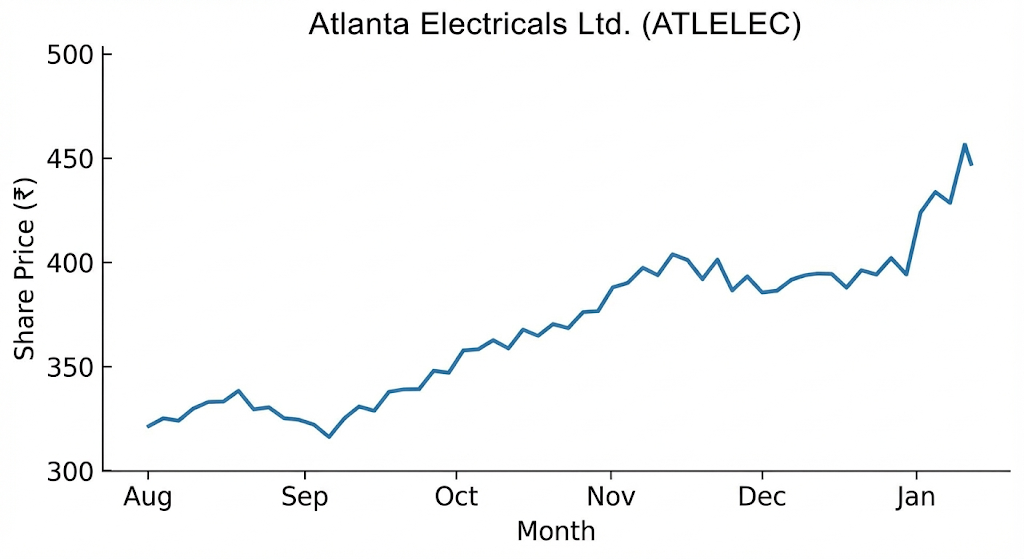

Atlanta Electricals Ltd (ATLANTAELE.NS) Shares of Atlanta Electricals Ltd closed at ₹940, down 2.5 percent on the session, after the company reported quarterly earnings. The stock has traded between a 52-week high near ₹1,097 and a 52-week low around ₹768. Recent trading shows a downward bias from mid-2025 peaks amid broader market volatility.

Quarterly Earnings Summary

Atlanta Electricals reported unaudited consolidated results for the quarter ended Dec. 31, 2025 (Q3 FY26). Revenue from operations rose 79.7 percent to ₹472 crore from ₹263 crore in the year-ago quarter. EBITDA increased about 119.6 percent to ₹91 crore, with EBITDA margin expanding to 19.4 percent from 15.8 percent a year earlier. Net profit nearly doubled to ₹43 crore. Consolidated order book reached a record ₹2,451 crore at quarter-end.

Year-Over-Year and Full-Year Context

On a nine-month basis (9MFY26), revenue was ₹1,104 crore, up 32.6 percent from ₹833 crore in the prior year period. EBITDA for 9MFY26 grew 56 percent to ₹195 crore, with margin expansion to 17.7 percent. Nine-month net profit increased about 34.6 percent to ₹100 crore. Financials reflect capacity expansion and higher utilization across manufacturing facilities.

For the full fiscal year ended March 31, 2025, annual revenue rose more than 40 percent, supported by an expanding product mix and stronger power transformer demand. Searchable filings show revenue growth from the prior fiscal year and expanding margins reflecting operating leverage benefits.

Detailed Call and Orders

During Q3 FY26, the company secured fresh orders totaling ₹796 crore, including major contracts from Gujarat Energy Transmission Corporation Ltd. (GETCO) and Adani Green Energy Ltd. Management noted that capex cycles are largely complete, with a shift toward capacity utilization and profitability.

Analyst Activity

There were no widely reported analyst upgrades, downgrades or price-target changes today for Atlanta Electricals Ltd. as of market close. Broker commentary remains centered on the company’s execution against its record order book and margin trends.

Six-Month Stock Price Trend