Stock Data:

| Ticker | NSE: ASTRAL |

| Exchange | NSE |

| Industry | PIPES |

Price Performance:

| Last 5 Days | +5.10% |

| YTD | +28.06% |

| Last 12 Months | +46.79% |

Company Description:

Astral Ltd is one of the leading manufacturers of plastic pipes in India. Over the years, the company has expanded its operations and product portfolio to include adhesives and infrastructure products. With manufacturing facilities in India, the UK, the US, and Kenya, Astral operates in multiple countries. The company employs over 4,000 people and has a strong distribution network with over 800 distributors in the plastic segment and 1,800 distributors in the adhesive segment. Astral has a widespread presence in India through a network of more than 30,000 dealers in the plastic segment and 4 lakh dealers in the adhesive segment.

Critical Success Factors:

1. Established Market Position: Astral has established itself as a prominent player in the plastic pipes industry, with a 25% market share in CPVC pipes and a 5% market share in PVC pipes. The company’s strong market position gives it a competitive advantage.

2. Diversified Product Portfolio: Astral has expanded its product portfolio beyond plastic pipes to include adhesives and infrastructure products. This diversification reduces its dependence on a single product category and allows for revenue stability.

3. Strong Distribution Network: The company has a robust distribution network with a large number of distributors and dealers across India. This enables Astral to reach a wide customer base efficiently and effectively.

4. Growth Opportunities: Astral is well-positioned to benefit from various government initiatives such as Housing for All, Smart Cities Mission, and Har Ghar Jal. These initiatives are expected to drive demand for Astral’s products in the long term.

5. Expansion Plans: Astral has planned capacity expansions in Hyderabad and Guwahati to cater to the growing demand. The company’s focus on expanding its manufacturing capabilities demonstrates its commitment to meeting customer needs and capturing market opportunities.

Key Challenges:

1. Market Competition: The building materials industry is highly competitive, and Astral faces competition from both domestic and international players. Increased competition could impact the company’s market share and pricing power.

2. Raw Material Price Volatility: Astral’s profitability is influenced by the prices of raw materials such as PVC and CPVC resins. Fluctuations in raw material prices could affect the company’s margins and profitability.

3. Regulatory Environment: Changes in government regulations and policies, especially related to the construction industry, can impact Astral’s operations. Compliance with regulations and obtaining necessary approvals is crucial for the company’s growth.

4. Economic Factors: Astral’s performance is closely tied to the overall economic conditions in the countries where it operates. Any adverse economic conditions, such as a slowdown in the construction sector, could impact the company’s growth prospects.

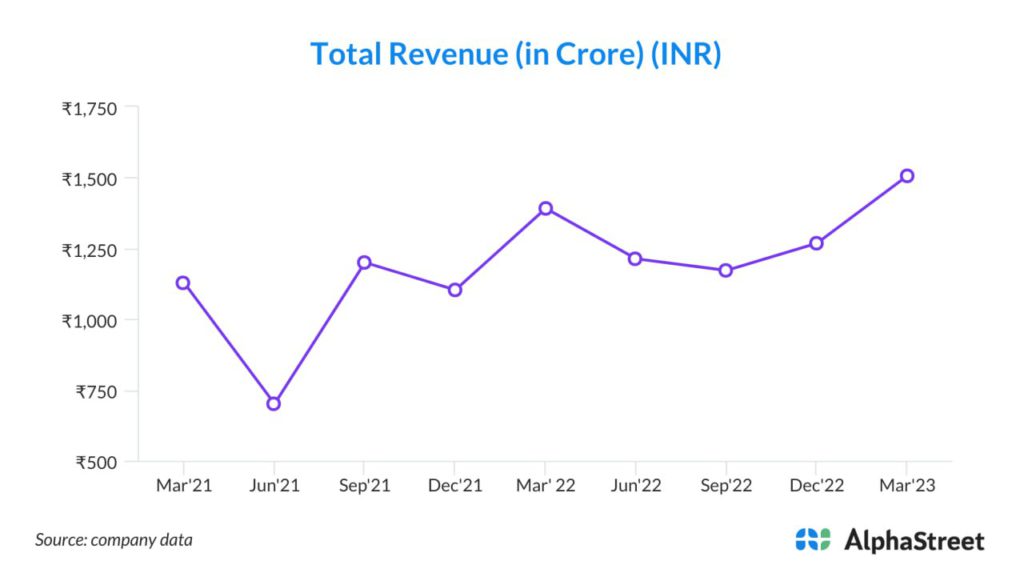

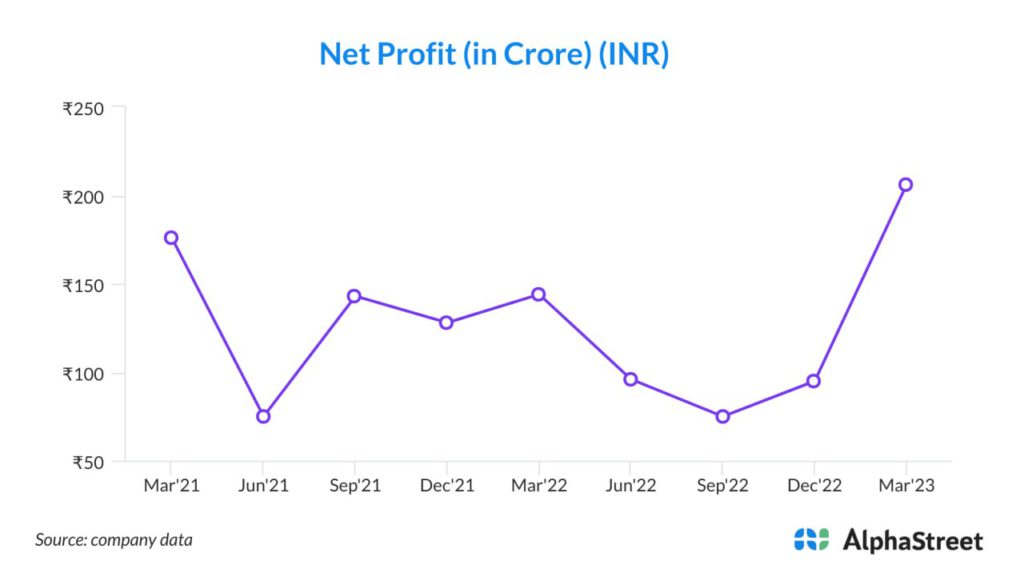

Financial Results:

In Q4FY2023, Astral reported consolidated net revenue growth of 8.3% year-on-year (YoY) and 18.8% quarter-on-quarter (QoQ) at Rs. 1,506 crore, surpassing estimates by 8%. The plumbing segment’s revenues grew by 4% YoY and 21% QoQ to Rs. 1,123.5 crore. The volume growth in the plumbing division was 15% YoY and 19% QoQ, while realizations declined by 10% YoY and increased by 2% QoQ. The paints and adhesive business reported a revenue increase of 25% YoY and 14% QoQ to Rs. 383 crore.Astral’s consolidated operating profit margin (OPM) stood at 20.5%, exceeding expectations and showing a significant improvement of 492 basis points (bps) YoY and 581 bps QoQ. The plumbing business EBIT margin improved by 566 bps YoY and 664 bps QoQ, mainly driven by higher contribution from CPVC product sales and operating leverage. The adhesive business also witnessed improved profitability.Adjusted net profit grew by 47% YoY and 24% QoQ to Rs. 124 crore, beating estimates by 22%. The strong financial performance was driven by higher revenues, improved operating margins, and tight cost control.

Conclusion:

Astral Ltd has exhibited strong financial performance, driven by its established market position, diversified product portfolio, and strong distribution network. With the government’s initiatives focusing on infrastructure development and affordable housing, Astral is well-positioned to capitalize on the growth opportunities in the construction industry. However, the company faces risks associated with market competition, raw material price volatility, regulatory changes, and economic factors. Investors should closely monitor the company’s execution of expansion plans, market dynamics, and regulatory developments for any potential impact on Astral’s future growth.