Arvind Fashion Limited is an Indian textile manufacturer and the flagship company of the Lalbhai Group. The company was incorporated in 1931. It has its headquarter in Ahmedabad, India, The products include cotton shirting, denim, knits and bottom weight (khaki) fabrics. Arvind Fashion is a major player of fashion in the India market. It has both global and international presence. It deals with renowned brands, both international and indigenous, like US Polo Assn., Arrow, Tommy Hilfiger, Calvin Klein, Flying Machine and Sephora, it has presence across lifestyle brands and prestige beauty.

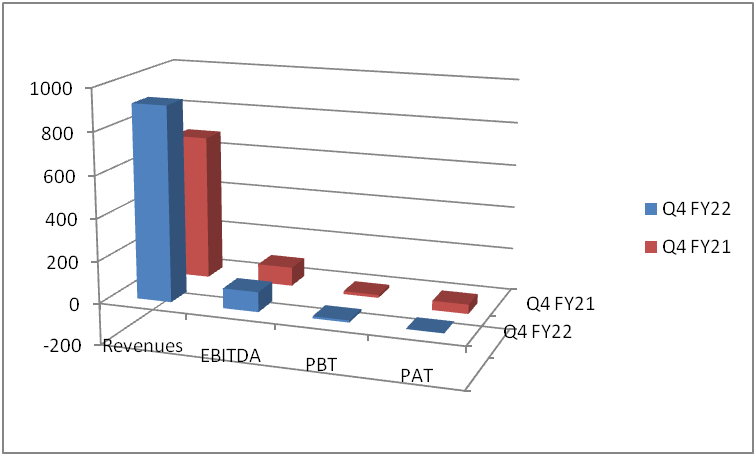

Financial Snapshots

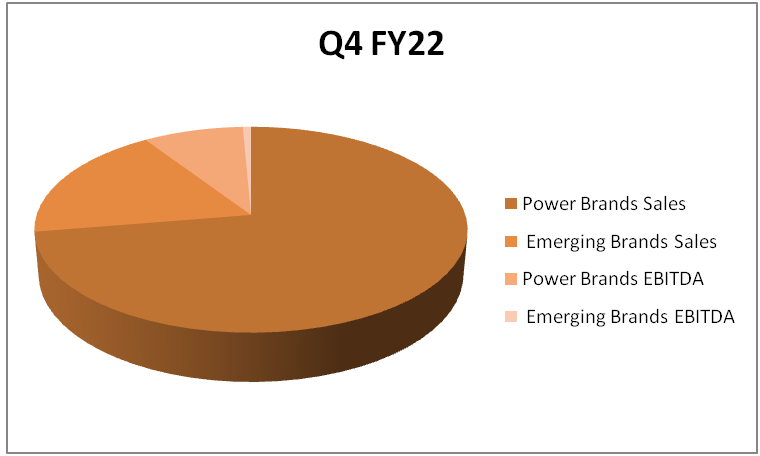

InQ4 FY22 revenues grew by 34% to Rs. 917 Crores. EBITDA grew 36% Y-o-Y to Rs 94 crores. The online. Power brands revenues grew by 32% with USPA, and Tommy Hilfiger with a double digit EBITDA margins. AFL grew its revenue by 32% and posted a net profit of Rs. 40 crores in the second half of FY22.

Business Growth

The company anticipates that the business will get momentum in the coming years. The retail online channel will grow by 60% to 65%. The company is targeting in reducing the net debt in FY23. The supply chain initiative needs to get increased and stock turns further in FY23.

The major achievements’ include tightening of the inventory control. The better control of inventory has improved the overall gross margin. The company has 800+ Omni-enabled stores. The company has achieved more than 1000 Crs profitable revenue through this omni channel.

Key Challenges

The key challenges include rising material cost and prevailing inflation. Prevailing covid has impacted the revenue growth for Arrow.

GroupWise Performance

In this quarter both Tommy Hilfiger and Calvin Klein, have delivered a great performance. They delivered strong double digit pre-IndAS EBITDA with a total growth more than 20%. Sephora delivered more than 50% growth in the quarter. Both AFL and Flying Machine performed very well. AFL has become one of the reputed brands in India. Flying Machine has performed very well in the Denim Sector. Moreover the partnership with Flipkart group has helped to grow the business.

Business Strategies

The company has invested total capex of Rs. 90 crores It has plans to renovate the stores and want the brands to be refreshed in the market place. It has strong multi-channel play with 150+ stores in FY22.