Arvind Fashions Limited, a prominent player in branded apparel, beauty, and footwear, commands a robust portfolio of both owned and internationally licensed brands spanning multiple market segments. The company’s focus on style, quality, and innovation sustains its leadership in India’s fast-evolving retail landscape.

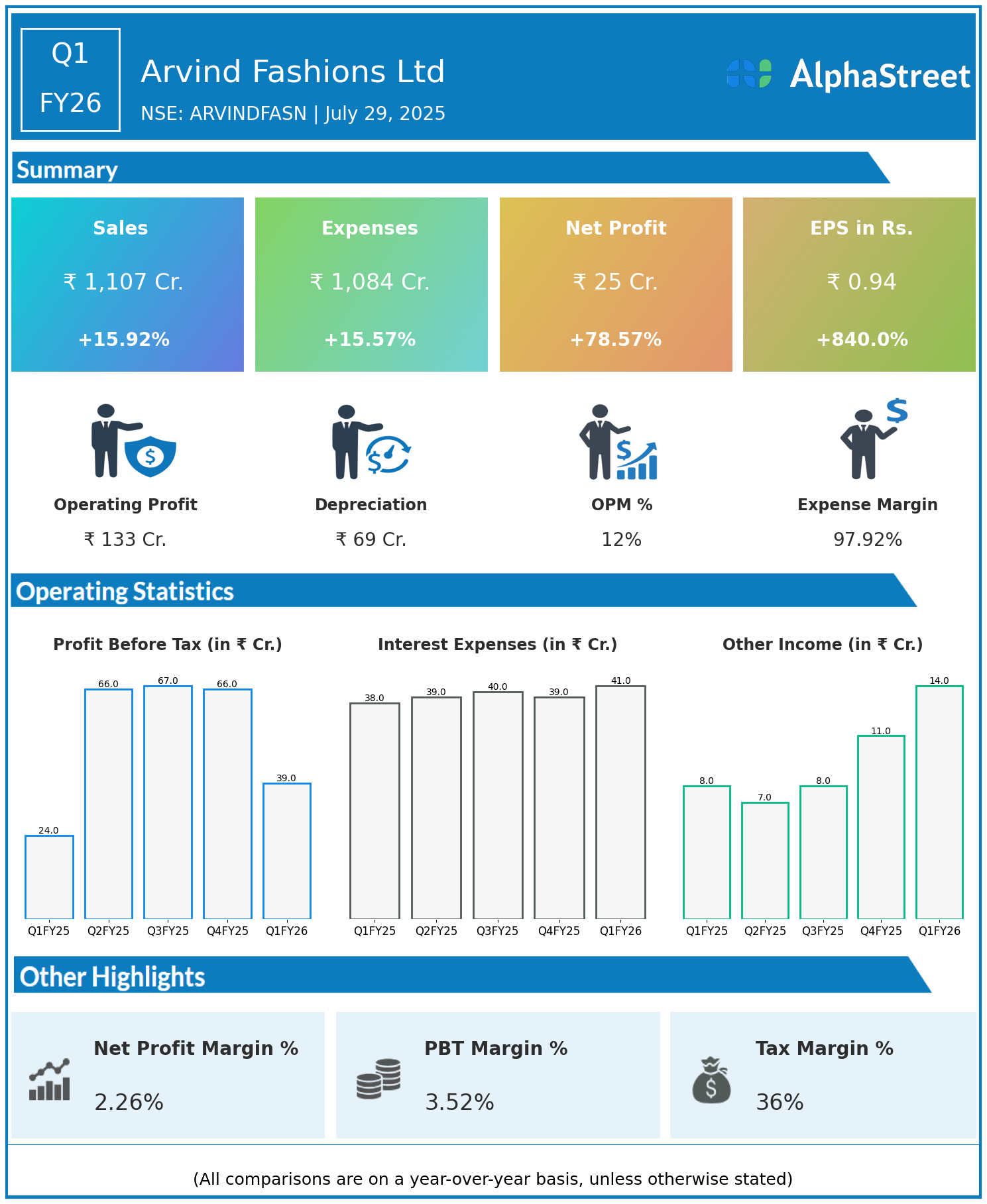

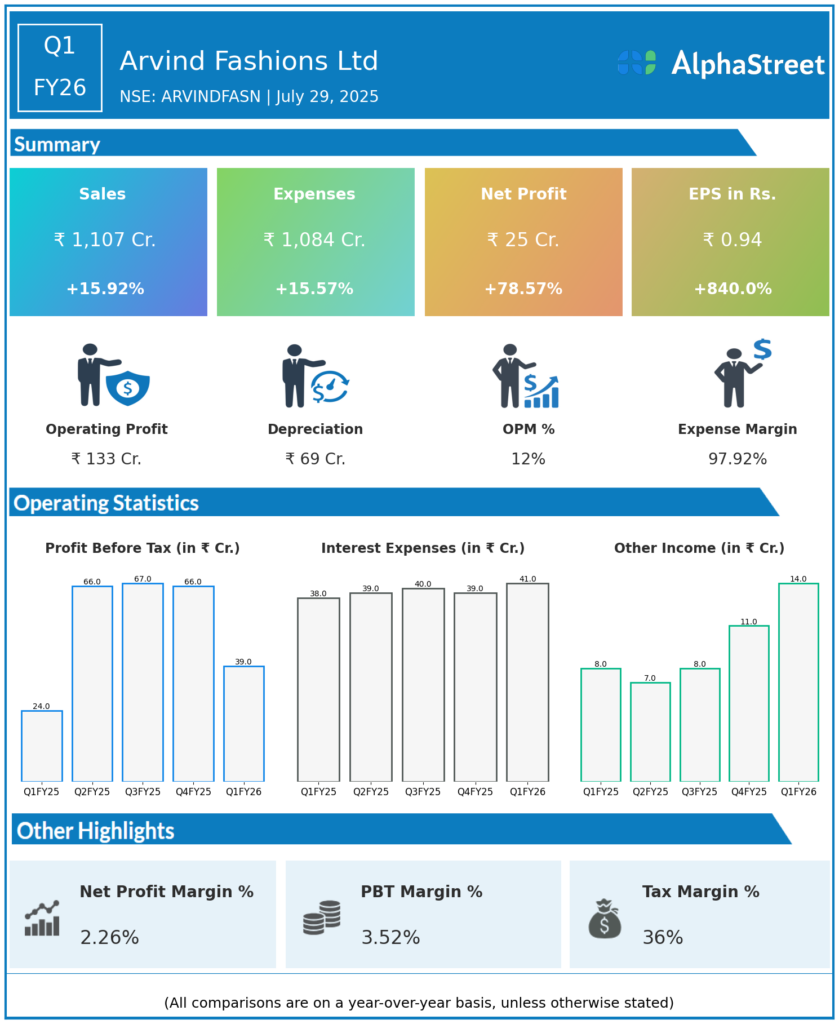

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹1,107 crore, up 15.92% year-on-year (YoY) from ₹955 crore in Q1 FY25.

- Total Expenses: ₹1,084 crore, up 15.57% YoY from ₹938 crore.

- Consolidated Net Profit (PAT): ₹25 crore, up an impressive 78.57% from ₹14 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹0.94, up a remarkable 840% from ₹0.10 YoY.

Operational & Strategic Highlights

- Broad-Based Revenue Growth: Strong performance across core apparel, beauty, and footwear segments, buoyed by higher demand, expanded retail footprint, and improved brand traction.

- Margin Expansion: Net profit growth outpaced revenue, pointing to better operating leverage and effective cost discipline.

- Portfolio Strength: Continued to scale both owned power brands and key global licenses, diversifying offerings to adapt to evolving consumer preferences.

- Omnichannel Focus: Enhanced digital initiatives and e-commerce integration bolstered customer engagement and sales contributions from online channels.

- Retail Expansion: Opened new stores in high-potential cities, while strengthening presence in Tier II and III markets, capturing broader market share.

- Product Innovation: Invested in contemporary collections and collaborated with global trendsetters to refresh existing lines and introduce new formats.

- Cost Management: Rigorous controls on overheads and inventory optimized working capital, supporting strong profit growth amidst rising expenses.

- Sustainability Initiatives: Advanced eco-friendly sourcing, ethical supply chains, and conscious fashion, aligning with growing consumer awareness.

Corporate Developments

Q1 FY26 marks a robust quarter for Arvind Fashions, driven by resilient demand and a sharp rise in profitability. The company’s disciplined execution, expanding brand portfolio, and increasing digital penetration reinforce its competitive strength in India’s premium and mass-market fashion segments.

Looking Ahead

Arvind Fashions Ltd remains committed to further strengthening its brand ecosystem, investing in both physical and digital retail, and launching innovative products to capture new growth opportunities. Continued focus on operational excellence and customer-centric strategies is expected to drive sustainable growth and long-term value creation through FY26 and beyond.