Arvind Limited is one of India’s leading vertically integrated textile companies with a legacy spanning almost eight decades. Recognized as one of the largest denim manufacturers globally, Arvind also produces a diverse range of cotton shirting, denim, knits, bottom weights (Khakis) fabrics, along with jeans and shirts garments. The company’s integrated operations and broad product portfolio position it as a key player in both domestic and international textile markets.

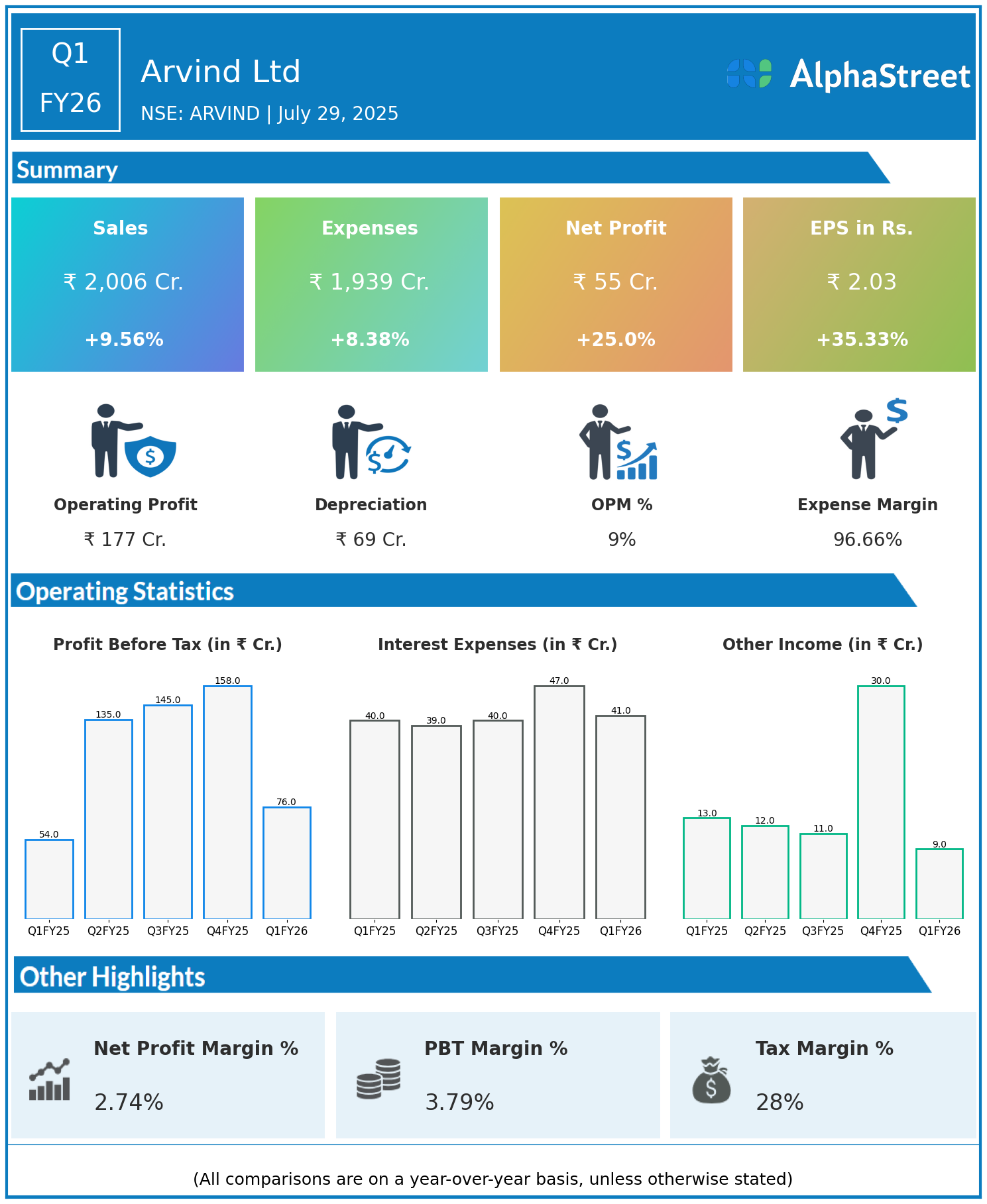

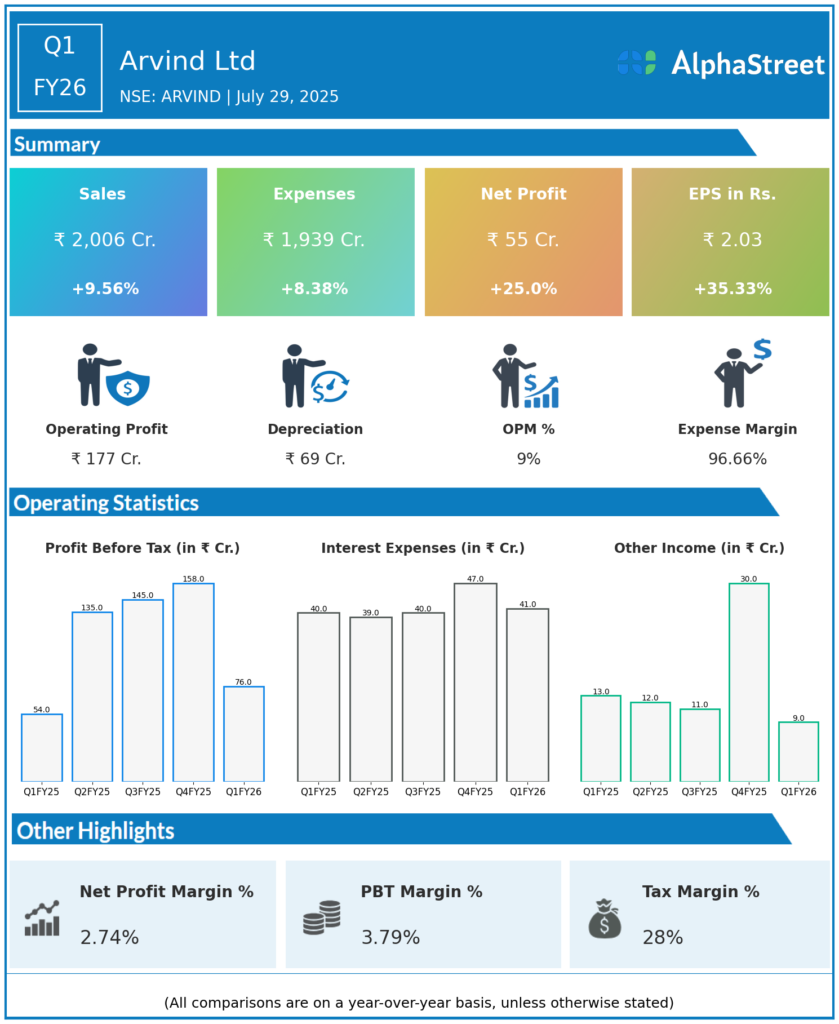

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹2,006 crore, up 9.56% year-on-year (YoY) from ₹1,831 crore in Q1 FY25.

- Total Expenses: ₹1,939 crore, up 8.38% YoY from ₹1,789 crore.

- Consolidated Net Profit (PAT): ₹55 crore, up 25.0% from ₹44 crore in Q1 FY25.

- Earnings Per Share (EPS): ₹2.03, up 35.33% from ₹1.50 YoY.

Operational & Strategic Highlights

- Revenue Growth: Growth driven by steady demand across multiple product segments including denim, cotton shirting, knits, and garments, supported by enhanced market reach and brand equity.

- Cost Management: Expenses increased moderately but at a slower pace than revenue, aiding margin improvement and operational leverage.

- Profitability Improvement: Significant net profit growth and EPS expansion reflect efficient cost management, a favorable product mix, and improved operational performance.

- Product Diversification: Continued focus on a wide portfolio from fabrics to readymade garments helps cater to diverse customer preferences across segments.

- Vertical Integration: The integrated manufacturing setup allows Arvind to optimize processes, control quality, and maintain competitive advantage.

- Sustainability & Innovation: The company maintains commitment to sustainable manufacturing practices, incorporating energy and water conservation measures aligned with global environmental standards.

Corporate Developments

Q1 FY26 results demonstrate Arvind Ltd’s robust operational capability and profitable growth trajectory in a competitive textile sector. The combination of revenue growth and margin expansion underscores solid execution and strategic focus.

Looking Ahead

Arvind Limited is well-positioned to leverage growth opportunities by scaling capacity, strengthening brand presence, and driving innovation in textile and apparel segments. The continued emphasis on sustainability and operational efficiency is expected to support long-term value creation through FY26 and beyond.