Aurobindo Pharma Limited is a key player in the pharmaceutical industry. It manufactures and markets active pharmaceutical ingredients (APIs), generic pharmaceuticals, and related services. The company supports global healthcare with a broad product portfolio that serves both developed and emerging markets.

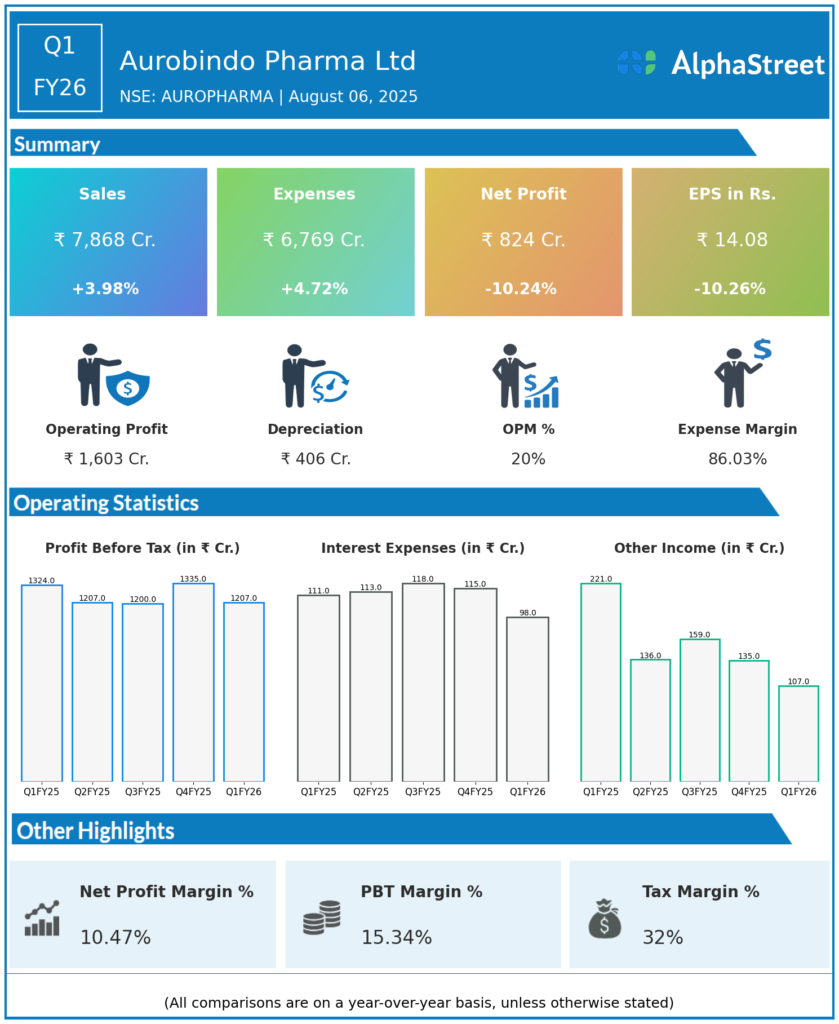

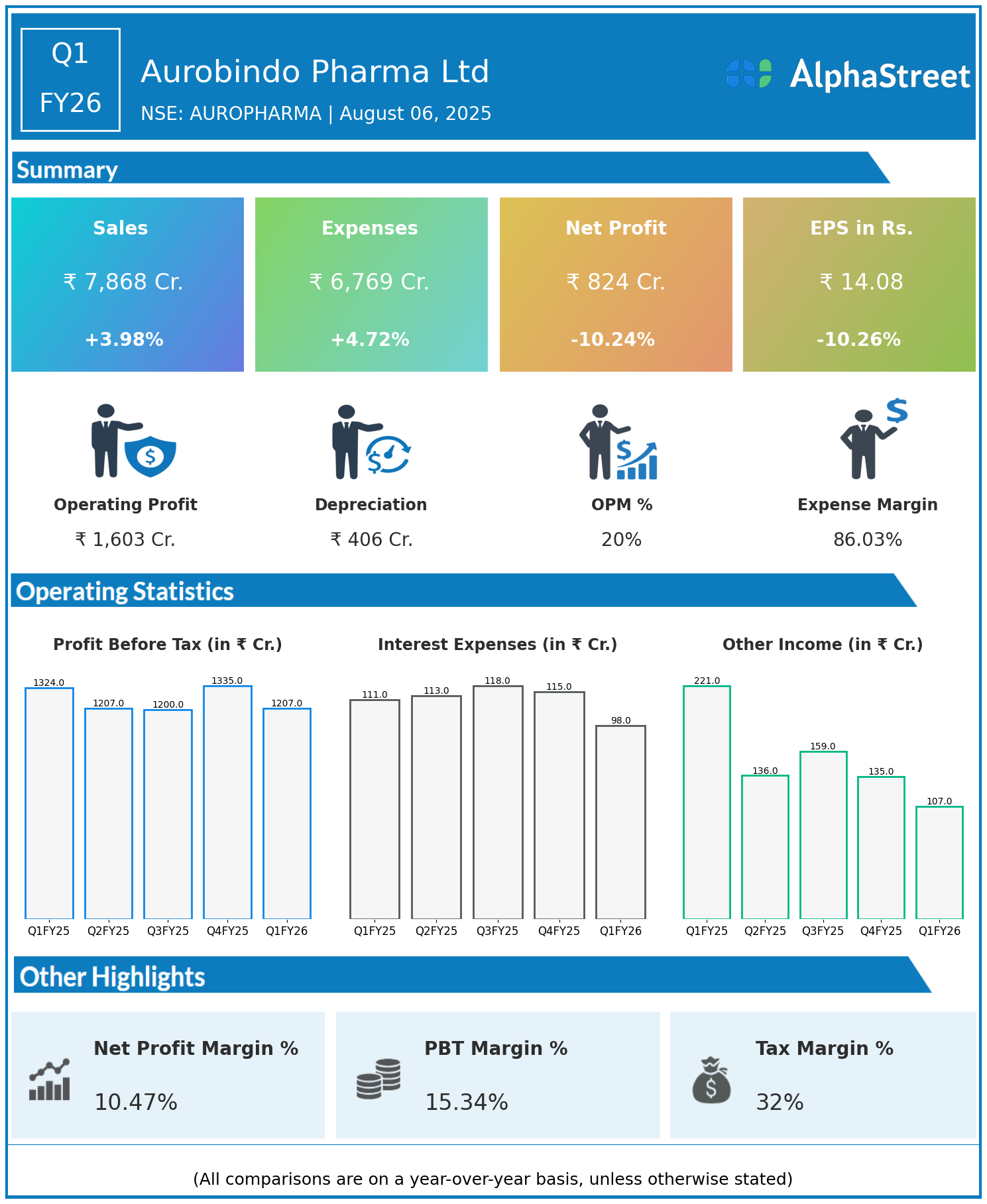

In Q1 FY26, Aurobindo Pharma reported revenue of ₹7,868 crore, up 3.98% year-on-year (YoY) from ₹7,567 crore in Q1 FY25. Total expenses rose 4.72% YoY to ₹6,769 crore from ₹6,464 crore. However, consolidated net profit (PAT) declined 10.24% to ₹824 crore from ₹918 crore. Earnings per share (EPS) also dropped 10.26% to ₹14.08 compared to ₹15.69 YoY.

Operational and Strategic Update

The modest revenue growth was driven by stable sales in key markets and strong demand for generics and APIs. This reflects continued end-market demand for essential medicines alongside new product launches. However, total expenses grew faster than revenue due to higher input costs, increased investment in research and development (R&D), and elevated operational expenses. These cost pressures reduced operating margins.

The double-digit decline in net profit and EPS highlights margin challenges, likely due to rising production costs and less favorable product mix or pricing. Aurobindo Pharma remains focused on portfolio optimization by diversifying products and maintaining leadership across multiple therapeutic areas in both regulated and semi-regulated markets. Regulatory compliance, manufacturing excellence, and supply chain efficiency continue to be central priorities.

R&D and Pipeline Development

The company is investing steadily in R&D to support its product pipeline for the US and global markets. These efforts are key to driving future growth and new product launches.

Strategic Initiatives

Aurobindo is working to improve operational efficiency, control manufacturing costs, and expand into specialty and value-added products. These initiatives aim to strengthen long-term competitiveness and profitability.

Corporate Developments and Outlook

Q1 FY26 results reflect industry challenges such as cost inflation and competitive pricing, even though demand remains healthy. The company’s operational focus and innovation are essential for navigating the evolving pharmaceutical landscape.

Looking ahead, Aurobindo Pharma is committed to expanding its pipeline, enhancing regulatory compliance, and optimizing costs. By concentrating on high-growth markets, improving operations, and investing in R&D and manufacturing capacity, it aims to sustain growth and create value for shareholders through FY26 and beyond.

To view the company’s previous earnings, click here