Apar Industries Limited, founded by Mr. Dharmsinh D. Desai in 1958, is a market leader in India with a strong global presence. The company has played a significant role in India’s electrification journey, evolving from manufacturing power transmission cables to operating across three broad business segments: Conductors, Transformer & Specialty Oils (TSO), and Power/Telecom Cables.

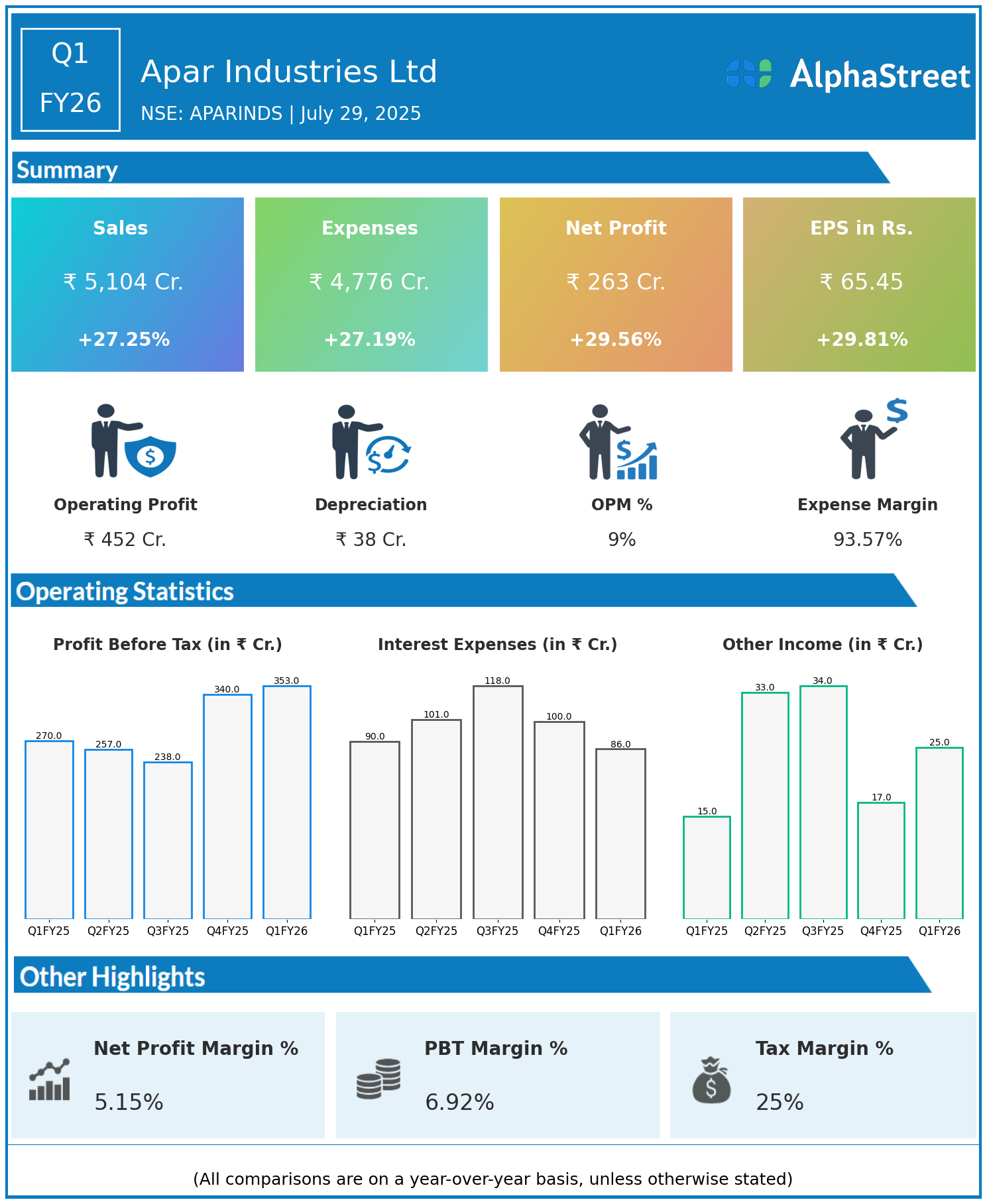

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹5,104 crore, up 27.25% year-on-year (YoY) from ₹4,011 crore in Q1 FY25.

- Total Expenses: ₹4,776 crore, up 27.19% YoY from ₹3,755 crore.

- Consolidated Net Profit (PAT): ₹263 crore, up 29.56% from ₹203 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹65.45, up 29.81% from ₹50.42 YoY.

Operational & Strategic Highlights

- Strong Revenue Growth: Driven by heightened demand in electrification projects, infrastructure development, and expansion in domestic and international markets.

- Expense Management: Expenses grew in near line with revenue, reflecting effective cost control and scalability of operations.

- Improved Profitability: Net profit and EPS growth slightly outpaced top-line growth due to operational efficiencies and margin improvement.

- Business Segment Performance:

- Conductors: Continued leadership supported by infrastructure projects in power transmission.

- Transformer & Specialty Oils (TSO): Increasing demand for high-quality insulating oils contributes to transformer reliability and performance.

- Power/Telecom Cables: Benefits from expanding telecom infrastructure and power distribution networks.

- Innovation & Quality: Ongoing investments in technology and quality enhancement maintain Apar’s competitive edge in the market.

- Global Reach: Expanded presence in export markets and international projects further diversifies revenue streams.

- Sustainability Commitment: Apar integrates environmentally responsible manufacturing practices aligned with global sustainability trends.

Corporate Developments

Q1 FY26 reflects a robust quarter for Apar Industries, underscored by strong revenue growth and significant profit increase. The diversified portfolio and strategic focus on electrification and infrastructure position the company for sustained growth.

Looking Ahead

Apar Industries Ltd is well-positioned to leverage ongoing government infrastructure initiatives and global market opportunities. Continued emphasis on innovation, operational excellence, and market diversification will support long-term shareholder value creation through FY26 and beyond.