Indian tech companies reported somber results in the June quarter, broadly witnessing modest revenue growth and margin contractions. Operating margins suffered as the industry saw unprecedented levels of attrition, while the companies coughed up more wage hikes to retain employees.

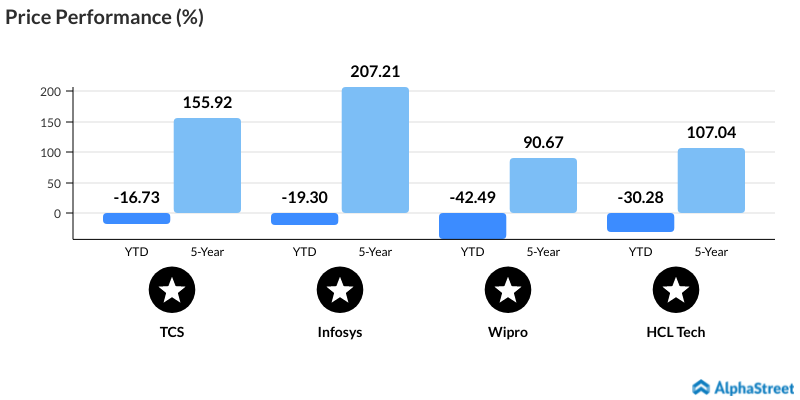

During the Covid lockdowns, the tech stocks jumped amid rapid adoption of internet-based services. However, fears of the U.S. recession have investors backtracking on these stocks on worries of spending cuts.

Quarterly Results and Outlook

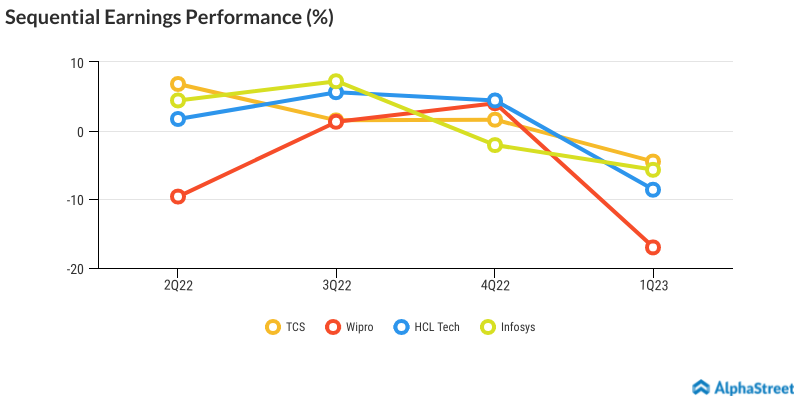

Tata Consultancy Services or TCS, the largest software exporter in the country, kicked off the earnings season earlier this month. The company missed street estimates and reported a mere 5% increase in net profit to INR9,478 crore for the first quarter. Additionally, profit fell 4.5% sequentially. Revenue rose 16% on year and 4% on quarter. Operating margin fell to 23.1% from 25.5% year ago, owing to annual salary increase, higher cost of managing employee attrition and normalizing travel costs.

Rajesh Gopinath, TCS Chief Executive Officer, said deal pipeline and closures continue to be strong. However, analysts remained skeptical noting clear signs of moderation in demand. Several analysts flagged a modest 1.2% on year growth in the order book.

Wipro and HCL Tech recorded a sequential drop of nearly 17% and 8.6%, respectively in net profit. IT giant Wipro saw a 21% on year fall in its net profit, widely missing analyst estimates, while revenue rose 19% from the year-ago period. Its IT services operating margin fell 200 basis points sequentially to 15%. HCL Tech’s revenue gained 16.9% on year for the April-June quarter, operating margin fell 90 basis points sequentially to 17%.

HCL Tech maintained its fiscal year 2023 revenue growth outlook in the 12%-14% range. HCL Tech CEO and managing director C Vijayakumar said the company is witnessing strong momentum in the market. “Our new bookings grew 23.4% on year supported by a good mix of large and mid sized deals and our pipeline remains near record high. Our operating margin came in at 17.0%. We have put in place the right measures that will improve our profitability going forward”, he added.

ICICI Direct Research, which retained a Hold rating on Wipro with target price of INR460, said that the company could use following levers to improve its EBIT margin going forward: a) improving its utilization levels, b) sub-contractor cost moderation, c) pyramid optimization by fresher hiring, d) better pricing led by its recent acquisition’s synergies, e) attrition moderation f) operational efficiency. Higher penetration in Europe, client mining, acquisition of new logos and traction digital revenues to further boost revenue growth will be some of the key triggers for future price performance, it added.

Infosys, the latest one to release results, reported a 3.2% rise in consolidated net profit to INR5,360 crore for the first quarter compared to a profit of INR5,195 crore in the same period last year. Profit fell 5.7% sequentially dampened by wage hikes. Revenue increased 23.6%. The company reported EBIT margin of 20.1%, down 140 basis points compared with the previous quarter.

The company hiked its revenue guidance for the current year to 14%-16% from 13%-15%. The operating margin is expected to be 21%-23%. In an investor note, Morgan Stanley said the revenue guidance is comforting but not enough to offset its weak margin outlook. House reiterated Overweight call on the stock with target price of INR1,535.

“We continue to gain market share and see a significant pipeline driven by our Cobalt cloud capabilities and differentiated digital value proposition,” said Infosys chief executive Salil Parekh. Hiring and competitive compensation revisions are expected to impact margins in the immediate term. However, stabilization in attrition levels could position the company for future growth.

Demand Scenario and Growth Visibility

Demand for operation transformation is strong as more companies apportion their capital spending budget to acquire latest technologies – cloud adoption, operating model transformation, growth and transformation (G&T) programs. As a result, Indian IT companies enjoy multiservice integrated deals, strong deal pipeline and potential new client additions.

TCS’s management remains optimistic on achieving a 25% operating margin by the fourth quarter. It said that it does not expect incremental supply-side pressure. Margin is expected to gradually recover from next quarter given slower wage revision, price hikes and Indian currency depreciation.

We believe that the demand scenario of the sector remains lucrative and vendor consolidation and captive monetization efforts should aid in near-term.

Weak Rupee

On July 19, rupee touched a new low, breaching past the 80-mark against the US dollar for the first-time ever. The Indian currency has lost nearly 7% since the beginning of this year.

The US dollar’s surge can be explained by the risk-off mode of the investors in face of recession fears in the U.S. The country’s inflation hit a four-decade high of 9.1% in June. According to a Reuters poll of Economists, the U.S. Federal Reserve will opt for another 75 basis point rate hike rather than a larger move at its meeting this week to quell stubbornly-high inflation as the likelihood of a recession over the next year rises to 40%.

As the rupee extends its slide against the dollar, investors are shifting towards export oriented sectors, for which a weaker domestic currency is a positive.

Rupee depreciation has helped Indian tech companies to partially offset the margin headwinds owing to wage inflation. Recovery of rupee or other adverse cross-currency movements would negatively impact Indian tech companies’ earnings. However, a potential recession in the US could also weigh on the pace of technology spending.

Conclusion

Volatility in IT stocks may persist in near-term tracking broader financial markets and deteriorating global economic conditions. Run to safe haven assets and higher interest rates could wane interest in these stocks.

However, the long-term outlook remains good with robust deal pipelines and potential price hikes for new contracts. We believe the Indian IT sector still has legs to run with double-digit growth projected in the next couple of years. The strong demand outlook more than offset others macro issues. The year-to-date correction of the technology stocks provides a good opportunity to accumulate as valuations look attractive.

| Company Name | Price (INR) | P/E |

| TCS | 3,178.95 | 30.23 |

| Infosys | 1,532.00 | 29.23 |

| HCL Tech | 924.55 | 22.88 |

| Wipro | 414.10 | 18.01 |