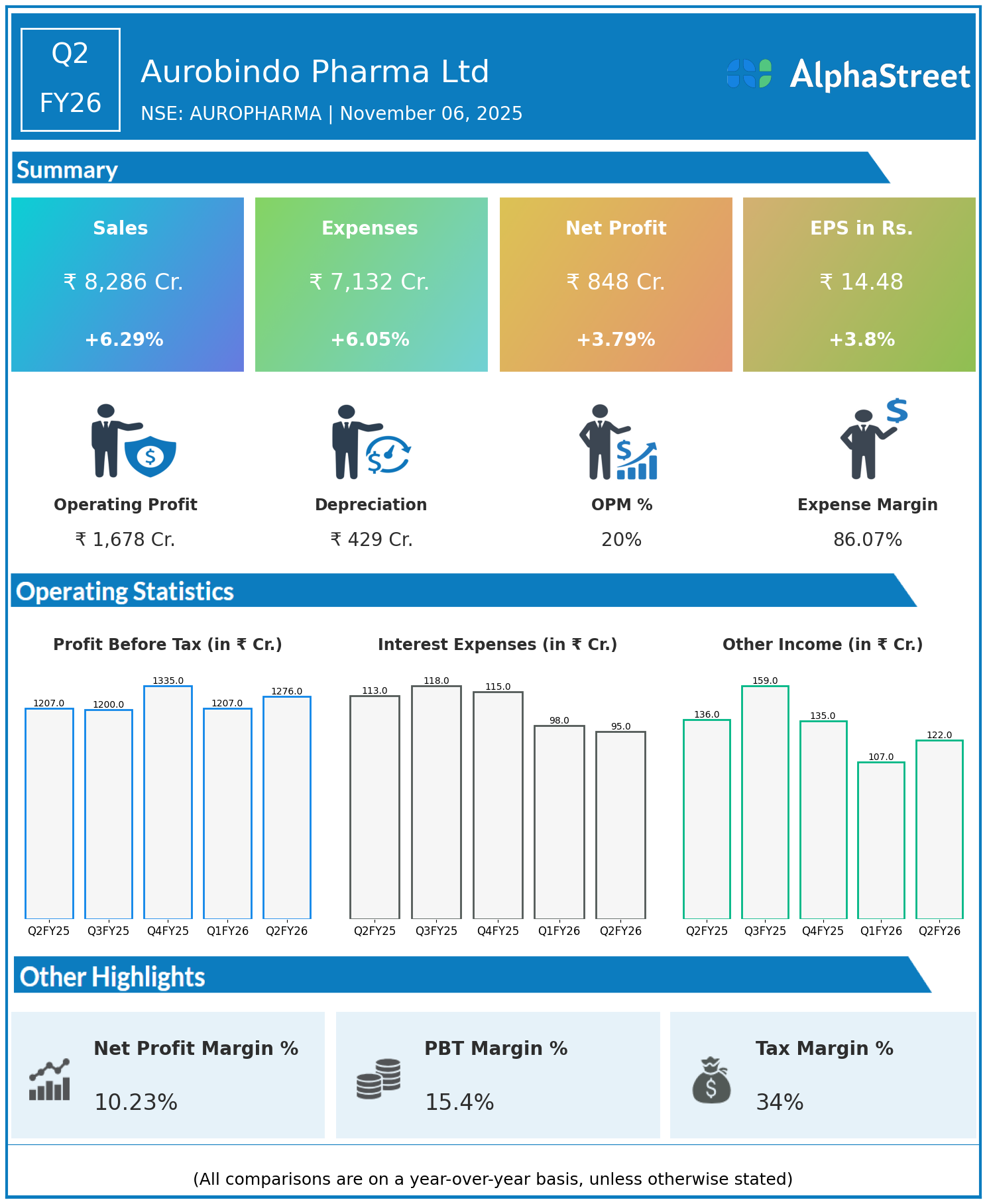

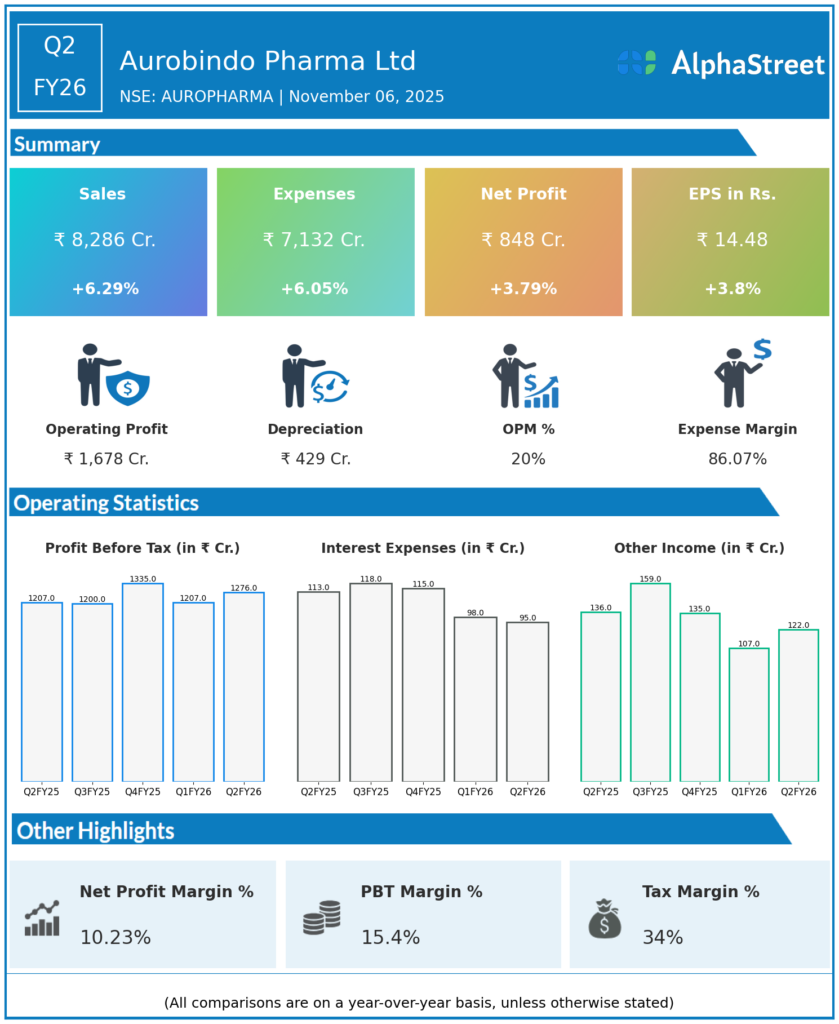

Aurobindo Pharma Ltd, a leading pharmaceutical company focused on active pharmaceutical ingredients and generic pharmaceuticals, reported a steady Q2FY26 financial performance with revenues rising 6.3% year-on-year to ₹8,286 crore. Consolidated net profit increased by 3.8% to ₹848 crore, reflecting resilience in key markets such as the US and Europe.

Key Highlights:

- Revenue Growth: Revenues for Q2FY26 rose to ₹8,286 crore from ₹7,796 crore in the prior year.

- Profit: Net profit grew modestly to ₹848 crore from ₹817 crore.

- EPS: Earnings per share increased 3.8% to ₹14.48.

- Market Performance: US formulations contributed 43.9% of revenues, growing 3.1%. European markets saw 17.8% growth, while growth markets increased 8.7%.

- EBITDA and Margins: EBITDA increased 7.1% to ₹1,678 crore, with a 20.3% margin.

- R&D: Continued focus on innovation with ₹414 crore spent on research and development.

- Strategic Remarks: Management highlighted balanced growth and profitability with ongoing strategic initiatives on track.

Financial Highlights:

- Revenues for the quarter rose 6.29% year on year to ₹8,286 crore, up from ₹7,796 crore.

- Total expenses increased by 6.05% to ₹7,132 crore compared to ₹6,725 crore last year.

- Consolidated net profit grew 3.79% to ₹848 crore, higher than ₹817 crore for the same quarter previously.

- Earnings per share increased by 3.80% to ₹14.48 from ₹13.95.

The company continues to benefit from steady demand in key regulated markets including the US and Europe. Operational efficiencies and a diverse product portfolio have helped maintain profitability amid evolving industry dynamics.

Strategic Outlook:

Aurobindo Pharma is focused on leveraging its R&D capabilities and market diversification to sustain growth. Its commitment to innovation, compliance, and expanding global footprints positions the company well for long-term value creation in the competitive pharmaceutical landscape.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.