Atlanta Electricals Ltd, incorporated in 1983, is one of India’s premier manufacturers and suppliers of power, auto, and inverter duty transformers. The company caters to the transmission and distribution segments through a broad range of products, including 315 MVA, 400 KV transformers, and 400 KV bus reactors, serving clients across 19 states and multiple union territories.

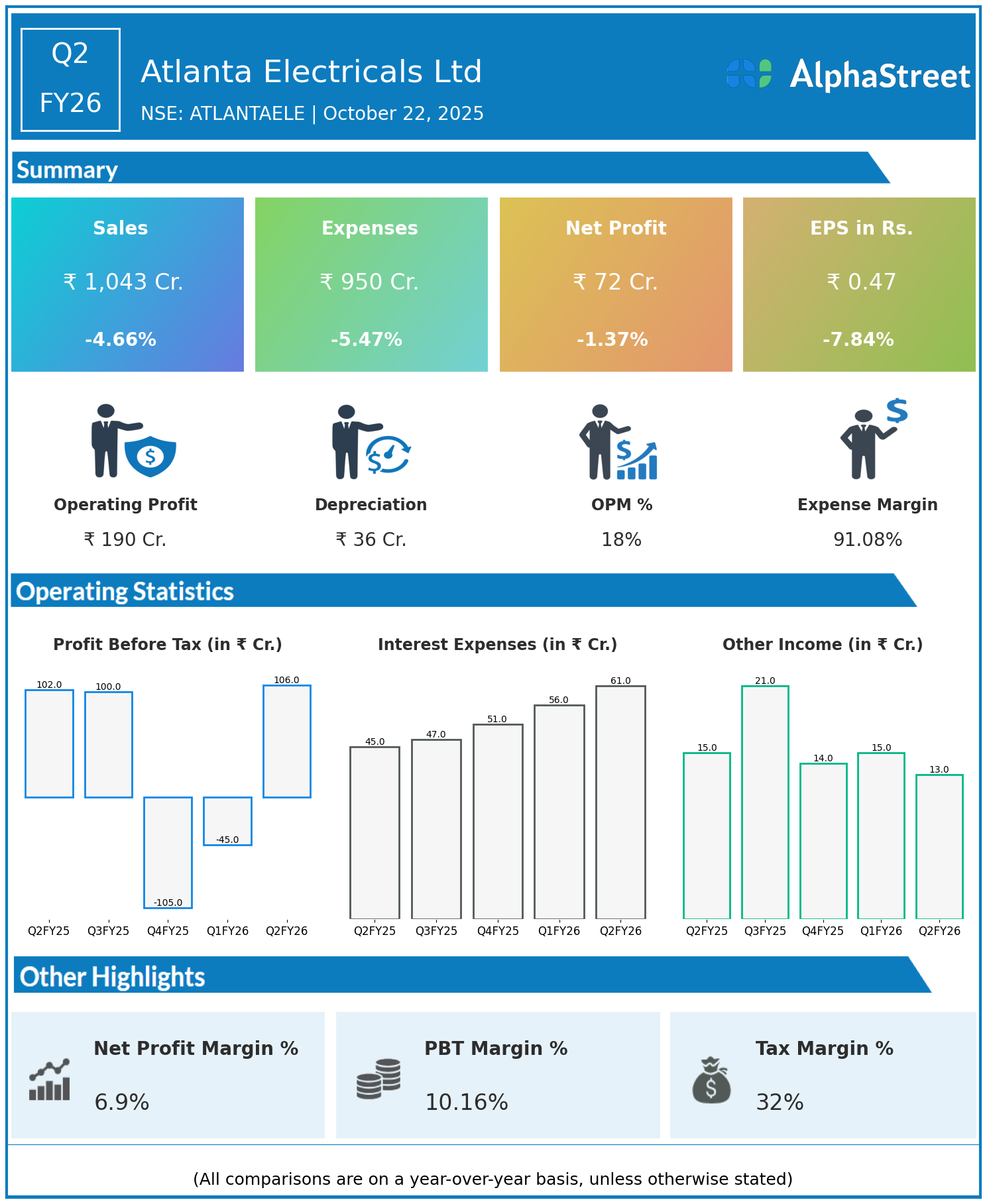

Q2 FY26 Earnings Summary

Consolidated revenue for Q2 FY26 stood at ₹315.11 crore, up 5.1% year on year from ₹299.68 crore.

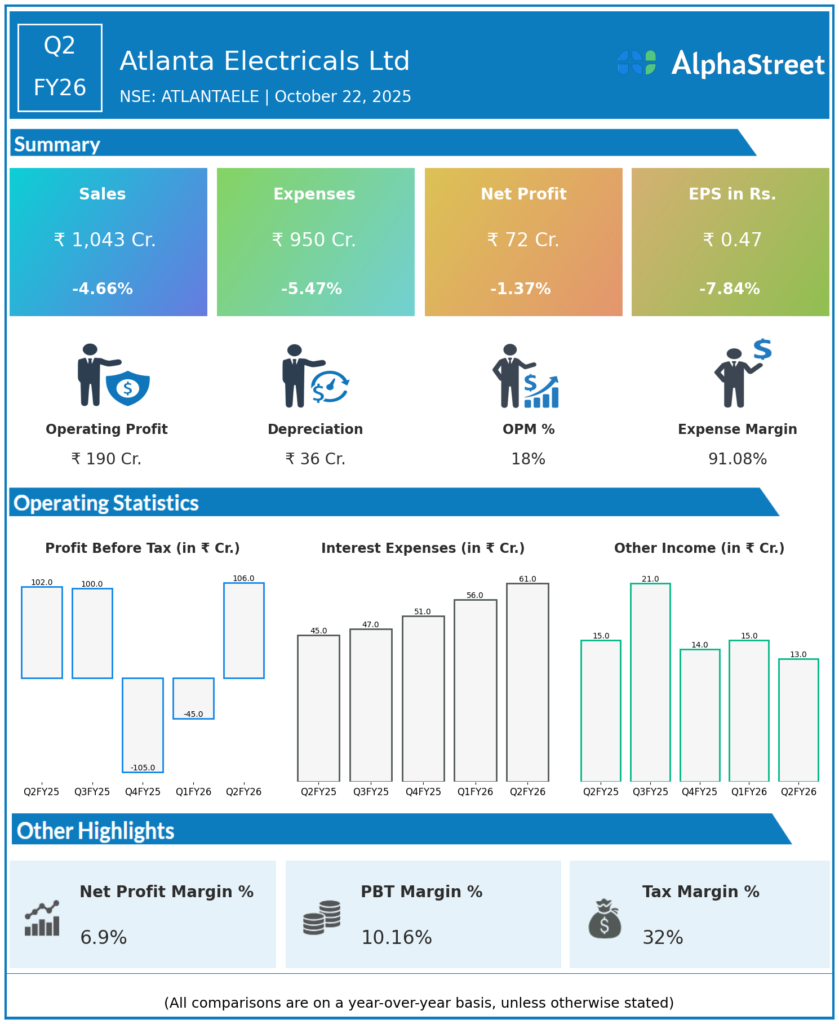

Profit Before Tax (PBT) climbed 22.6% to ₹41.97 crore from ₹34.23 crore in Q2 FY25.

Consolidated Net Profit rose 25.3% to ₹31.14 crore from ₹24.85 crore in the same quarter last year.

EBITDA margins improved to 17.8%, supported by higher capacity utilization and operational efficiency gains.

Operational and Business Highlights

The quarter benefited from disciplined project execution and a strong backlog of transformer orders.

Atlanta Electricals secured a major order worth ₹183.54 crore from BNC Power Projects for the supply of 400 KV and 132 KV class transformers and reactors at the Pugal site. This order is expected to enhance multi-quarter revenue visibility and strengthen execution momentum.

The company’s total installed production capacity now exceeds 63,000 MVA, following the successful commissioning of its new manufacturing facility and acquisition of its former joint venture partner’s stake in BTW-Atlanta Transformers India Pvt. Ltd.

Financial Position and Outlook

Backed by an order book of over ₹1,580 crore, Atlanta Electricals is positioned for steady performance through FY26.

Strategic focus on product innovation, cost optimization, and expanding renewable power sector orders continues to drive growth.

Management remains confident in sustaining double-digit revenue growth and improving profit margins, reflecting the company’s strong market positioning and increasing demand from India’s power infrastructure modernization drive.

Atlanta Electricals Ltd remains committed to innovation, efficiency, and quality as it continues powering India’s transmission and distribution networks.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.