Incorporated in 1996, Aurum PropTech Ltd operates in the business of software development and digital technology services for the real estate industry. The company focuses on developing PropTech solutions and digital platforms that enhance real estate transactions, rentals, and property management.

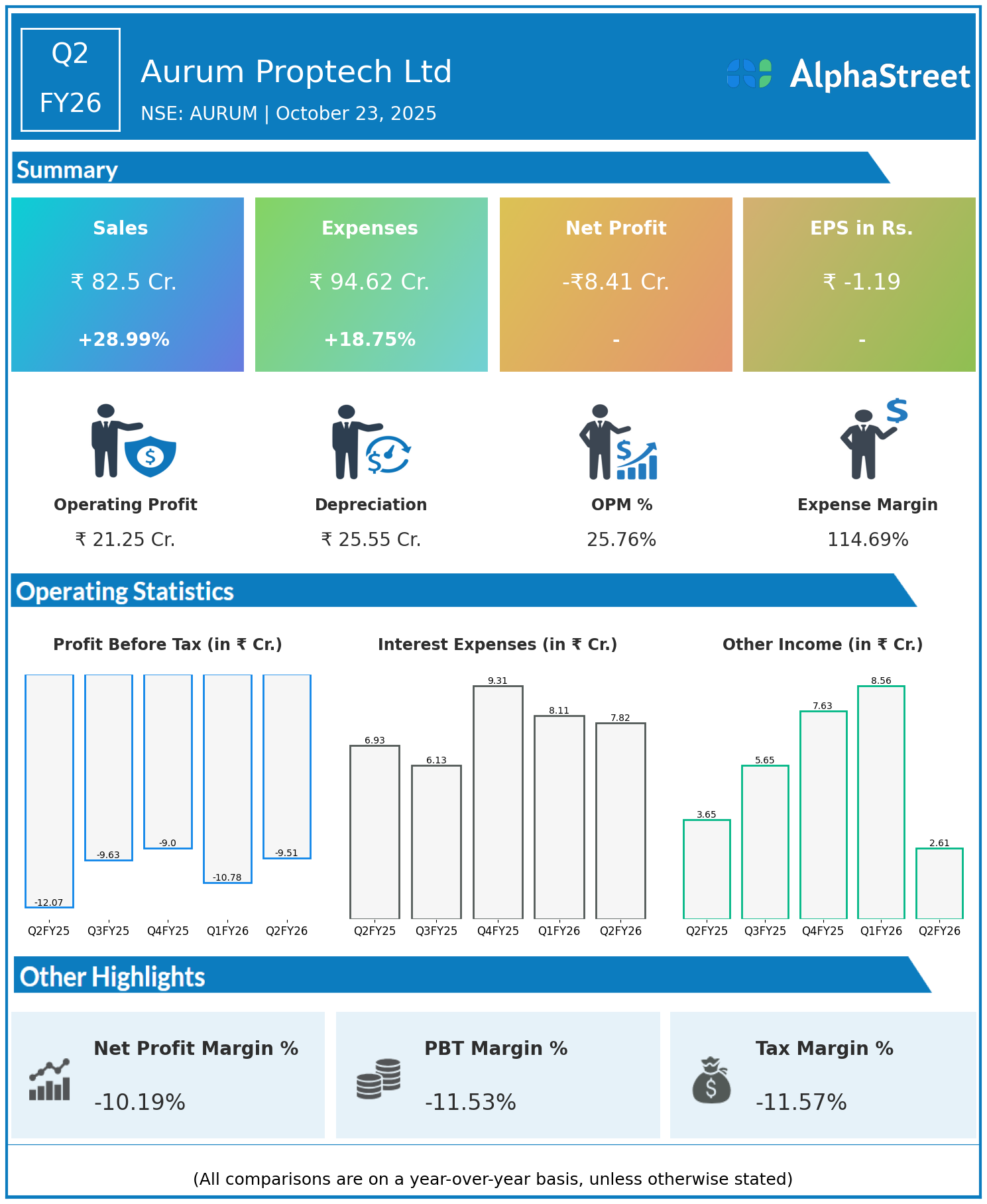

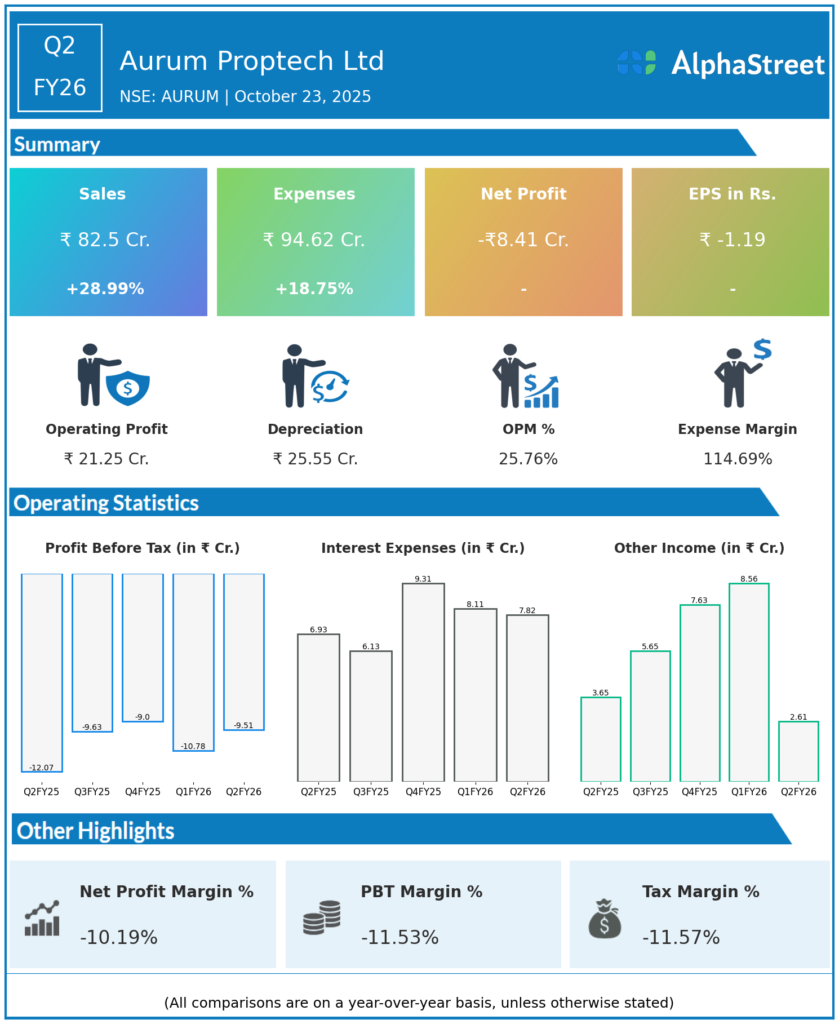

Q2 FY26 Earnings Summary

- Consolidated revenue rose 28.99% year on year to ₹82.50 crore from ₹63.96 crore, driven by growth in distribution and rental businesses.

- Total expenses increased 18.75% to ₹94.62 crore from ₹79.68 crore a year ago.

- Consolidated net loss narrowed to ₹8.41 crore compared to a ₹12.15 crore loss in Q2 FY25, reflecting improved operational efficiency.

- Earnings per share improved significantly to -₹1.19 from -₹3.27 in the corresponding quarter of the previous year.

- Operating margins expanded to 25.76% from 17.06% year on year, showcasing effective cost management.

Operational and Business Highlights

The company recorded its strongest quarterly income since inception, with total income of ₹87.66 crore, marking a 29.7% year-on-year increase.

The Distribution segment, powered by Sell.do and Aurum Analytica, grew 62% year on year through AI-led product innovation and expanding client reach.

The Rental business achieved 25% growth, led by HelloWorld’s scaling operations and NestAway’s fourfold revenue run-rate increase, along with the UAE launch of the Nestr platform.

On the investment side, Aurum PropTech acquired an additional 8.2% stake in K2V2 Technologies, increasing its total holding to 90.14%, while divesting a minor 0.6% stake in Integrow Asset Management.

Management initiated groundwork for launching its first Small and Medium REIT asset, ensuring compliance and strategic readiness before rollout.

Financial Position and Outlook

Aurum PropTech remains focused on balancing growth and profitability across its ecosystem of real estate digital platforms.

While depreciation (₹25.5 crore) and interest (₹7.8 crore) continue to weigh on the net results, the company’s strong revenue performance and margin gains underscore a solid operational turnaround.

Management highlighted its commitment to disciplined capital deployment and plans to achieve breakeven by FY27 through scaling high-margin PropTech solutions.

Aurum PropTech Ltd continues its evolution from a real estate services provider to a full-stack PropTech platform, leveraging AI-driven digital innovation and sustainable growth strategies for FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.