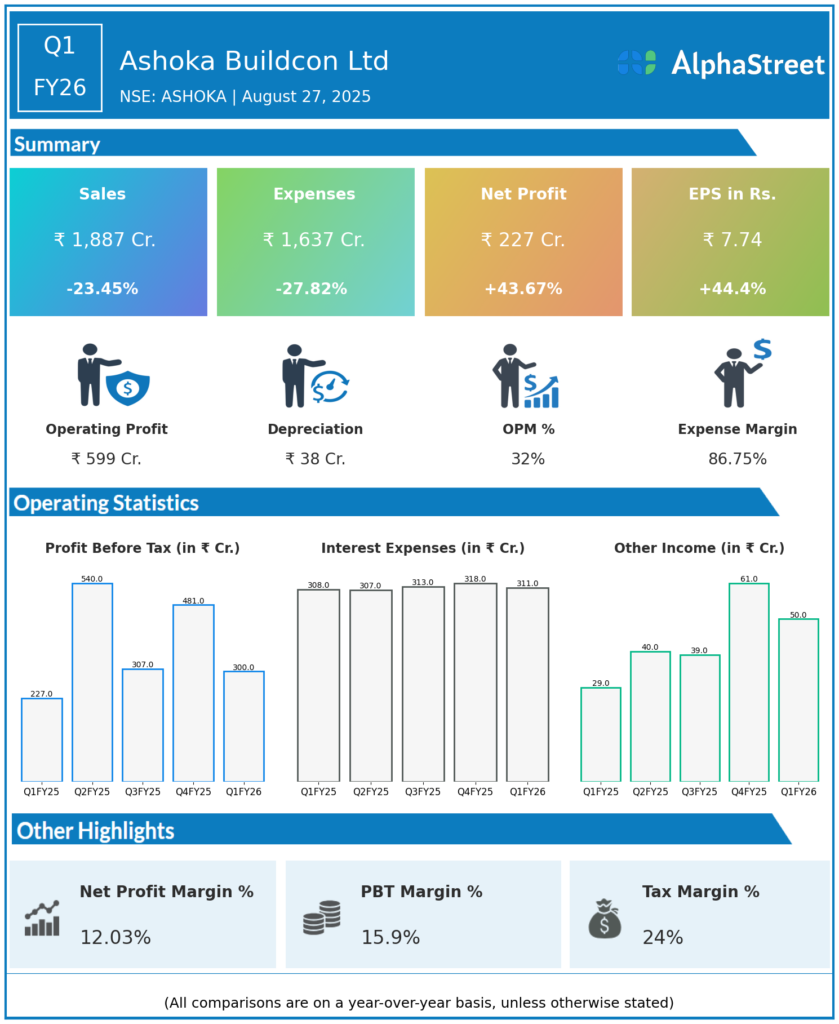

Ashoka Buildcon Ltd is engaged in construction and infrastructure projects on EPC and BOT basis and also involved in the sale of ready mix concrete (RMC). Presenting below its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

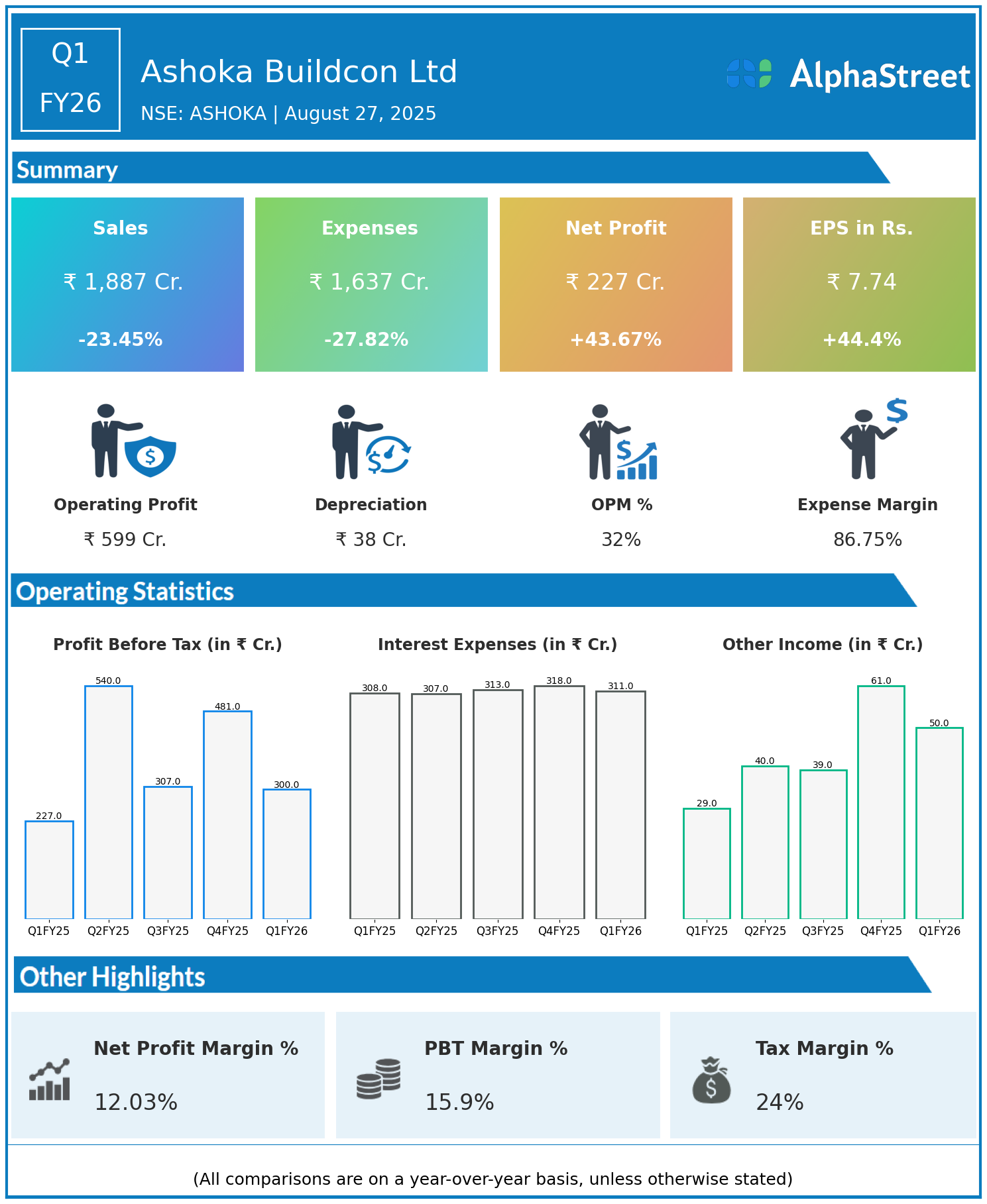

- Revenue: ₹1,887 crore, down 23.45% year-on-year (YoY) from ₹2,465 crore in Q1 FY25.

- Total Expenses: ₹1,637 crore, down 27.82% YoY from ₹2,268 crore.

- Consolidated Net Profit (PAT): ₹227 crore, up 43.67% from ₹158 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹7.74, up 44.40% from ₹5.36 YoY.

Operational & Strategic Update

- Revenue Decline: Revenues dropped by over 23%, possibly reflecting order book execution slowdown or project phase transitions.

- Expense Reduction: Expenses declined by nearly 28%, outpacing revenue fall and contributing to margin expansion.

- Profit Growth: Despite revenue decline, net profit and EPS surged by approximately 44%, indicating strong cost management and operational leverage.

- Market Position: Ashoka Buildcon continues to maintain a strong presence in infrastructure construction with diversified EPC and BOT projects.

- Strategic Focus: The company is focused on efficient project completion, cost optimization, and bolstering profitability despite challenging revenue conditions.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 reflects Ashoka Buildcon Ltd’s ability to improve profitability through operational efficiency, offsetting revenue pressures.

Looking Ahead

Ashoka Buildcon Ltd aims to sustain margin improvements with disciplined cost controls and execution efficiency while seeking project inflows to revive revenue growth and drive long-term value.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.