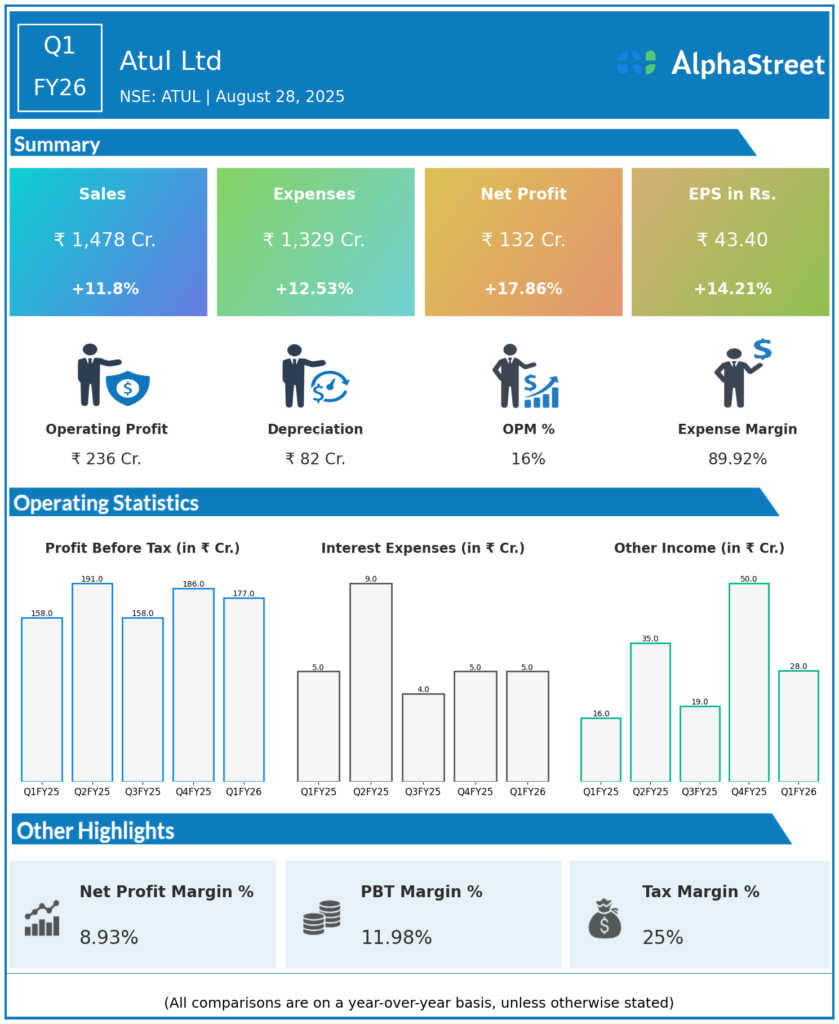

Atul Ltd is a diversified and integrated Indian chemical company, part of the Lalbhai Group, Gujarat, with products spanning Life Science Chemicals and Performance & Other Chemicals used across various industries. Presenting below its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹1,478 crore, up 11.8% year-on-year (YoY) from ₹1,322 crore in Q1 FY25.

- Total Expenses: ₹1,329 crore, up 12.53% YoY from ₹1,181 crore.

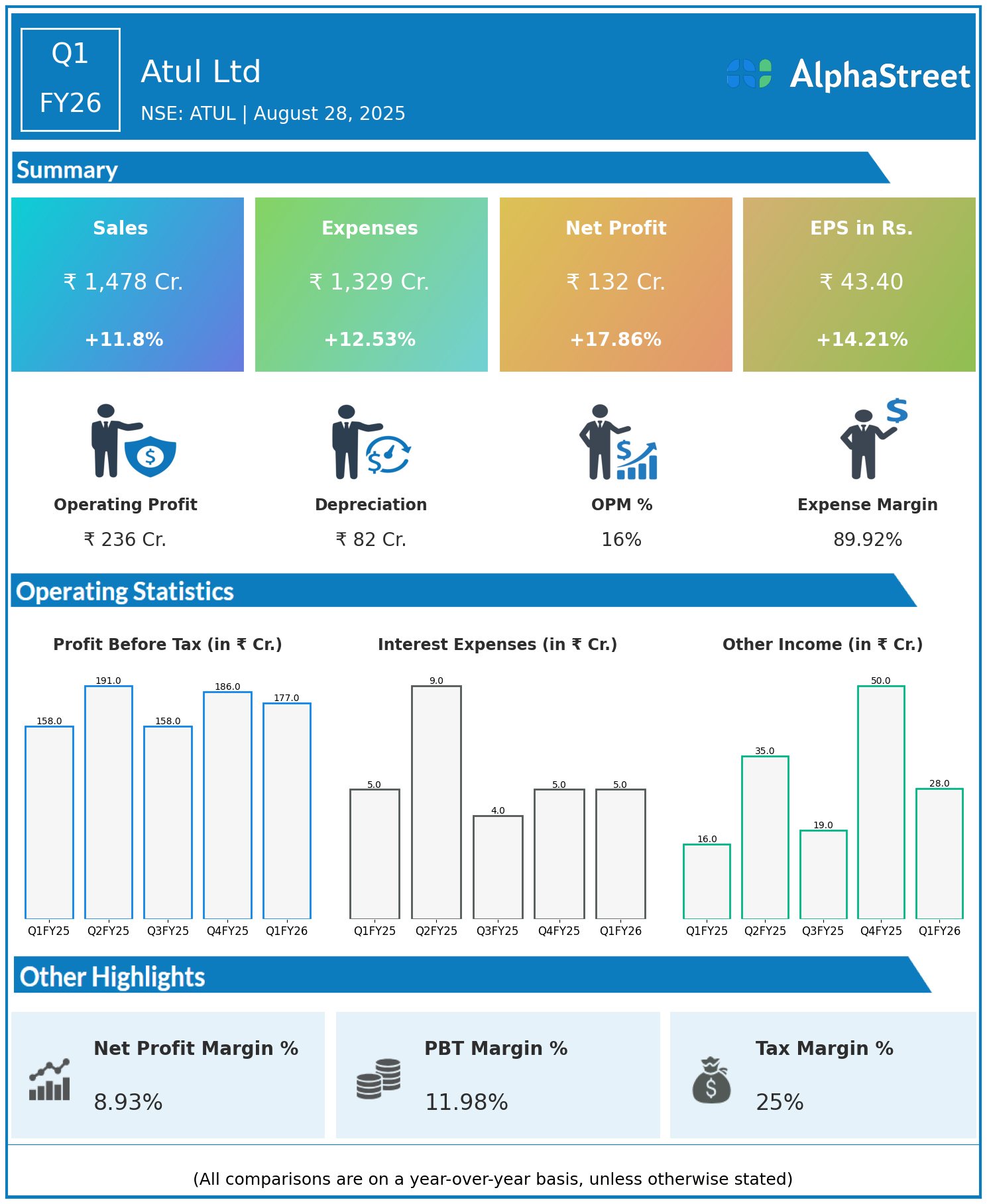

- Consolidated Net Profit (PAT): ₹132 crore, up 17.86% from ₹112 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹43.40, up 14.21% from ₹38.00 YoY.

Operational & Strategic Update

- Solid Revenue Growth: Revenue grew by nearly 12%, highlighting healthy demand for Atul’s diversified chemical products spanning life sciences and performance chemicals.

- Expense Increase: Total expenses rose somewhat more than revenue, reflecting input cost trends and operational scaling.

- Strong Profit Growth: Net profit and EPS increased substantially, with net profit up nearly 18%, indicating improved margins and efficient operations.

- Market Position: Atul Ltd retains a strong position across chemical industry segments, supporting varied end-user industries.

- Strategic Focus: The company emphasizes innovation, portfolio diversification, and process improvement to support growth and competitiveness.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results showcase Atul Ltd’s robust and balanced growth in revenues and profits, supported by both core segment expansion and operational discipline.

Looking Ahead

Atul Ltd aims to leverage its integrated business model and diversified portfolio to drive sustainable growth, innovation, and margin improvement across life science and performance chemical segments.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.