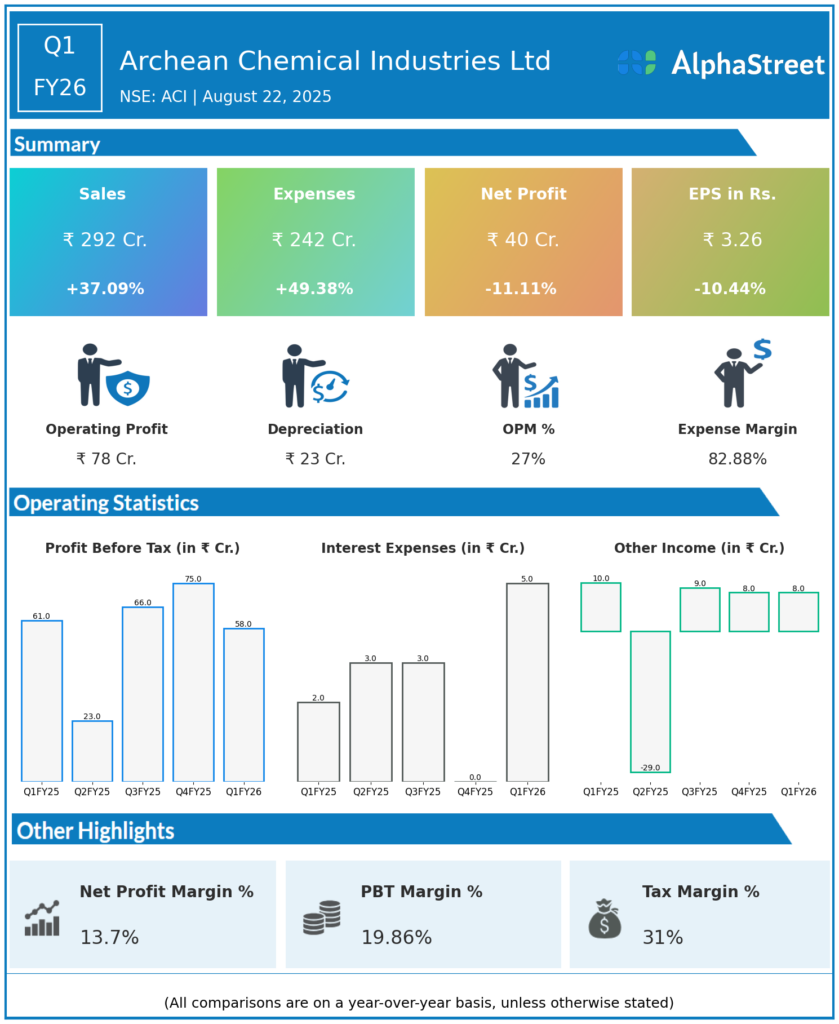

Archean Chemical Industries Limited, India’s largest exporter of bromine and industrial salt in Fiscal 2021, is a leading specialty marine chemical manufacturer focused on producing and exporting bromine, industrial salt, and sulphate of potash globally. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

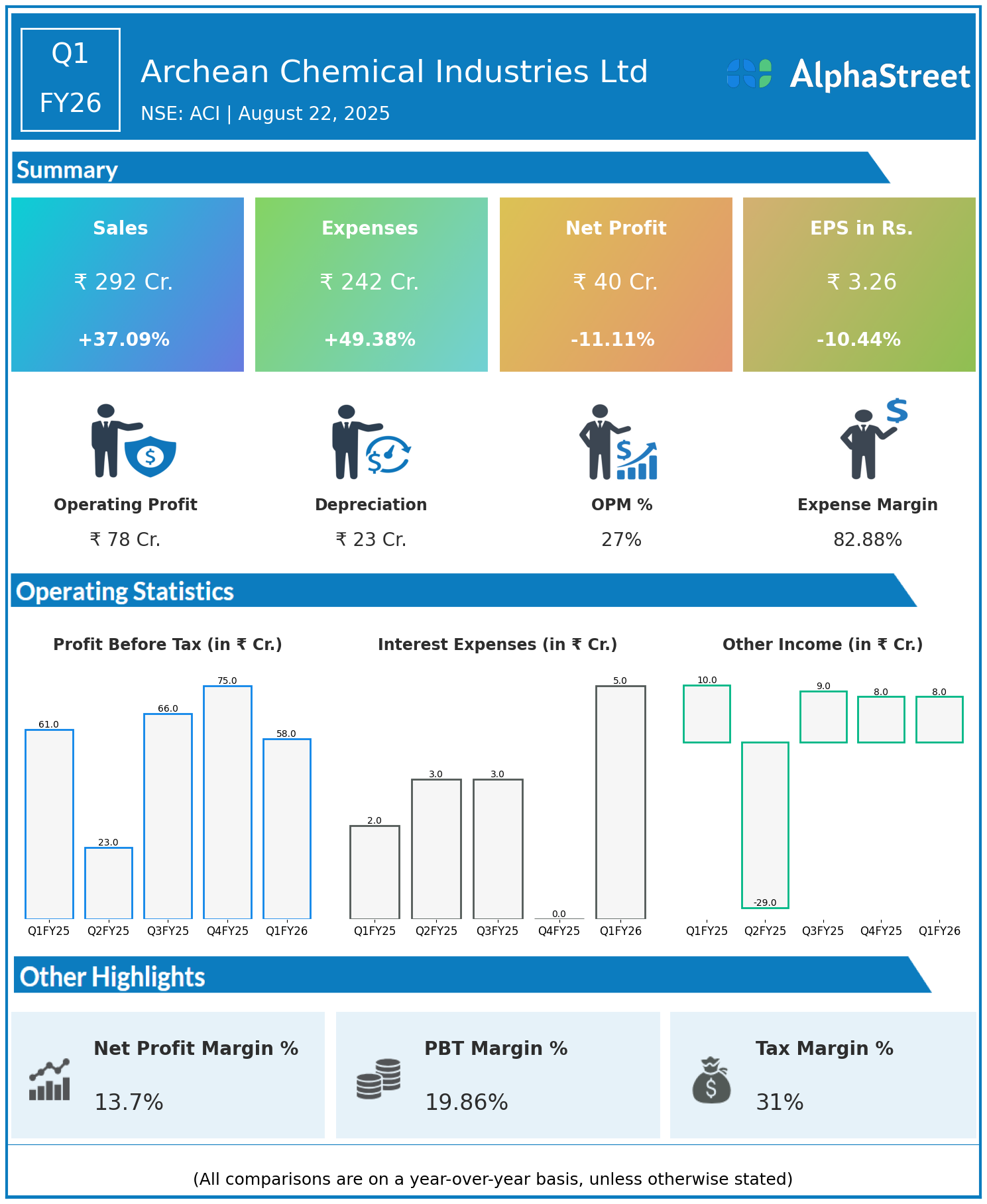

- Revenue: ₹292 crore, up 37.09% year-on-year (YoY) from ₹213 crore in Q1 FY25.

- Total Expenses: ₹242 crore, up 49.38% YoY from ₹162 crore.

- Consolidated Net Profit (PAT): ₹40 crore, down 11.11% from ₹45 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹3.26, down 10.44% from ₹3.64 YoY.

Operational & Strategic Update

- Strong Revenue Growth: Revenue soared by 37%, driven by higher sales volume or improved pricing in bromine, industrial salt, and specialty marine chemicals.

- Sharp Expense Increase: Expenses rose even faster (49.38%), led by higher input, energy, and operational costs, eroding margins.

- Profit Decline: Net profit and EPS fell by just over 11% and 10%, respectively, as cost escalation outpaced revenue growth and weighed on overall profitability.

- Market Position: The company maintains leadership in marine chemicals, export markets, and continues to expand capacity and product reach.

- Strategic Focus: Archean Chemical Industries is investing in efficiency improvements, capacity expansion, and broadening its global customer base to regain profitability traction.

Corporate Developments in Q1 FY26 Earnings

The Q1 FY26 results reflect a robust top-line performance offset by significant margin pressure from cost inflation and operational expenses.

Looking Ahead

Archean Chemical Industries Ltd aims to restore profit growth through better cost management, expansion into new export markets, and deploying operational efficiencies. Ongoing investments in product differentiation and scaling up production are expected to support recovery in subsequent quarters.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.