Ajmera Realty & Infra India Ltd (ARIIL), incorporated in 1985, provides residential and rented commercial properties with a presence in major Indian cities such as Mumbai, Bengaluru, Ahmedabad, as well as international markets like Bahrain and the UK .Presenting below its Q1 FY26 Earnings Results:

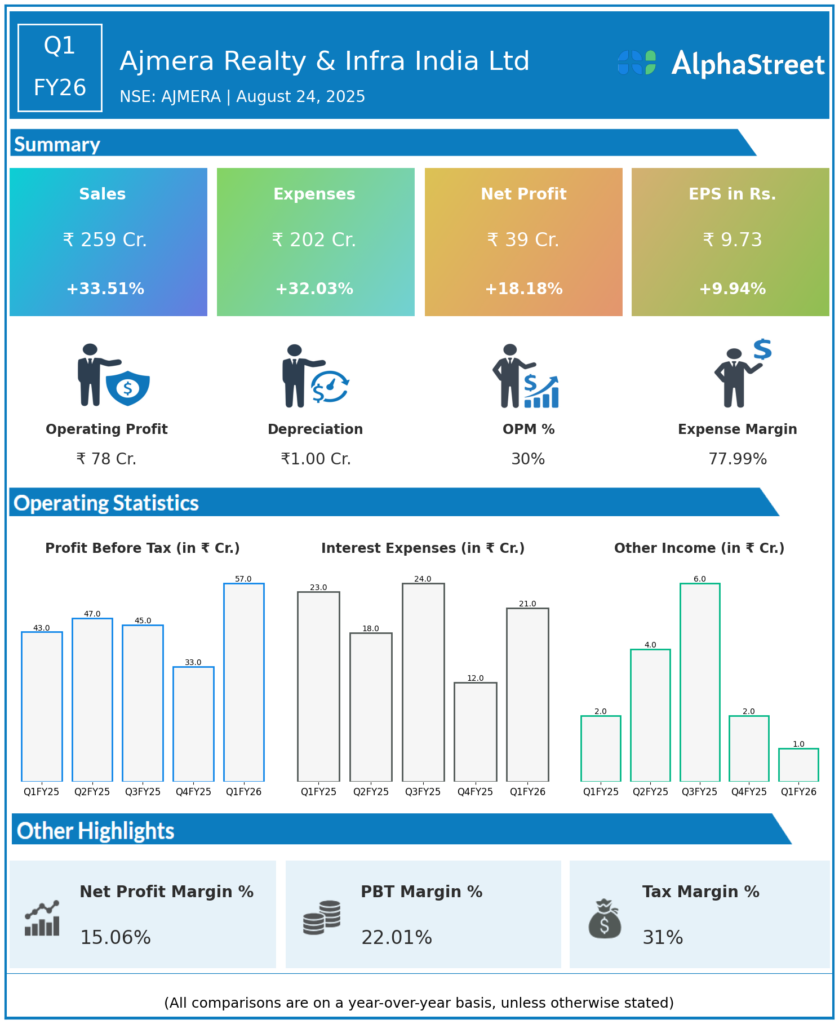

Q1 FY26 Earnings Results

- Revenue: ₹259 crore, up 33.51% year-on-year (YoY) from ₹194 crore in Q1 FY25.

- Total Expenses: ₹202 crore, up 32.03% YoY from ₹153 crore.

- Consolidated Net Profit (PAT): ₹39 crore, up 18.18% from ₹33 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹9.73, up 9.94% from ₹8.85 YoY.

Operational & Strategic Update

- Strong Revenue Growth: Revenue rose by over 33%, reflecting robust sales momentum and project delivery in core real estate markets.

- Expense Increase: Expenses were up 32%, largely in line with revenue, indicating disciplined cost management alongside growth.

- Profitability Expansion: Net profit increased by 18%, while EPS grew by almost 10%, demonstrating operational leverage and continued profitability improvement.

- Market Position: Ajmera Realty & Infra retains a strong position within residential and commercial real estate, both domestically and in select international markets.

- Strategic Focus: The company is focused on developing new projects, enhancing value offerings, and expanding its presence in established and emerging markets.

Corporate Developments in Q1 FY26 Earnings

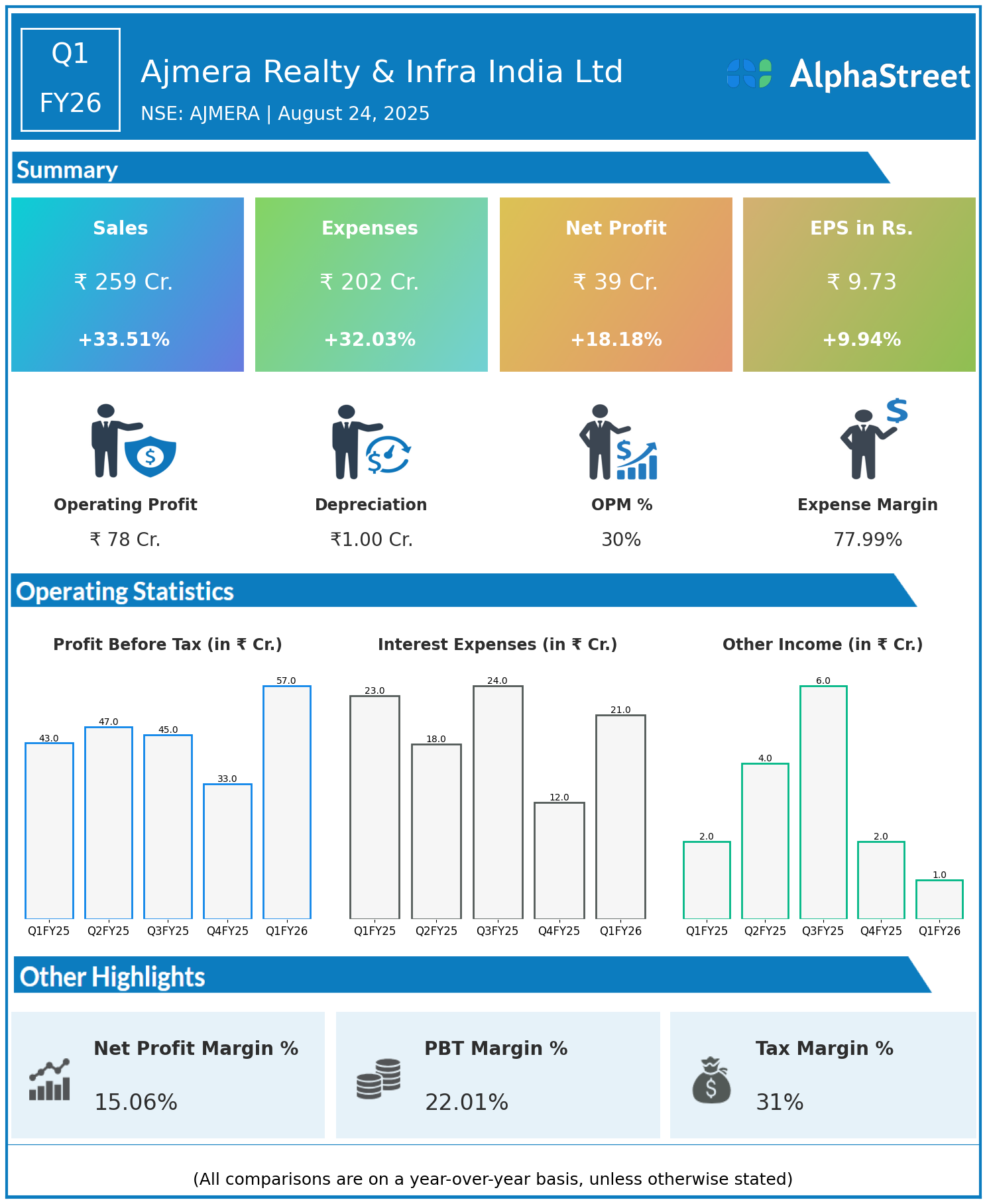

Q1 FY26 results spotlight Ajmera Realty & Infra India Ltd’s ability to sustain profit growth and operational resilience while executing project delivery in a competitive sector.

Looking Ahead

The company continues to explore new development opportunities, scale up landmark projects, and strengthen its market presence, targeting further growth and shareholder value through FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.