Stock Data:

| Ticker | NSE: ARVIND |

| Exchange | NSE |

| Industry | TEXTILES |

Price Performance:

| Last 5 Days | -5.09 % |

| YTD | +86.31 % |

| Last 12 Months | +49.98% |

Company Description:

Arvind Ltd is a renowned Indian conglomerate with a rich legacy spanning over nine decades. Headquartered in Ahmedabad, India, the company is a diversified leader in textiles, branded apparel, advanced materials, and retail. Arvind is internationally recognized for its commitment to quality, innovation, and sustainability. In the textile sector, Arvind is a global player, producing a wide range of fabrics, denim, and garments. Its Advanced Materials division offers cutting-edge solutions in areas like fire protection and composites. The company’s robust retail presence includes iconic brands like Flying Machine and Arrow. Arvind is dedicated to sustainable practices, emphasizing environmental responsibility and social welfare. With a global footprint and a commitment to excellence, Arvind continues to shape the future of textiles and fashion.

Critical Success Factors:

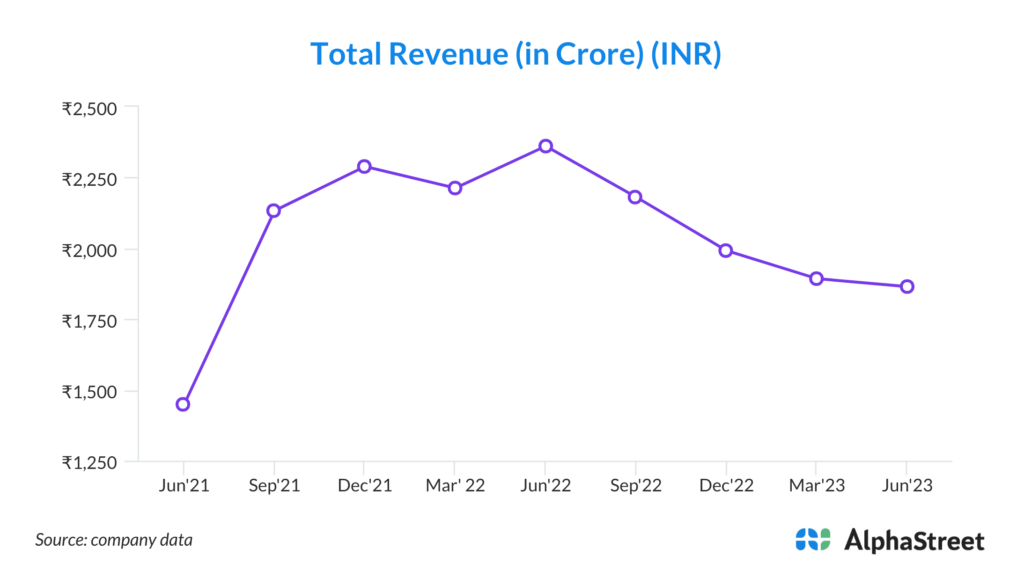

1. Stable Global Apparel Demand: Arvind Ltd benefits from a relatively stable global apparel demand environment, with uncertainties not leading to significant downturns. This stability in consumer demand has allowed the company to plan and strategize effectively, mitigating the impacts of market fluctuations.

2. Strong Textile Export Volumes: Despite challenges, Arvind Ltd maintained steady textile export volumes, demonstrating its resilience in international markets. This consistency in export performance contributes to the company’s overall revenue stability.

3. Growth in Advanced Materials Division (AMD): Arvind’s AMD exhibited remarkable growth, with revenues soaring by 23% in the first quarter compared to the previous year. This growth showcases the company’s ability to tap into emerging markets and capitalize on opportunities within the AMD sector.

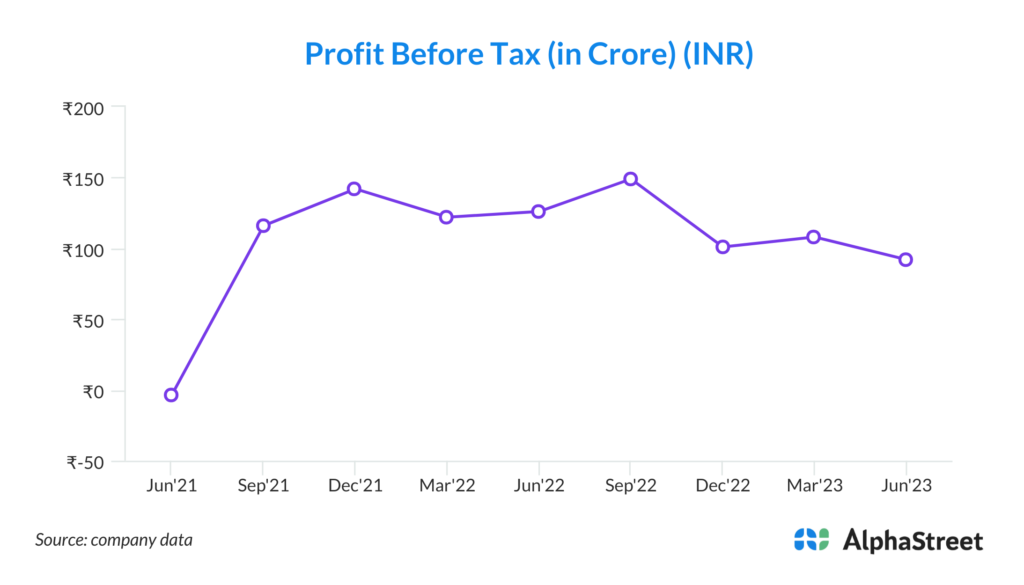

4. Margin Improvement: Arvind achieved improved EBITDA margins, primarily due to effective cost management strategies in response to softer input costs. These margin improvements reflect the company’s agility in adjusting its operations to maintain profitability.

5. Capex Program: Arvind’s ambitious INR 600 crore capex program is poised to enhance the company’s capacity in the Advanced Materials Division and garment manufacturing. This strategic investment positions Arvind for potential revenue growth, demonstrating its commitment to staying competitive and relevant.

6. Debt Reduction: Arvind Ltd’s consistent efforts to reduce long-term debt levels signify its financial prudence and commitment to maintaining a healthy balance sheet. The ability to decrease debt, even in a challenging market, strengthens the company’s financial resilience and provides room for future investments and expansion initiatives.

Key Challenges:

1. Market Uncertainty: Arvind Ltd operates in a business environment plagued by market volatility and unpredictability. Fluctuations in consumer demand due to economic conditions and geopolitical factors can significantly impact the company’s revenue and profitability. Adapting to these ever-changing market dynamics is crucial to mitigate potential risks.

2. Domestic Textile Market Decline: Recent declines in the domestic textile and apparel markets over the last two quarters have raised concerns. After a robust year initially, the market softened from February-March onwards, potentially affecting Arvind’s financial performance if this trend persists.

3. Input Price Volatility: Arvind’s vulnerability to abrupt shifts in input prices, particularly cotton (a key raw material), presents a substantial risk. Rapid price fluctuations can lead to unpredictable production costs and, subsequently, affect profit margins. Effective risk management strategies are essential to counter this threat.

4. Dependence on Seasonal Demand: The company’s dependence on seasonal demand, particularly during festivals like Diwali, leaves it exposed to market fluctuations and consumer sentiment during specific times of the year. Timely adaptation to changing demand patterns is crucial to minimize associated risks.

5. Global Economic Conditions: Arvind’s export-focused business is susceptible to shifts in global economic conditions. Factors like trade policies, tariffs, and currency exchange rate fluctuations can impact international sales and profitability. Diversifying markets and staying informed about global economic developments are essential risk mitigation strategies.

6. Competitive Landscape: The textile and apparel industry is fiercely competitive, which can lead to price wars and margin pressures. Arvind must continually innovate and differentiate its products to maintain market share and profitability. Effective marketing strategies and a focus on product quality are vital for sustaining competitiveness in the market.