Aurobindo Pharma Limited is an Indian pharmaceutical company. It was established in the year 1986. The founders include Mr. P.V. Ramprasad Reddy, Mr. K. Nityananda Reddy and a small group of highly committed professionals. The company started its operation in the year 1988-89 with a single unit manufacturing Semi-Synthetic Penicillin (SSP) at Pondicherry.

The company is mainly focused on R&D and innovation. Aurobindo Pharma ranks second in India in Pharmaceutical Industry. 90% of revenues derived by Arobindo Pharma are from international operations. The company has exported business in 150+countries. It mainly deals with generic drugs, over-the-counter drugs, vaccines, diagnostics, contact lenses and animal health. The vision of the company is “to become a leading and an admired global pharma company, ranked in the top 25 by 2030”.

Country of operation

The company is headquartered in HITEC City, Hyderabad, India. It has expanded its generic drug market in new territories like Poland, Italy, Spain, Czech Republic, Portugal and France.

Product Portfolio

The company has its presence in key therapeutic segments which includes neurosciences, cardiovascular, anti-retrovirals, anti-diabetics, gastroenterology and cephalosporins.

Company Strategies

The company focuses on R&D. It has 5 R&D centres spread over 16000 square meters. It has 3 R&D centres in USA with 1700+ scientists & analysts. It has world class talent and it has launched multiple affordable products across multiple Therapeutic areas.

Key Financial Highlights

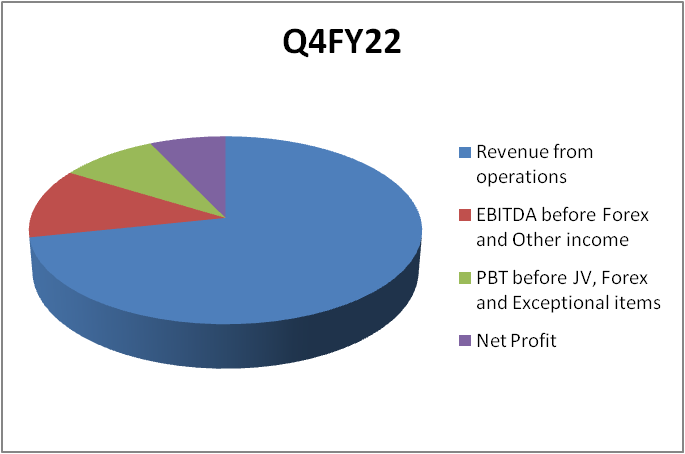

| Amount (INR Cr) | Q4FY22 | Q4FY21 | Change YoY |

| Revenue from operations | 5,809.40 | 6,007.10 | -3.3 |

| EBITDA before Forex and Other income | 974.4 | 1,276.30 | -23.7 |

| PBT before JV, Forex and Exceptional items | 740.8 | 1,055.70 | -29.8 |

| Net Profit | 576.1 | 802 | -28.2 |

Financial Snapshots

Revenue from Operations decreased by 3.3% to at 5,809.4 Crores. The EBIDTA before Forex and Other income stood at INR 974.4 Cr and the margin for the quarter is 16.8 %. Net profit has declined to 576.1 crore from 802 crore compared to prior the quarter. Research & Development (R&D) spend in FY 22 is Rs 1,581 which is 6.7% of revenue. In Q4 FY 2022 Basic & Diluted EPS is Rs 9.84 per share.

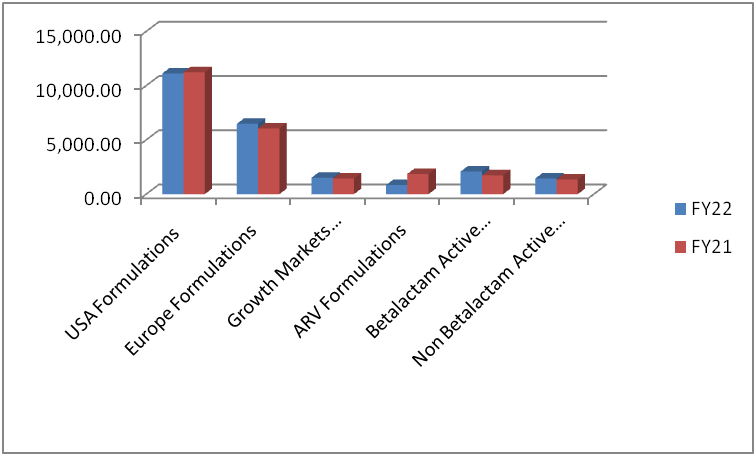

Analysis of Revenue on basis of segment

For US formulation the revenue shows a decline of 1% YoY to INR 11,122.1 Crores. In Q4 the revenue shows a decline 4.7% y-o-y. In Europe the revenue grew by 6.9% YoY to INR 6,480.3 Crores. However, Q4 FY 2022 was relatively flat at INR 1,540.7 Crores. ARV business revenue shows a decline of 55.3% YoY to to INR 1,862.8 Crores. However, in Q4, business revenue declined 52% YoY to INR 235.9 Crores. For Growth market revenue grew 4.6% YoY to INR 1,503.9 Crores on the other hand, Q4 posted a growth of 28% Y-O-Y. The Active Pharmaceutical Ingredients posted revenue of INR 3,515.6 Crores with a growth of 13.9% YoY.

Regulatory Approvals

Aurobindo Pharma has filed 14 ANDAs including 3 Injectables with USFDA in Q4 FY22. However, it has received final approval for 3 ANDAs including 2 injectable products. For FY 2022 the company filed 727 ANDAs with USFDA and received approval for 505 ANDAs and 33 are still tentative. The final approval of ANDA includes Colchicine Tablets, USP used as an Anti-Inflammatory Agent, Doxercalciferol Injection used as an Anti-Parathyroid Agent and Esmolol Hydrochloride in Sodium Chloride Injection (gBrevibloc) mainly used as a Cardio Vascular Drugs.

Operational Efficiency

Aurobindo Pharma has moved with phase 1 clinical trial with immunology assets and expects that it will be in the top three products by 2024-25 with a $4 billion potential market opportunity. Most of the clinical trials are in the review procedure, however the company anticipates that if everything goes well then Q1 2023 would be a potential launch into the Indian market.