Aurum Proptech Limited, a leading technology-driven real estate company in India, reported impressive Q1 FY24 financial results, with revenues surging to ₹44.16 Crores and a turnaround in EBITDA. The company has diversified its offerings, introduced new products and expanded its ecosystem across technology, services, and capital. Key updates include HelloWorld’s growth in co-living, Aurum Analytica’s success with developers, and Sell.Do’s consistent performance. The acquisition of NestAway marks the eighth strategic move, with plans for operational optimization to drive profitability. Aurum Proptech continues to shape and revolutionize the real estate industry with its dynamic and thriving businesses.

Stock Data

| Ticker | AURUM |

| Industry | Real Estate |

| Exchange | NSE |

Share Price

| Last 5 Days | -2.3% |

| Last 1 Month | -10.1% |

| Last 6 Months | 22.3% |

Business Basics

Aurum Proptech Limited is a new-age technology company that is revolutionizing real estate with an integrated PropTech ecosystem that connects real estate, people, and technology. It offers Software-as-a-Service (SaaS) and Realty-as-a-Service (RaaS) solutions to developers, brokers, and property buyers. The company has an active customer base of approximately 250 B2B SaaS customers and more than 7,000 RaaS customers across 46 cities and towns in India. Aurum Proptech’s platforms hosted more than 30,000 potential buyers, 5,000-plus brokers, and channel partners in the past quarter, enabling the distribution of residential projects of 350-plus developers. The company has seen significant traction in its co-living RaaS offering and has launched a premium co-living cohort called HelloWorld Select, expanding its target customer base. The PropTech ecosystem fosters data-driven real estate financing and investment, boosting business productivity, improving customer satisfaction, and encouraging connected living.

Q1 FY24 Financial Performance

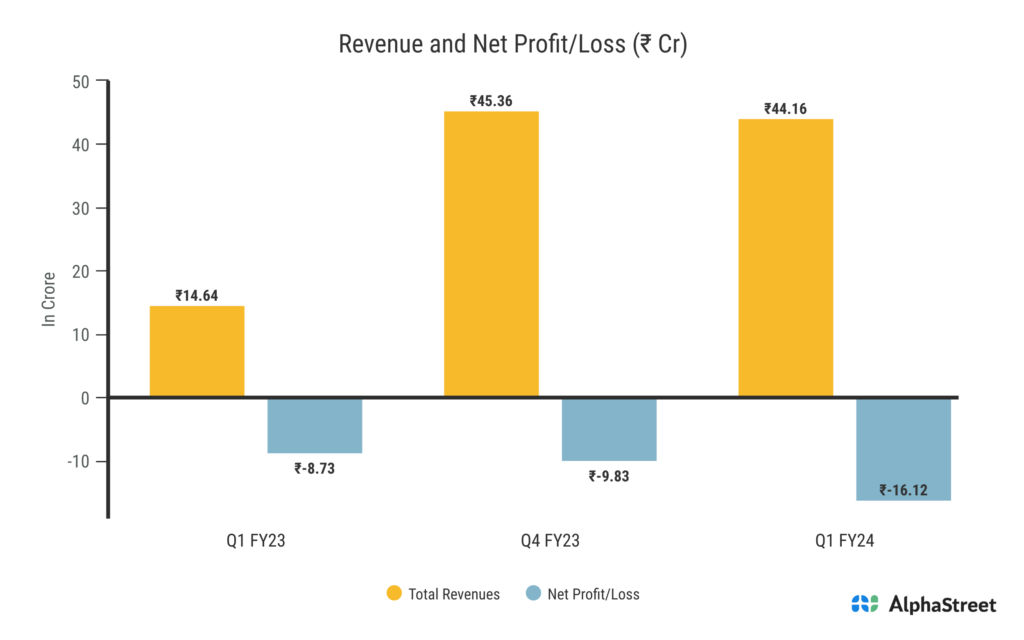

Aurum Proptech Limited reported Revenues for Q1FY24 of ₹44.16 Crores up from ₹14.64 Crore year on year, a rise of 193.33%. The Earnings per Share is -₹1.76, from -₹0.96 in the same quarter of the previous year.

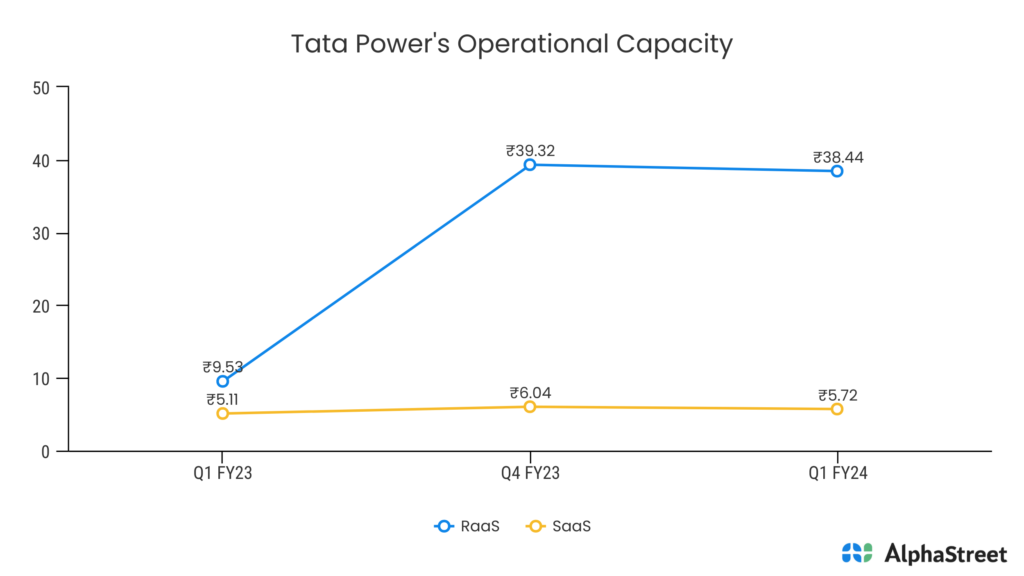

EBITDA for the quarter was ₹1.8 crores, marking a significant turnaround from a negative EBITDA of ₹5.69 crores in the previous year. However, the company reported a loss of ₹16.12 crores for the quarter, compared to ₹8.73 crores in the previous year. SaaS and RaaS revenue for the quarter were ₹5.72 crores and ₹38.44 crores, respectively, demonstrating consistent growth.

To read more about Aurum Proptech’s Financials:

Aurum PropTech’s Expanding Ecosystem

The company introduced three new products: Aurum WiseX, YieldWiseX, and TheOfficeMonk, expanding its reach and offerings in the real estate and PropTech space. Aurum Proptech boasts a diverse and dynamic product portfolio that can be categorized into three distinct types: technology, services, and capital. In the realm of technology, they offer an array of innovative solutions designed to streamline real estate operations. These include Sell.do, a powerful CRM for the real estate sector, and BeyondWalls, a broker aggregation tech platform aimed at simplifying the home buying process. Additionally, they provide Aurum Liv, a transaction platform catering to both primary and secondary sales, as well as Aurum Analytics, a data-driven solution that enhances performance marketing and channel sales. HouseMonk, a rental management SaaS platform with a global customer base, and OfficeMonk, a B2B SaaS product dedicated to commercial property management, round out their impressive tech offerings.

In the services sector, Aurum Proptech stands out with HelloWorld, a co-living company operating in 15 cities. They also spearhead Nest Away, a prominent residential rental platform and PropTech brand in India, demonstrating their commitment to providing comprehensive real estate services. Furthermore, they offer Aurum InstaHome, a transaction platform powered by an Automated Valuation Model (AVM) for precise and efficient property transactions.

Aurum Proptech’s capital offerings encompass InteGrow Asset Management, a data-driven platform focused on managing real estate assets, and Aurum WiseX, a cutting-edge Neo-realty investment platform that empowers investors. Additionally, they provide Aurum Kuber, a home loan SaaS platform that equips real estate buyers with the knowledge needed to make informed decisions regarding home financing. With this comprehensive portfolio spanning technology, services, and capital, Aurum Proptech continues to shape and revolutionize the real estate industry.

| Development | Monetization | Consumption | |

| Technology | Sell.Do, Nest Away, Aurum Analytica, Aurum Liv | HouseMonk, OfficeMonk | |

| Services | HelloWorld, Beyond Walls, InstaHome | ||

| Capital | Integrow | Aurum WiseX, Aurum KuberX |

Key Business Updates

In the latest business updates, HelloWorld has made significant strides with the addition of 29 new properties, resulting in a substantial inventory of 11,195 live beds. Their Annual Recurring Revenue (ARR) has also seen impressive growth, standing at an impressive ₹89.3 Crores. Aurum Analytica, on the other hand, has been actively expanding its reach by signing up 30 new developers and successfully serving 116 projects. Their ARR has reached INR 24 Crores, reflecting their continued success in the industry.

Sell.Do has maintained its ARR at a commendable ₹49.3 Crores, demonstrating their consistent performance in the market. Meanwhile, Beyond Walls has achieved a remarkable feat as Sell.Do secured the #4 spot in the global ranking for Top Real Estate CRM systems and the #7 position in the Easiest to Use category, underscoring their user-friendly and efficient platform. Housemonk boasts a robust sales pipeline, with an ARR exceeding $1.1 million, indicating strong potential for future growth and success.

Lastly, OfficeMonk has made an impressive start by acquiring 6 new clients within the first quarter of its launch, indicating a promising beginning for TheOfficeMonk’s services. These updates reflect the dynamic and thriving nature of these businesses across various sectors.

Acquisition of NestAway and Strategic Growth

Aurum Proptech Company proudly unveiled the acquisition of NestAway during the conference call. This acquisition marks the eighth in the past 24 months, strategically aligned with the goal of addressing unmet needs within the real estate value chain, including technology, capital, and services. With this acquisition, Aurum Proptech believes it has a comprehensive ecosystem to benefit consumers, developers, and intermediaries.

The restructuring journey of NestAway has already begun, with a focus on cultural transformation, unit economics, and customer-centricity. Operational optimization measures include downsizing from 14 cities to 6 cities, reducing the team size from 350 to 195, and monthly salary expenses from INR 2.7 crores to INR 1.3 crores. The objective is to transition NestAway into a lean and profitable organization by the end of the year, paving the way for hyper growth in 2024 and 2025.