Aurobindo Pharma Limited (NSE: AUROPHARMA) is a pharmaceutical company based in Hyderabad, India. The company was founded in 1986 and has since grown to become one of the largest pharmaceutical companies in India, with a presence in over 150 countries. Aurobindo Pharma produces a wide range of generic and specialty pharmaceutical products, including active pharmaceutical ingredients, finished dosages, and biotechnology products. The company has a strong focus on research and development, and has several state-of-the-art manufacturing facilities in India and Europe. The company’s product portfolio includes treatments for a variety of therapeutic areas, including cardiovascular disease, CNS disorders, anti-retrovirals, and anti-malarials.

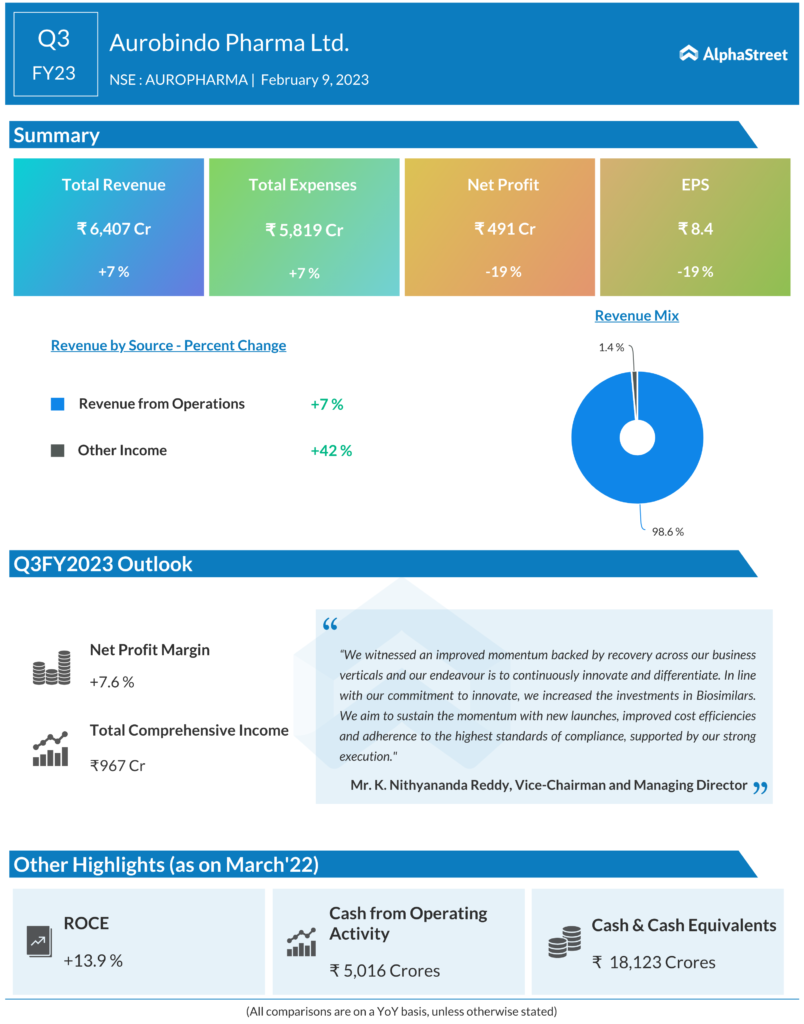

Aurobindo Pharma has released its Q3FY23 financial results. The company reported a revenue from operations of Rs 6,407.1 crore, which represents an increase of 6.7% YoY. The US formulation revenue showed a growth of 9.3% YoY to reach Rs 3,001.2 crore, while Europe formulation revenue increased by 0.4% YoY to Rs 1,701.2 crore. The growth markets revenue experienced a growth of 25.7% YoY, reaching Rs 498.9 crore. Additionally, the company’s ARV revenue improved by 61.3% YoY to reach Rs 251.2 crore. The API revenue was reported at Rs 954.6 crore.

The company’s EBITDA before forex and other income was reported at Rs 954.4 crore, with an EBITDA margin of 14.9%. The quarter saw an accelerated spend in research and development, with R&D spend amounting to Rs 415.2 crore, or 6.5% of revenues. The company received final approval for 15 ANDAs, including 4 injectable products, from the US FDA. The net profit for the quarter stood at Rs 491.2 crore, an increase from the previous quarter’s net profit of Rs 409.4 crore. The Basic & Diluted EPS for the quarter was Rs 8.38 per share. The company’s board has approved an interim dividend of 300%, or Rs 3 per equity share of Rs 1 for the year FY23.

In a statement, the Vice-Chairman and Managing Director of the company, Mr. K. Nithyananda Reddy, expressed his satisfaction with the company’s performance and stated their commitment to continuously innovate and differentiate. He mentioned that the company has increased its investments in Biosimilars and aims to sustain its momentum with new launches, improved cost efficiencies, and adherence to high standards of compliance.