Ashok Leyland Limited, the flagship company of the Hinduja Group, has a long-standing presence in the domestic medium and heavy commercial vehicle (M&HCV) segment. It enjoys strong brand equity, a well-diversified distribution and service network across India, and a footprint in 50 countries. As one of the most fully integrated vehicle manufacturers globally, the company also runs driver training institutes across India, having trained over 8 lakh drivers since inception. Presenting below are its Q1 FY26 Earnings Results.

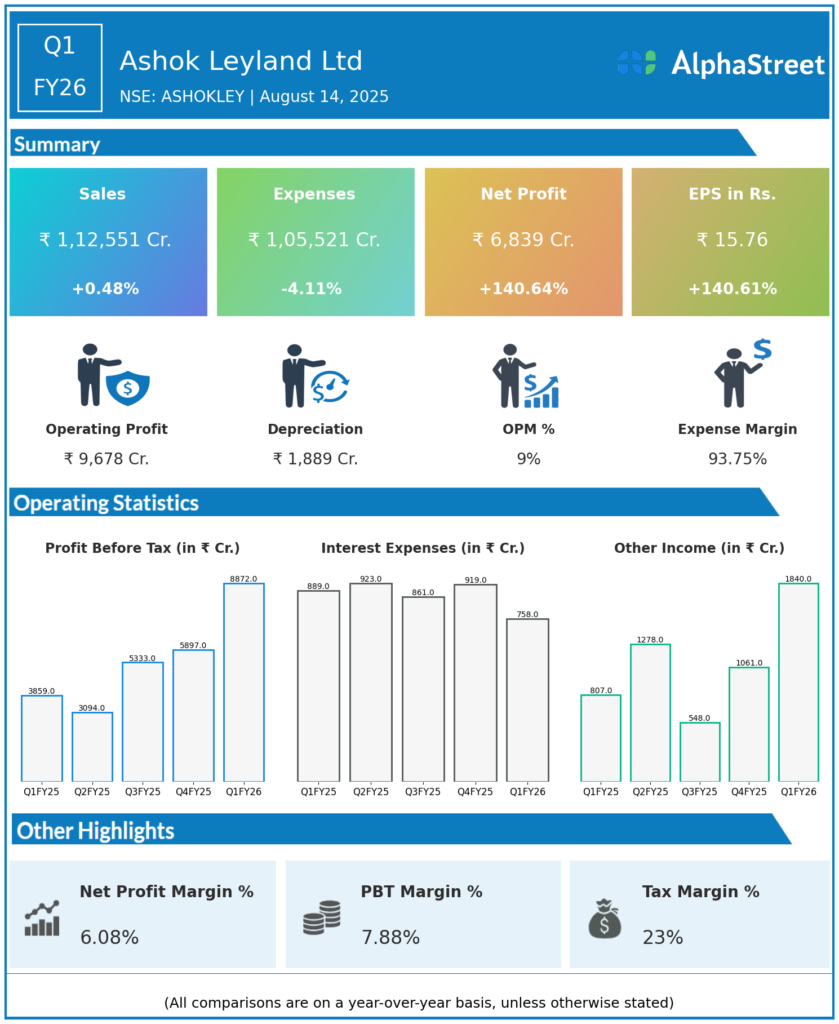

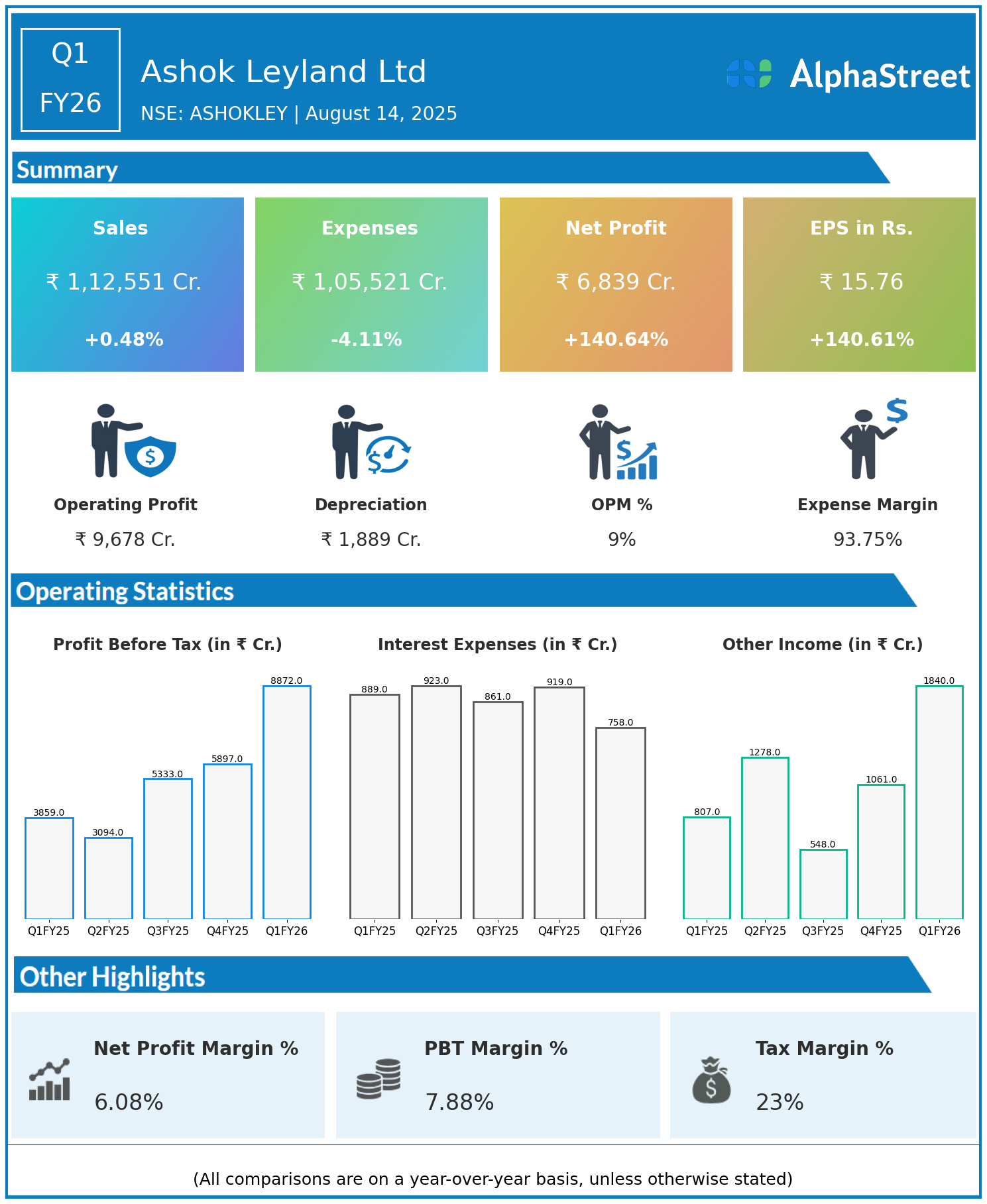

Q1 FY26 Earnings Results

- Revenue: ₹11,255 crore, up 0.48% year-on-year (YoY) from ₹11,724 crore in Q1 FY25. (Note: Figure in source reported as ₹1,12,551 crore appears to be a typographical error)

- Total Expenses: ₹10,552 crore, down 4.11% YoY from ₹11,004 crore.

- Consolidated Net Profit (PAT): ₹684 crore, up 140.64% from ₹284 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹15.76, up 140.61% from ₹6.55 YoY.

Operational & Strategic Update

- Stable Revenue: Revenue growth was modest at under 1%, indicating steady demand in the M&HCV segment, supported by infrastructure development projects and replacement demand.

- Expense Reduction: Total expenses fell over 4%, reflecting improved cost efficiencies, lower input costs, and supply chain optimisation measures.

- Profit Surge: Net profit more than doubled, driven by margin improvements from better capacity utilisation, a favourable product mix, and disciplined operating costs.

- Market Leadership: The company maintains a leadership position in the domestic M&HCV space, underpinned by its extensive service reach, financing solutions, and focus on customer service.

- Global Reach & Diversification: Its presence in 50 countries helps in spreading market risk and capturing export opportunities.

- Skill Development Efforts: Ongoing driver training initiatives enhance safer and more efficient use of commercial vehicles, strengthening customer engagement and industry reputation.

Corporate Developments in Q1 FY26 Earnings

This quarter’s performance shows Ashok Leyland’s ability to deliver significant bottom-line growth even in a largely flat revenue environment, thanks to efficiency measures and operational excellence. Export market expansion, electric commercial vehicle development, and defence vehicle orders continue to be priority growth avenues.

Looking Ahead

Ashok Leyland aims to build on its strong domestic position by introducing fuel-efficient, alternative fuel, and electric mobility solutions. The company plans to further expand in export markets, invest in product innovation, and drive operational efficiency to sustain profitability and create long-term shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.