Automotive Axles Limited, established in 1981 as a joint venture between Kalyani Group and Meritor Inc, USA (each holding 35.5% ownership), is a leading manufacturer and supplier of automotive parts. The company serves major domestic and global manufacturers in the trucks and buses segment—including LCV, MCV, HCV, military, and off-highway vehicles. Presenting below are its Q1 FY26 Earnings Results.

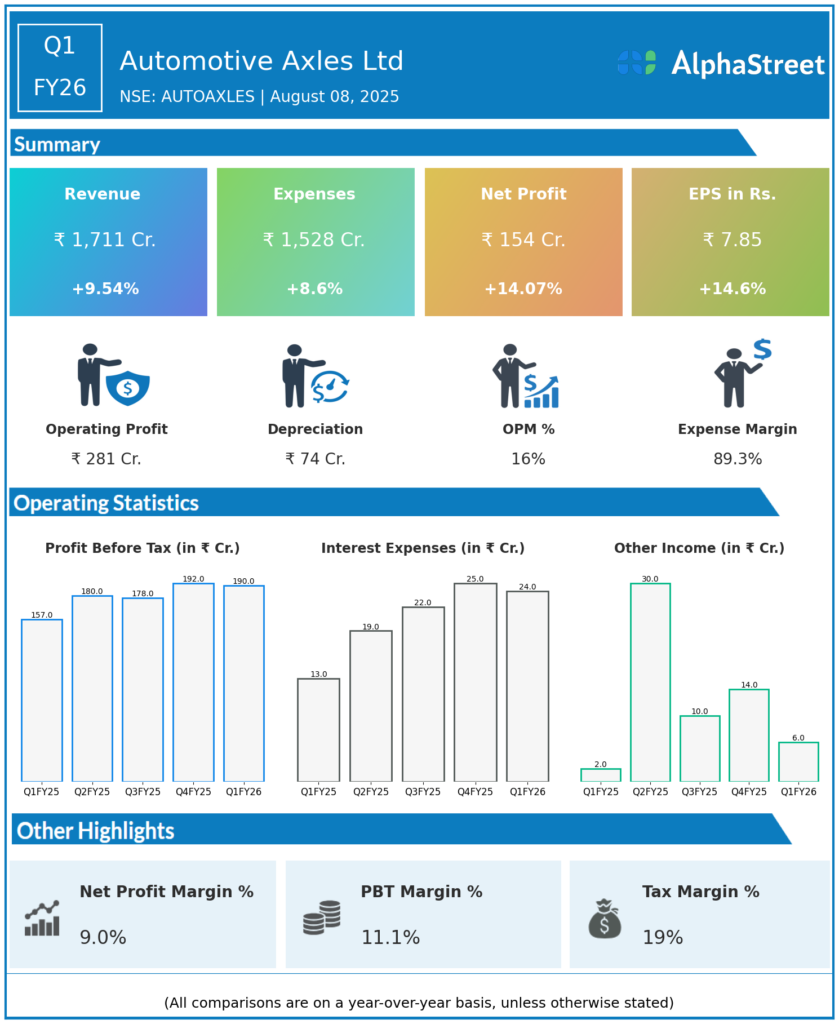

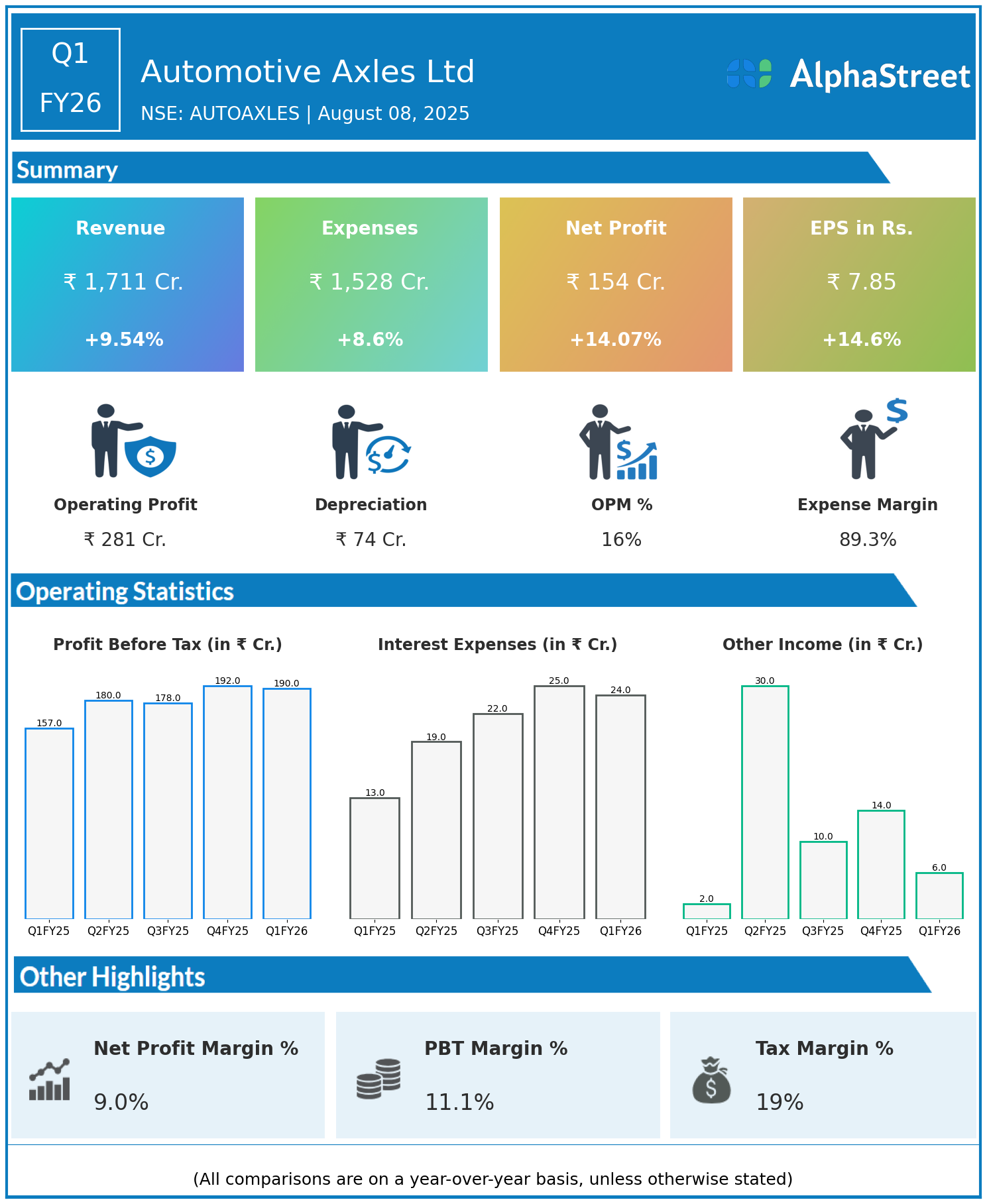

Q1 FY26 Earnings Results

- Revenue: ₹1,711 crore, up 9.54% year-on-year (YoY) from ₹1,562 crore in Q1 FY25.

- Total Expenses: ₹1,528 crore, up 8.6% YoY from ₹1,407 crore.

- Consolidated Net Profit (PAT): ₹154 crore, up 14.07% from ₹135 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹7.85, up 14.60% from ₹6.85 YoY.

Operational & Strategic Update

- Revenue Growth: Growth of nearly 10% was driven by increasing demand from commercial vehicle manufacturers domestically and internationally, reflecting stronger market conditions in the trucks and buses segment.

- Cost Management: Expenses grew moderately and remained well-controlled relative to revenue expansion, supporting margin enhancement.

- Profitability Improvement: Net profit and EPS outpaced revenue growth, indicating operational efficiencies, improved product mix, and effective cost discipline.

- Product & Market Focus: Automotive Axles continues to strengthen its position in axles and driveline components for LCV, MCV, HCV, military, and off-highway vehicle segments, capitalizing on growth in freight, defense, and specialized vehicle markets.

- Joint Venture Benefits: Collaboration with Meritor Inc provides technological support, global best practices, and stronger access to international markets.

- Strategic Initiatives: The company is focused on scaling advanced product development, expanding capacity, enhancing after-market support, and aligning with evolving regulations and customer needs.

Corporate Developments Q1 FY26 Earnings

Q1 FY26 reflects solid growth for Automotive Axles, combining resilient demand with efficient cost management and profitability gains. The company’s ability to serve both domestic and global commercial vehicle OEMs remains a key competitive advantage.

Looking Ahead

Automotive Axles is well-positioned to benefit from continued expansion in the commercial vehicle sector, including opportunities in defense and off-highway segments. Continued innovation, capacity augmentation, and strategic collaborations are expected to drive sustained growth and margin improvement through FY26 and beyond.

To view Automotive Axles ‘s previous results: Click Here