Avantel Limited, incorporated in 1990, specializes in designing, developing, and maintaining advanced wireless and satellite communication solutions, defence electronics, radar systems, and network management software applications. It primarily serves customers from the aerospace, defence, and strategic communication sectors.

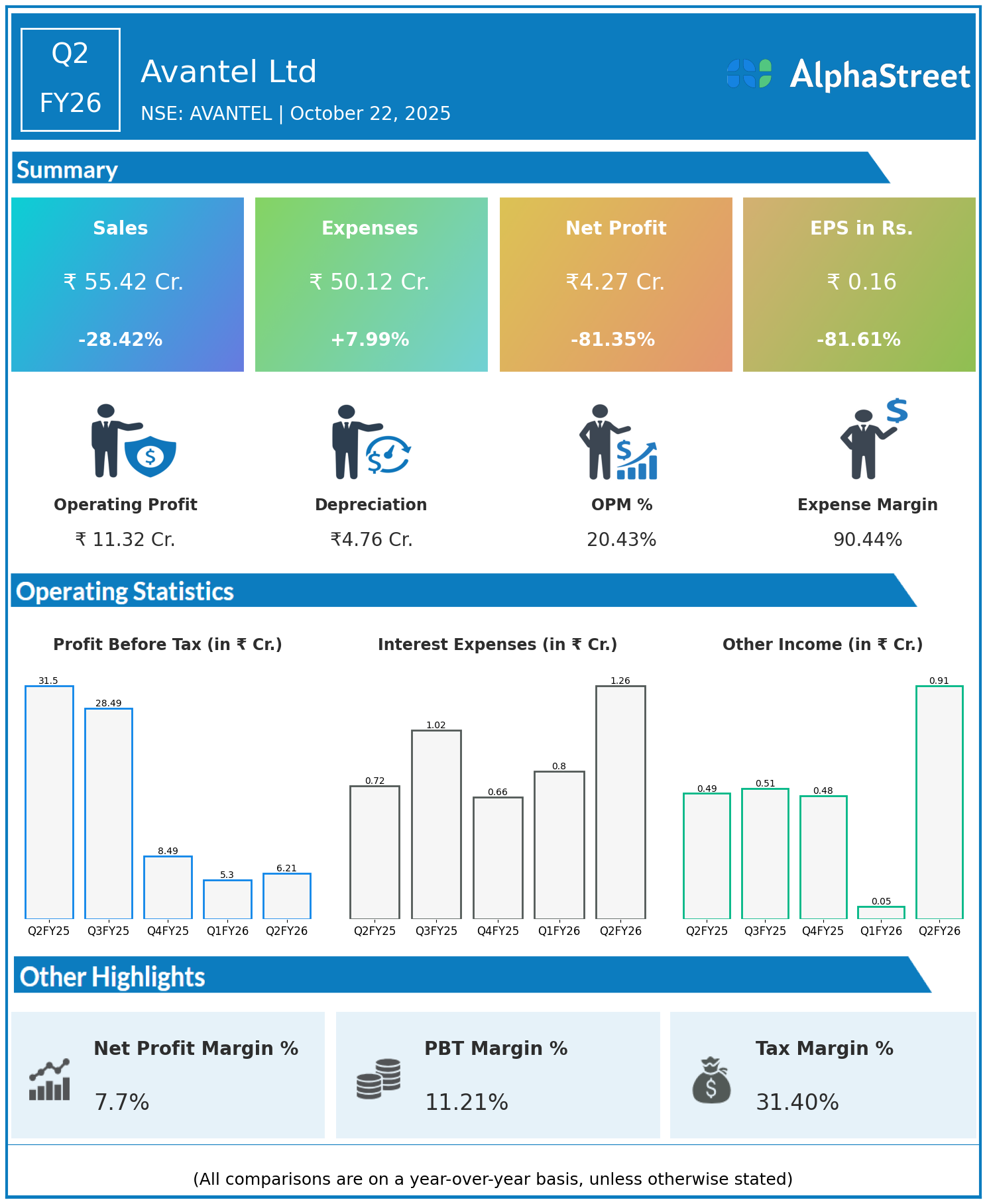

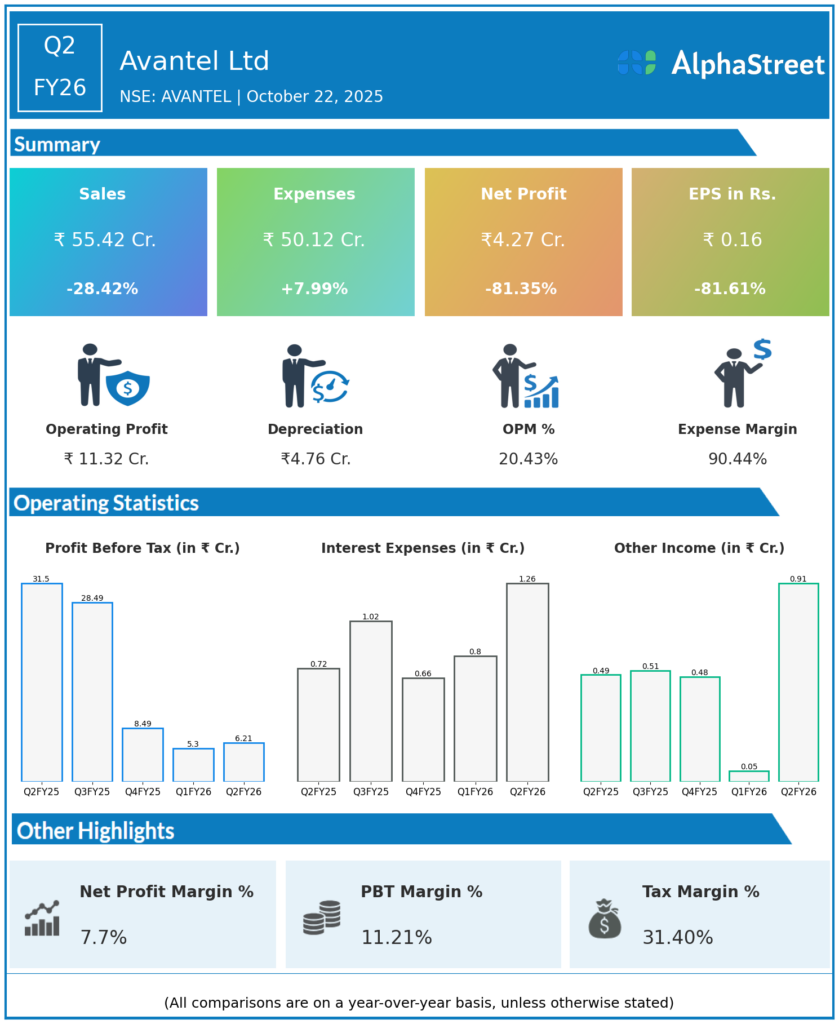

Q2 FY26 Earnings Summary

Consolidated revenue stood at ₹55.42 crore, down 28.42% year on year from ₹77.42 crore.

Total expenses rose 7.99% to ₹50.12 crore from ₹46.41 crore during the same period last year.

Consolidated Net Profit plummeted 81.35% to ₹4.27 crore from ₹22.90 crore in Q2 FY25.

Earnings Per Share (EPS) declined sharply to ₹0.16 from ₹0.87, reflecting one of the weakest profitability quarters in recent history.

EBITDA margins dropped to 20.43% from 44.81% a year earlier, reflecting severe margin compression.

Operational and Business Highlights

The decline in profit and revenue was mainly due to subdued order inflow and execution delays in key defence and satellite communication contracts.

Sales from the Communications and Signal Processing Products segment fell nearly 28% year on year, while the emerging Healthcare segment saw 81% growth, albeit on a small base.

The company’s total cost base increased due to higher interest outgo, rising depreciation costs, and incremental employee benefit expenses tied to R&D and project staffing needs.

Avantel allotted 7,600 equity shares under its ESOP 2023 during the quarter, demonstrating confidence in its long-term growth framework.

Return on capital employed (ROCE) stood at 31.54%, and the debt-to-equity ratio remained healthy at just 0.14, indicating strong capital efficiency and low leverage.

Financial Position and Outlook

Despite the steep short-term profit decline, Avantel continues to maintain a robust balance sheet with total equity of ₹323.64 crore and total assets of ₹388.90 crore as of September 2025.

The company remains optimistic about recovering order flows in the second half of FY26, driven by upcoming government defence contracts and increased demand for satellite-based communication systems.

Management is focused on stabilizing margins through operating cost control, diversification into adjacent verticals, and scaling its defence electronics portfolio.

Avantel Ltd enters H2 FY26 with a cautious outlook but remains well-positioned to capitalize on aerospace and defence opportunities, supported by a strong product pipeline and disciplined financial management.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.