Asahi India Glass Limited (AIS) is India’s leading value-added integrated glass solutions company, with a dominant presence in both the automotive and architectural glass segments. Established in 1984, AIS was formed as a joint venture between the Labroo Family, Asahi Glass Co. of Japan, and Maruti Udyog Ltd (now Maruti Suzuki India Ltd). The company is renowned for its innovation, quality products, and leadership in the glass industry.

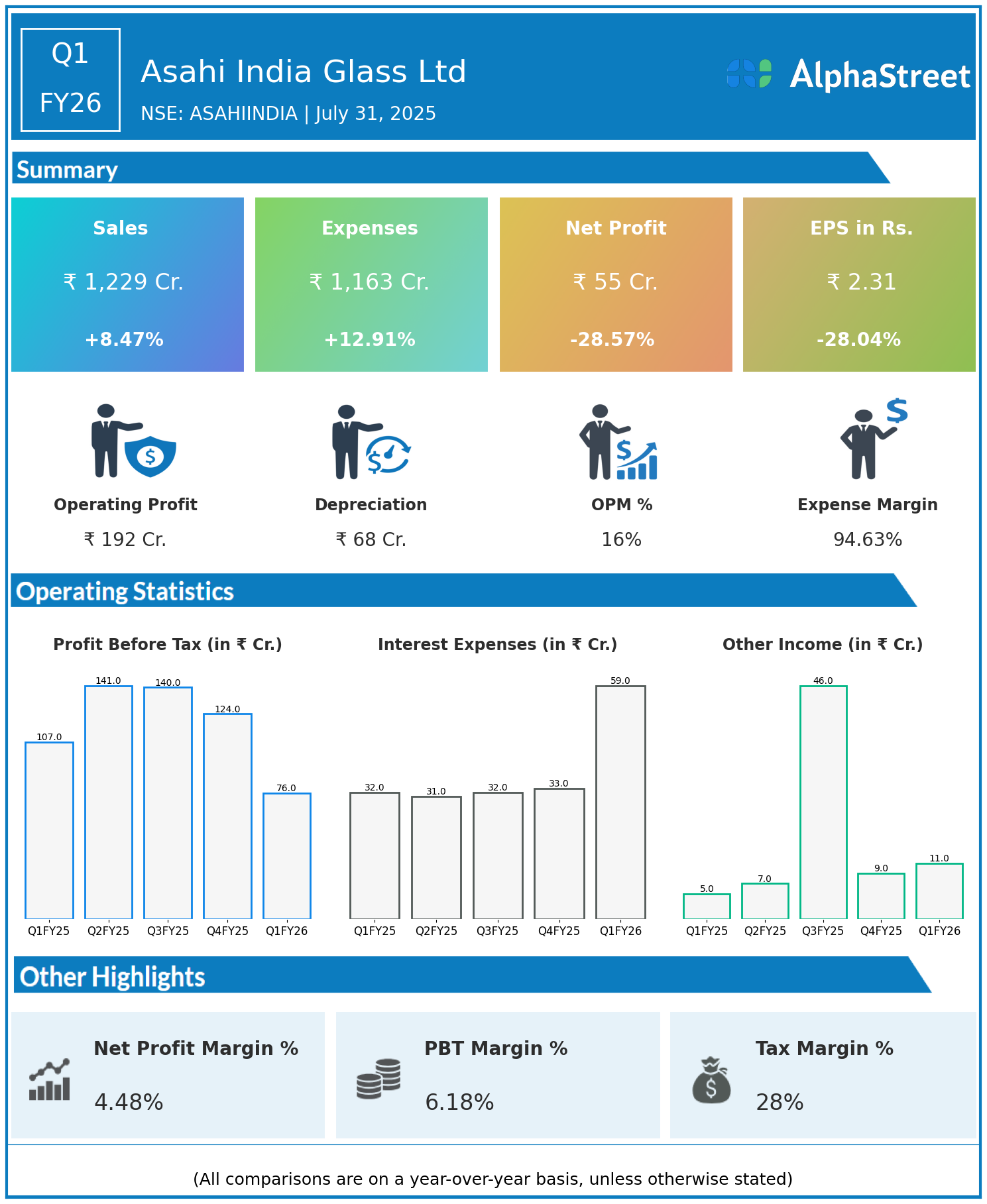

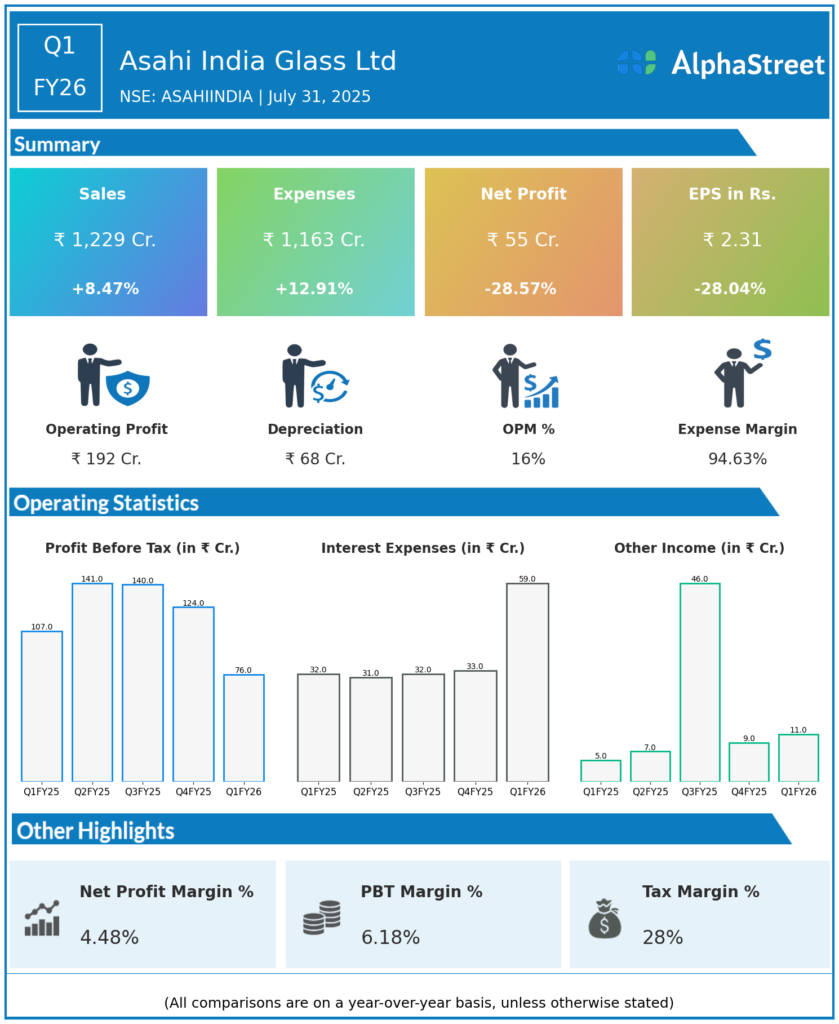

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹1,229 crore, up 8.47% year-on-year (YoY) from ₹1,133 crore in Q1 FY25.

- Total Expenses: ₹1,163 crore, up 12.91% YoY from ₹1,030 crore.

- Consolidated Net Profit (PAT): ₹55 crore, down 28.57% from ₹77 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹2.31, down 28.04% from ₹3.21 YoY.

Operational & Strategic Update

- Revenue Growth: The healthy revenue increase was driven by strong demand across automotive and architectural segments, as the market gradually recovers and expands.

- Rising Expenses: Total expenses grew at a higher pace than revenue, mainly due to increased raw material costs, energy prices, and operational expenses, impacting margins.

- Profitability Decline: The sharp drop in net profit and EPS reflects margin pressures from rising input costs and inflationary challenges amid competitive market conditions.

- Segment Focus: AIS maintains a strong foothold in automotive glass, catering to OEMs and aftermarket requirements, while simultaneously driving growth in architectural glass with value-added solutions.

- Innovation & Quality: Continued investments in R&D and manufacturing capabilities support product differentiation and customer satisfaction.

- Sustainability Initiatives: The company pursues energy-efficient production processes and eco-friendly product offerings aligning with global sustainability trends.

Corporate Developments

Q1 FY26 was a mixed quarter for Asahi India Glass Ltd, with solid top-line growth tempered by margin contraction and profit decline. The company’s integrated operations and diversified market presence provide resilience amid cost pressures and competitive dynamics.

Looking Ahead

Asahi India Glass Ltd is focused on improving operational efficiencies, managing cost inflation, and expanding value-added product portfolios in automotive and architectural markets. Continued emphasis on innovation, sustainability, and market penetration is expected to support recovery in profitability and sustainable growth in FY26 and beyond.