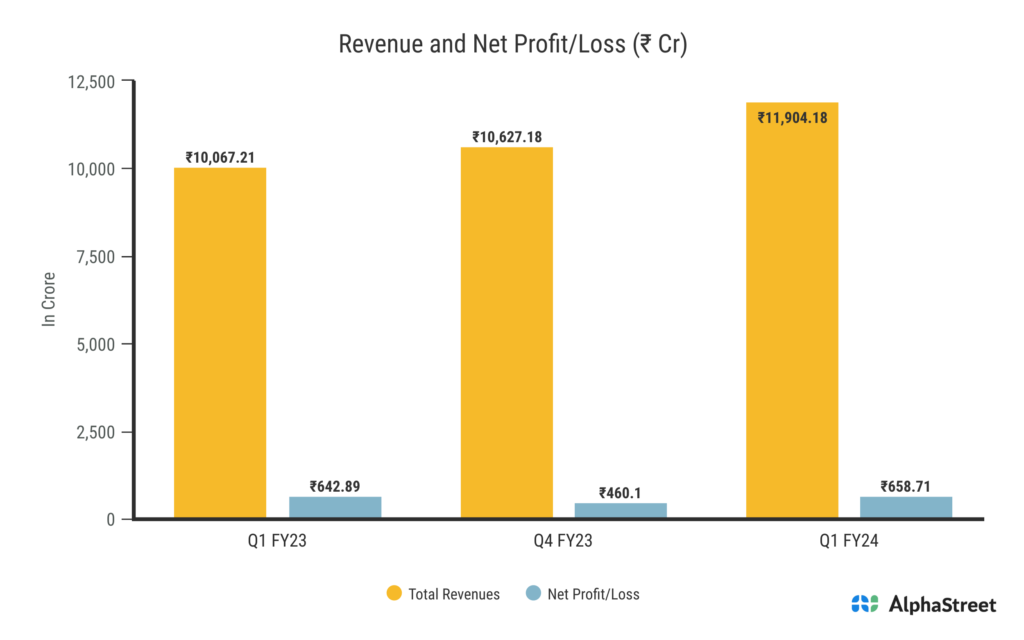

Avenue Supermarts Ltd reported Revenues for Q1FY24 of ₹11,865.00 Crores up from ₹10,038.00 Crore year on year, a rise of 18.2%. Consolidated Net Profit of ₹659.00 Crores up 2.49% from ₹643.00 Crores in the same quarter of the previous year. The Earnings per Share is ₹10.13, up 2.01% from ₹9.93 in the same quarter of the previous year.

Dmart Ready & Store Expansion

In regards to the expansion of their store network and the performance of DMART Ready, the management at Avenue E-commerce Limited, the umbrella company for DMART Ready, provided some insights. They acknowledged that DMART Ready, their e-commerce venture, had expanded into 10 additional cities. However, the incremental revenues generated from these new city locations had not met the management’s expectations. This was attributed to the fact that the current operating model resembled more of a pilot program, indicating that the company was still fine-tuning its approach in these new cities. Despite this, the company maintained a strong belief in the immense potential of grocery e-commerce, particularly in large and densely populated towns.

In terms of physical store expansion, the fiscal year 2022, Dmart opened 50 stores, a figure influenced by delayed openings from the previous year. In 2023, the company successfully launched 40 new stores. The management has acknowledged the challenges in predicting the exact number of store openings due to complexities in real estate strategy.

Retail Industry In India

India’s retail industry is a dynamic and rapidly evolving sector that plays a pivotal role in the country’s economy. It encompasses a wide spectrum of businesses, from small neighborhood kirana (mom-and-pop) stores to large modern retail chains. India’s retail industry is incredibly diverse, with a mix of traditional and modern retail formats. Traditional retail, consisting of millions of small, family-owned stores, continues to dominate the market. These kirana stores have been a part of Indian retail for generations and remain a crucial source of daily essentials for many consumers. However, the landscape is rapidly changing with the growth of organized, modern retail chains like Reliance Retail, DMart, and Big Bazaar. These chains offer a wide range of products and services under one roof, providing consumers with convenience and a modern shopping experience.

Indian retail industry was one of the largest in the world, with a market size exceeding $800 billion. The CAGR of the retail industry in India had been around 10-12% over the past few years, showcasing its resilience and potential. The industry encompasses various formats, including traditional mom-and-pop stores, supermarkets, hypermarkets, ecommerce, and organized retail chains. DMart, operated by Avenue Supermarts Limited, is one of the prominent players in India’s organized retail sector. As of my last update, DMart had established a strong presence primarily in Western and Southern India. While I don’t have access to the most recent data, it’s worth noting that DMart was known for its efficient supply chain, competitive pricing, and customer-centric approach, which contributed to its success.