Aurum Proptech Limited (NSE: AURUM) is a new-age technology company that is revolutionizing real estate with an integrated PropTech ecosystem that connects real estate, people, and technology. The PropTech ecosystem fosters data-driven real estate financing and investment, boosting business productivity, improving customer satisfaction, and encouraging connected living.

Previously, the business provided insurance technology services under the name Majesco Limited. Aurum Group bought the promoter’s stake in Majesco to develop it as a property technology company. Upon receiving shareholder approval for the name change in September 2021, Majesco was rebranded as Aurum Proptech. The company is leveraging technology and its domain experience in building India’s first real estate technology ecosystem.

Aurum Proptech’s Product Line by Segments

Investment & Financing

- InteGrow Asset Management- Data-Driven Asset Management Platform focused on Real Estate.

- Aurum Infinity- Fractional ownership platform for commercial real estate.

Enterprise Efficiency

- Sell.do- A CRM for Real Estate which was acquired in 2021.

- Aurum Sea- Sound Emotion Analyser data science product for sentiment analysis.

- Aurum Crex- Customer Relationship Experts’ is a technology-enabled integrated fulfillment centre.

Customer Experience

- BeyondWalls- Broker Aggregation Tech Platform for a simplified home buying experience.

- Aurum Liv- Real Estate transaction platform for primary and secondary sales.

- Aurum AVM- Automated Valuation Model a Data science product for estimation of property value.

- Aurum LSE- Lead Scoring Engine Data science product for mapping consumer behaviour.

Connected Living

- HouseMonk- Rental Management SaaS Platform with customers in India and abroad.

- HelloWorld- Co-living company with a 15-city operation.

- Aurum Kuber- Home Loan SaaS Platform that enables real estate buyers to take informed decisions on home financing.

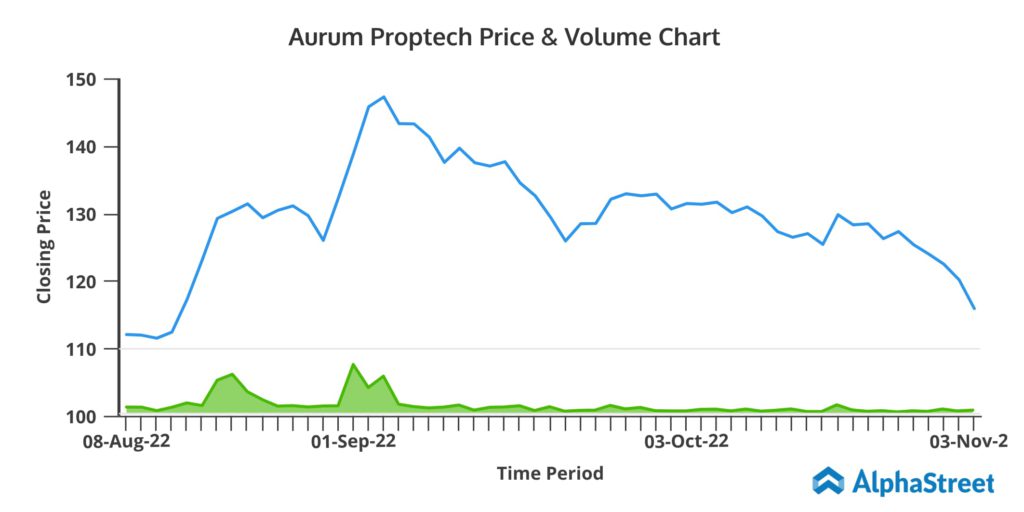

Recent Share Price Insights

- The share price was closed at ₹116 as of November 3, 2022, with a one-year high of ₹162.

- The stock has increased by nearly 24% in 6 months and 68% over the year.

- Results were announced on October 18th. The stock has decreased by almost 11% since that time.

Financial Performance

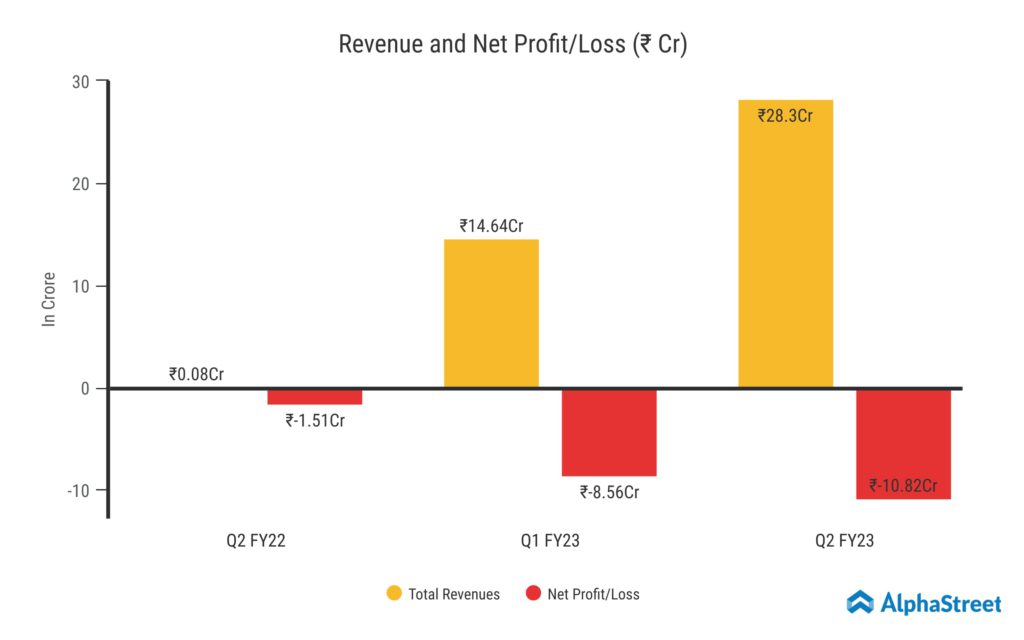

Aurum Proptech Limited reported a Revenue from Operations of ₹28.30 Crores in Q2 FY23, a significant boost from ₹0.08 Crore from the same quarter previous year. The Revenue was driven by the Real Estate as a Service (RAAS) Segment which surged to ₹23.57 Crore. The Consolidated Net Loss for the business was -₹10.82 Crore. The Earnings per Share was -₹2.24 for Q2 FY23.

Recent Highlights

In November 2022, Aurum PropTech introduced the “Entrepreneur-in-Residence” (Aurum EIR) program. Ashish Deora, Founder and Chief Executive Officer of Aurum Proptech, said “The Indian PropTech landscape presents a USD 100 billion opportunity for the new age entrepreneurs. Having built successful enterprises in various industries, Aurum understands the skill and energy that entrepreneurs bring to the table in building and scaling up businesses. Aurum is an ideal platform for them to build and own and be a force multiplier with us.”

Developments in Products/Services

Integrow Asset Management, a RaaS product in the Investment & Finance segment, has applied for a PMS licence to expand in real estate investments. It has also completed its first data-driven lending in the form of a NEIS. The other RaaS Product BeyondWalls has a 5% market share in Pune and dominates the primary residential sale market there. It has sold 3600 units since its launch and has a monthly sale of almost 350 units. HelloWorld, a connected living RaaS solution has achieved market leadership in the student living segment of Kota city. It is present in more than 15 Indian cities and has partnerships with more than 120 corporations. Additionally, it continues to be a significant player in the Bangalore, Pune, and NCR rental markets.

Sell.do, a SaaS on enterprise efficiency, continues to be the market leader in the real estate CRM space in India. As of Q2 FY23, the platform has relationships with 600 real estate developers across the country. TheHouseMonk platform, which is active in more than 15 countries, has continued to expand its SaaS business in the South-East Asian market. It has catered to 47 rental property owners and managed almost 28,000 Rental Units & 60,000 tenants worldwide. Currently, the platform handles $6.9 million in rental revenue each quarter.

The expansion of Aurum’s user base and market share for its products and services should increase Revenue for both its SaaS and RaaS segments.

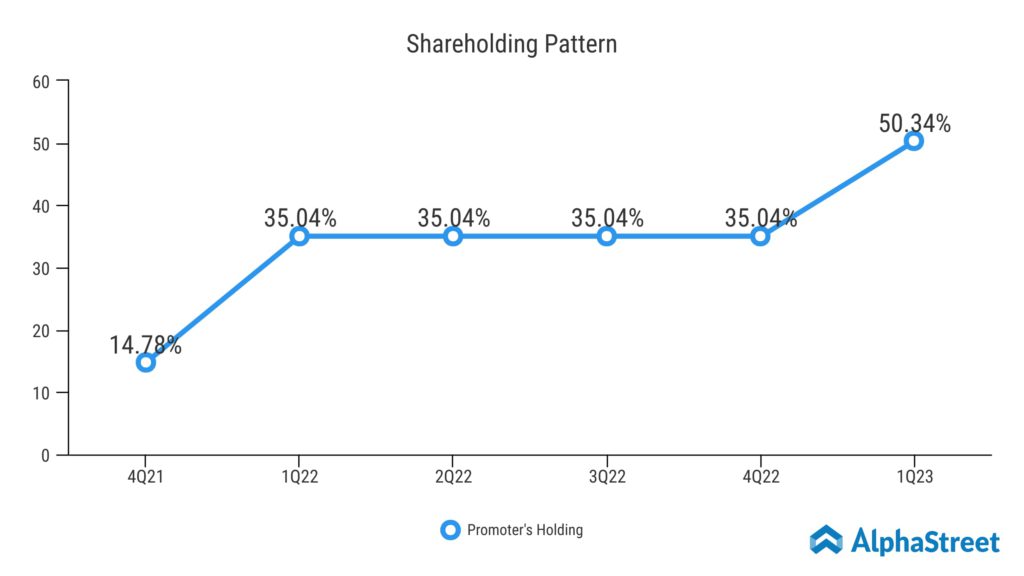

Aurum Proptech’s Increased Promoters Shareholding

On June 20, 2021, the real estate developer Aurum Group acquired the promoter’s 14.78% stake in Majesco (now Aurum Proptech). In Q1 FY22, the Group increased its shareholding to 35.04% through an open offer. Following the completion of its Rs 343.55 crore rights issue, the shareholding jumped to 50.34% from 35.04%. The rights issue was brought in to help Aurum PropTech become even stronger and to give it financial flexibility for capturing future growth in accordance with its strategic plan.

Real Estate Industry Analysis

Demand for both commercial and residential spaces has improved recently in India. The much-needed infrastructure for India’s expanding needs is being provided by the significantly expanding retail and hospitality industries. By 2030, the real estate market is predicted to grow to $1 trillion from $200 billion in 2021. In 2030, it is anticipated to make up roughly 10% of the country’s total GDP. Given India’s fast economic growth, this sector is likely to expand due to favourable demographics, changing lifestyles, rising per capita income, and increasing standards of living.