Asian Paints Limited is India’s largest home decor company with a rich legacy spanning over 80 years. The company’s portfolio includes flagship brands such as Asian Paints and Apco, offering an extensive range of products including wall paints, wall coverings, waterproofing solutions, texture painting, wall stickers, mechanized tools, adhesives, modular kitchens, sanitaryware, lighting, soft furnishings, and uPVC windows.

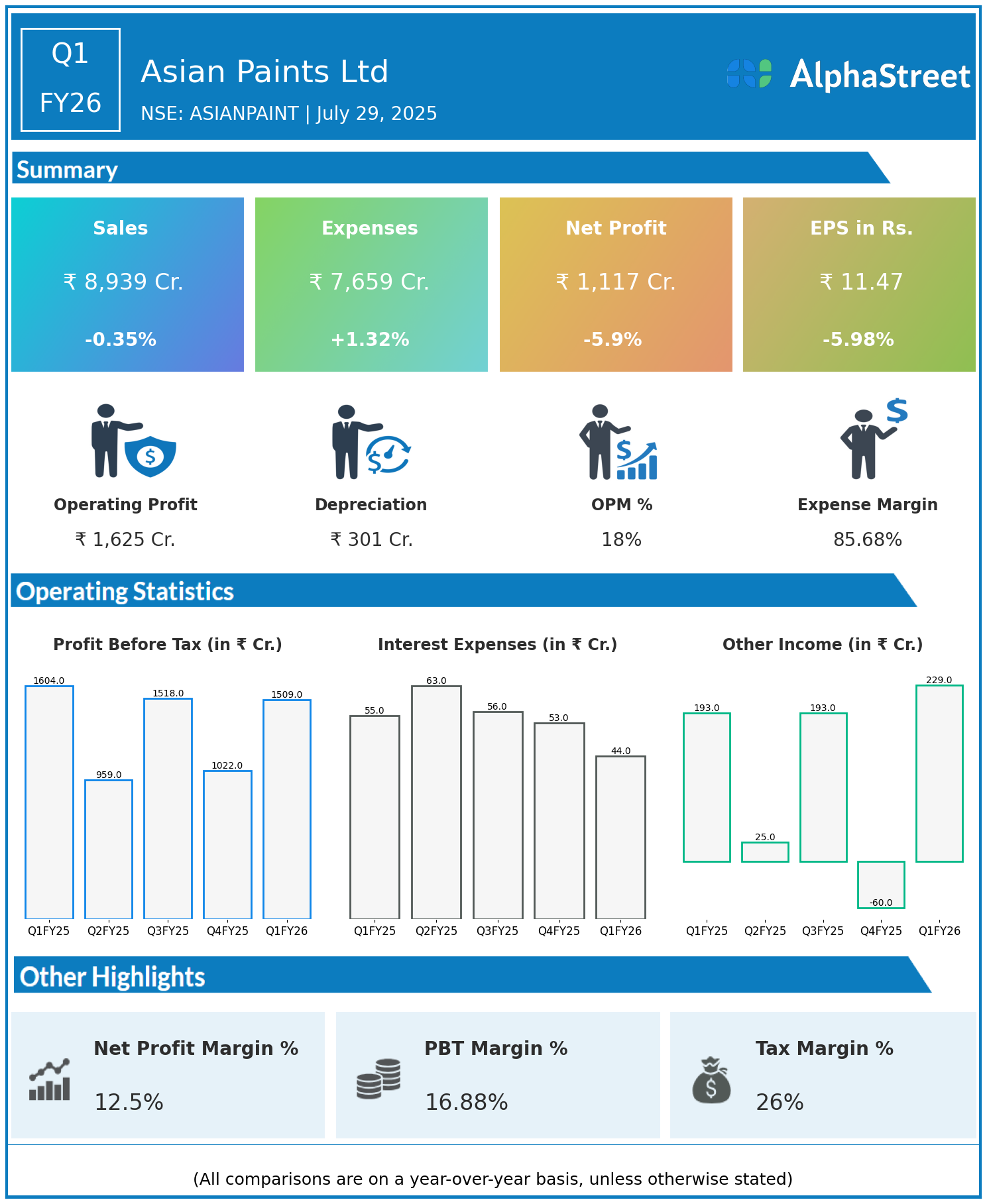

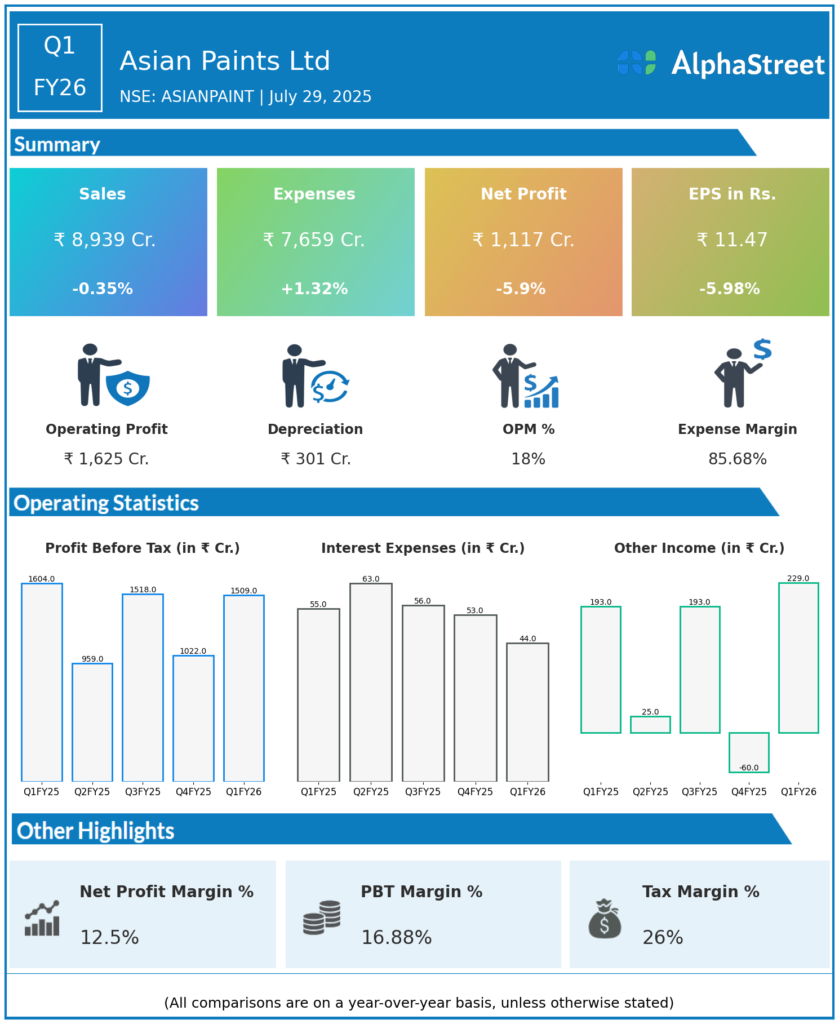

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹8,939 crore, marginally down 0.35% year-on-year (YoY) from ₹8,970 crore in Q1 FY25.

- Total Expenses: ₹7,659 crore, up 1.32% YoY from ₹7,559 crore.

- Consolidated Net Profit (PAT): ₹1,117 crore, down 5.9% from ₹1,187 crore in Q1 FY25.

- Earnings Per Share (EPS): ₹11.47, down 5.98% from ₹12.20 YoY.

Operational & Strategic Update

- Revenue Stability: Asian Paints sustained nearly stable revenue despite a challenging macroeconomic environment and competitive pressures in the home decor and construction sectors.

- Increase in Expenses: Total expenses rose modestly, impacted by higher raw material prices, inflation, and operational costs.

- Profitability Pressure: The decline in net profit and EPS primarily reflects margin compression due to cost increases outpacing revenue growth.

- Market Leadership: The company maintains its dominant position in the home decor space, supported by a diverse product portfolio and continuous innovation.

- Innovation & Branding: Strong brand equity, product innovation, and enhanced digital outreach remain key growth drivers.

- Operational Efficiency: Focus on supply chain optimization, sustainable sourcing, and cost containment to manage inflationary impacts.

- Sustainability Efforts: Commitment to green manufacturing, water conservation, and reducing environmental footprint aligns with corporate responsibility goals.

Corporate Developments

Q1 FY26 reflects Asian Paints’ resilience in maintaining steady revenues amid inflationary and competitive challenges but underlines the need for ongoing cost control and margin improvement strategies.

Looking Ahead

Asian Paints aims to strengthen market leadership through continuous product innovation, efficiency improvements, and enhanced customer engagement. Emphasis on digital expansion and sustainability initiatives is expected to support growth and margin recovery in the coming quarters.