Aurionpro Solutions Ltd, established in 1997, provides business solutions in transaction banking platforms, customer experience (ACE Platform), smart city and smart transportation solutions, and cybersecurity. The company primarily serves the banking industry in India and internationally with software products and consulting services. Presenting below its Q1 FY26 Earnings Results.

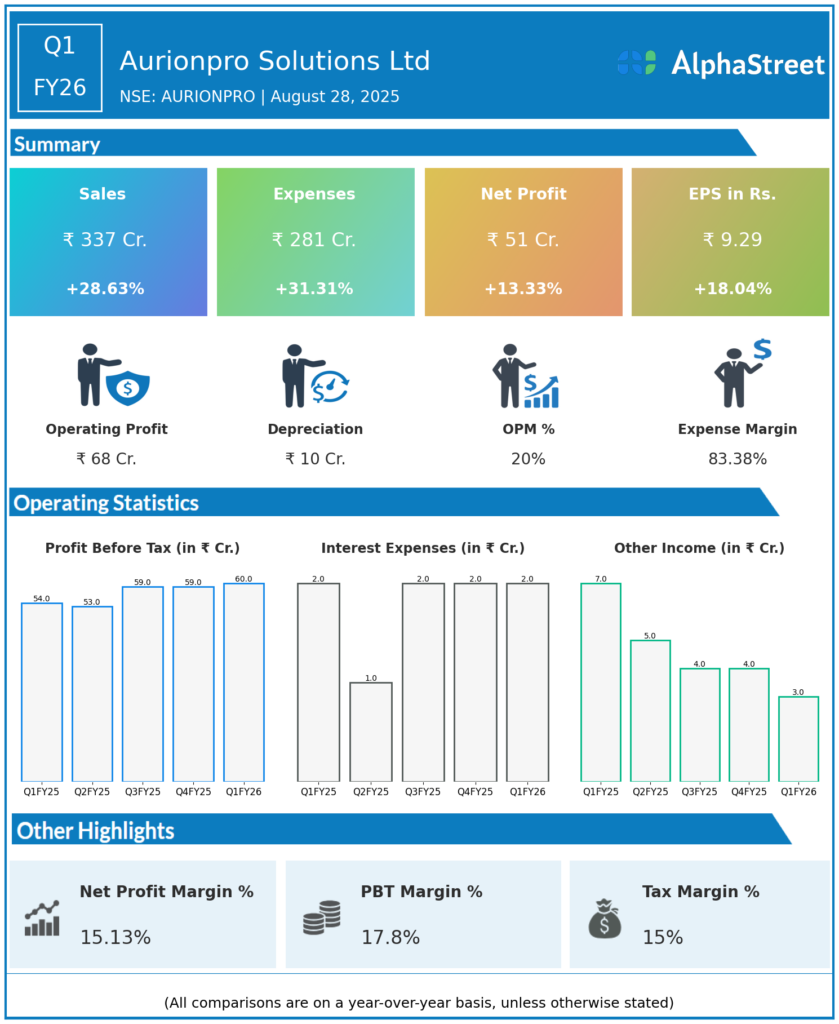

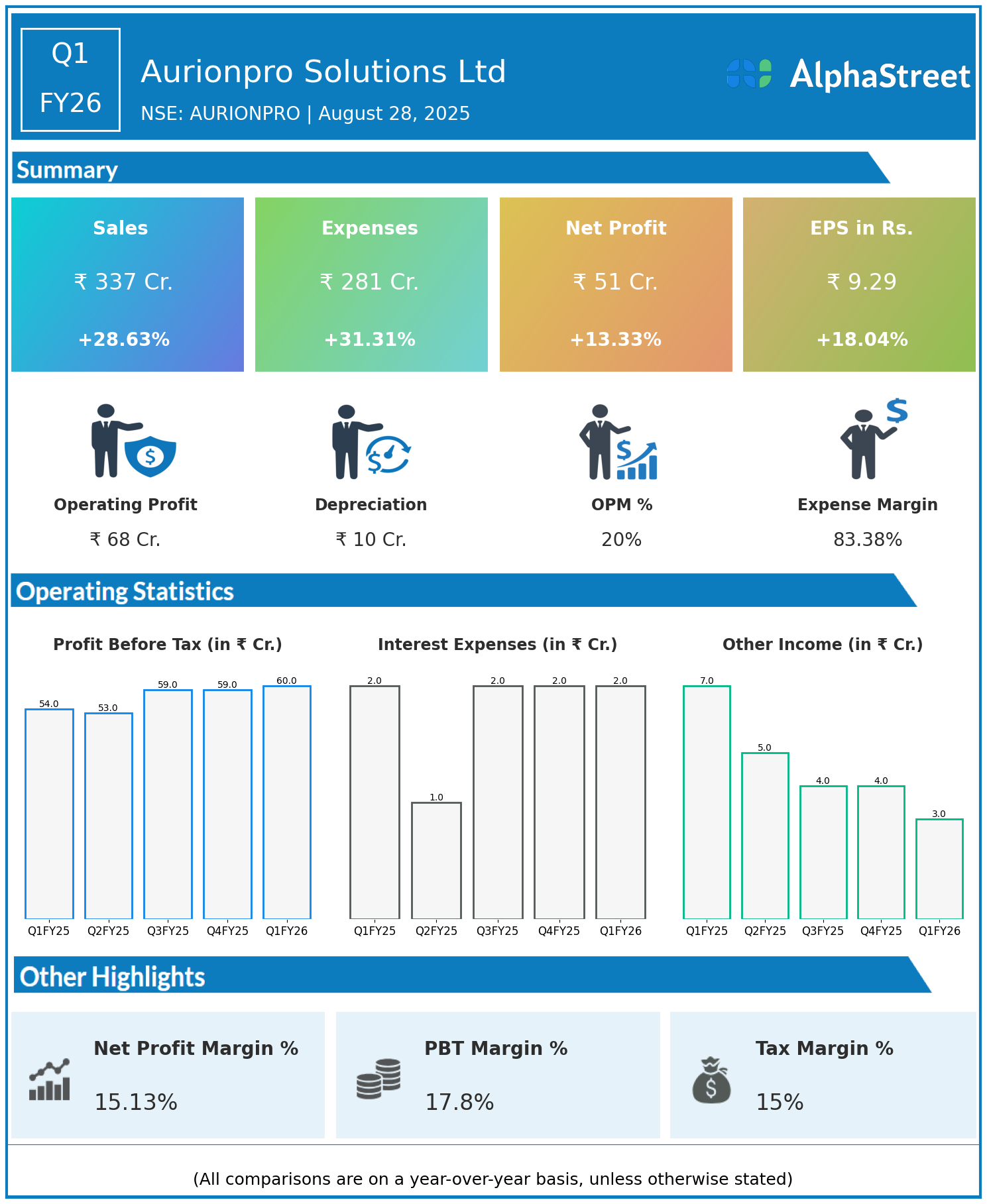

Q1 FY26 Earnings Results

- Revenue: ₹337 crore, up 28.63% year-on-year (YoY) from ₹262 crore in Q1 FY25.

- Total Expenses: ₹281 crore, up 31.31% YoY from ₹214 crore.

- Consolidated Net Profit (PAT): ₹51 crore, up 13.33% from ₹45 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹9.29, up 18.04% from ₹7.87 YoY.

Operational & Strategic Update

- Strong Revenue Growth: Revenue rose nearly 29%, driven by expanded adoption of its banking and smart city solutions.

- Expense Rise: Expenses increased by over 31%, slightly outpacing revenue growth but managed to sustain profitability.

- Profit Improvement: Net profit and EPS grew by over 13% and 18% respectively, reflecting operational efficiency amid expense growth.

- Market Position: Aurionpro continues to strengthen its presence in business solutions for banking and technology-driven urban initiatives.

- Strategic Focus: The company is focusing on expanding product offerings, enhancing cybersecurity services, and growing its international footprint.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results highlight Aurionpro’s solid growth trajectory with improving profitability supported by revenue gains and strategic investments.

Looking Ahead

Aurionpro Solutions Ltd aims to maintain growth momentum by investing in technology innovation, expanding consulting services, and broadening its client base across digital banking and smart city domains.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.