Atul Ltd. is one of India’s most diversified and integrated chemical companies, and a leading member of the Lalbhai Group, Gujarat. The company delivers specialty and commodity chemicals to global and domestic markets through its Life Science Chemicals and Performance & Other Chemicals segments, spanning nine business verticals.

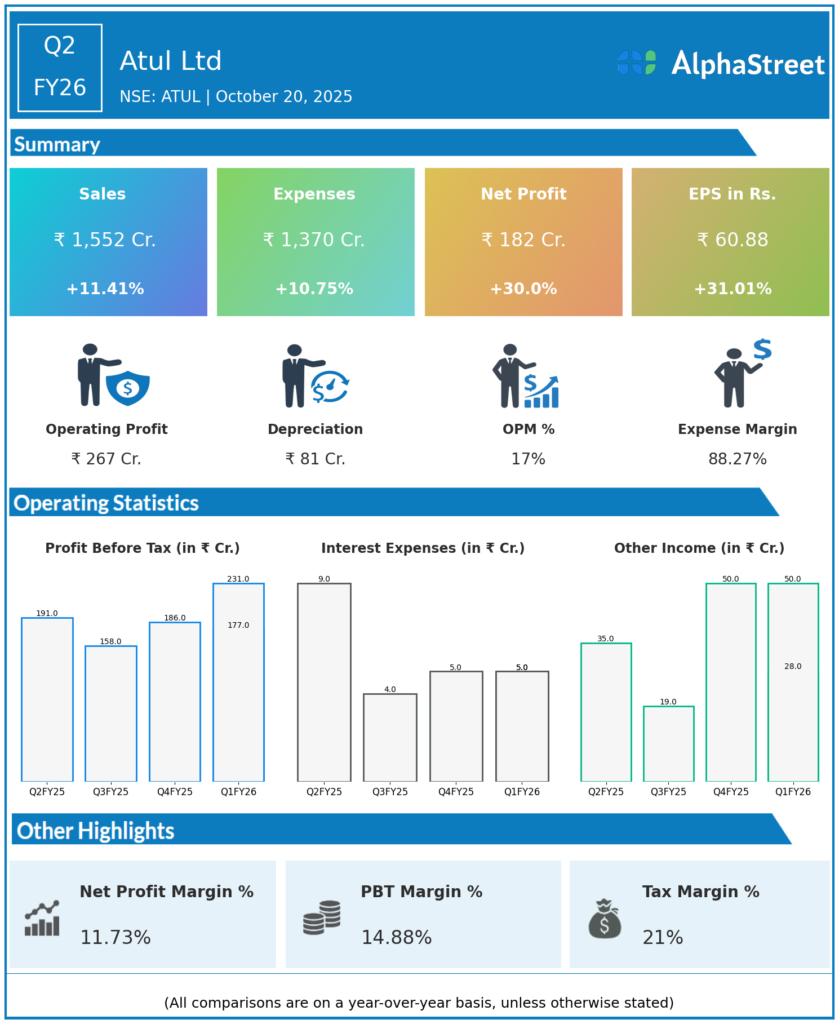

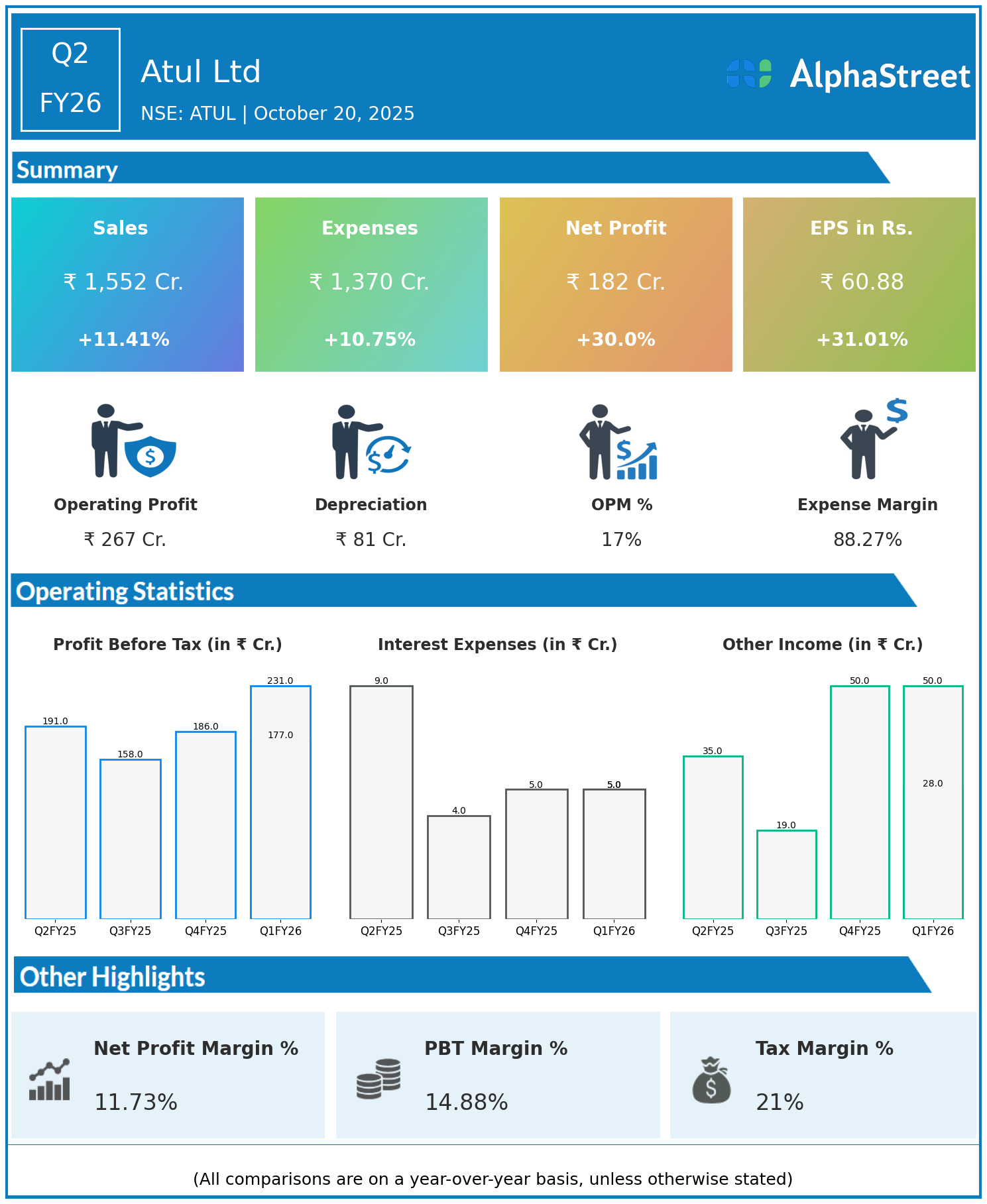

Q2 FY25 Earnings Summary (Jul–Sep 2025)

- Consolidated total income for Q2 FY25 was ₹1,600.35 crore, demonstrating consistent double-digit year-on-year growth.

- Profit after tax (PAT) for the quarter stood at ₹182.37 crore, marking a strong 31% rise over the prior year’s quarter.

- Earnings per Share (EPS) reached ₹58.53, reflecting disciplined financial management and robust demand for both segments.

- Life Science Chemicals segment reported quarterly revenue of ₹439.97 crore, while Performance & Other Chemicals contributed ₹1,145.11 crore to consolidated turnover.

Operational Excellence and Segment Performance

- Atul Ltd. has maintained momentum in both core chemical segments, ensuring steady volume increases and effective cost controls through process innovation and operational efficiencies.

- The strategy of balancing increased raw material costs with optimized sourcing and improved plant productivity has strengthened operating margins.

- Strategic investments in research and development have enabled new product introductions and improved competitiveness, while controlling employee and finance costs.

Corporate Strategy and Growth Initiatives

- The company has expanded its specialty chemicals portfolio and international reach, supporting sustained revenue and profit growth.

- Ongoing capacity expansions in critical intermediates and value-added chemicals are progressing to drive long-term growth.

- Atul emphasizes sustainable manufacturing, green chemistry, and resource optimization to minimize environmental impact.

Financial Position and Outlook

- Atul Ltd. concluded the quarter with a strong balance sheet, solid asset base, and robust equity, positioning itself for further expansion.

- With consistent segment growth, a diversified business model, and a strong culture of innovation, Atul Ltd. remains well-placed to extend its industry leadership in the remainder of FY25 and beyond.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.