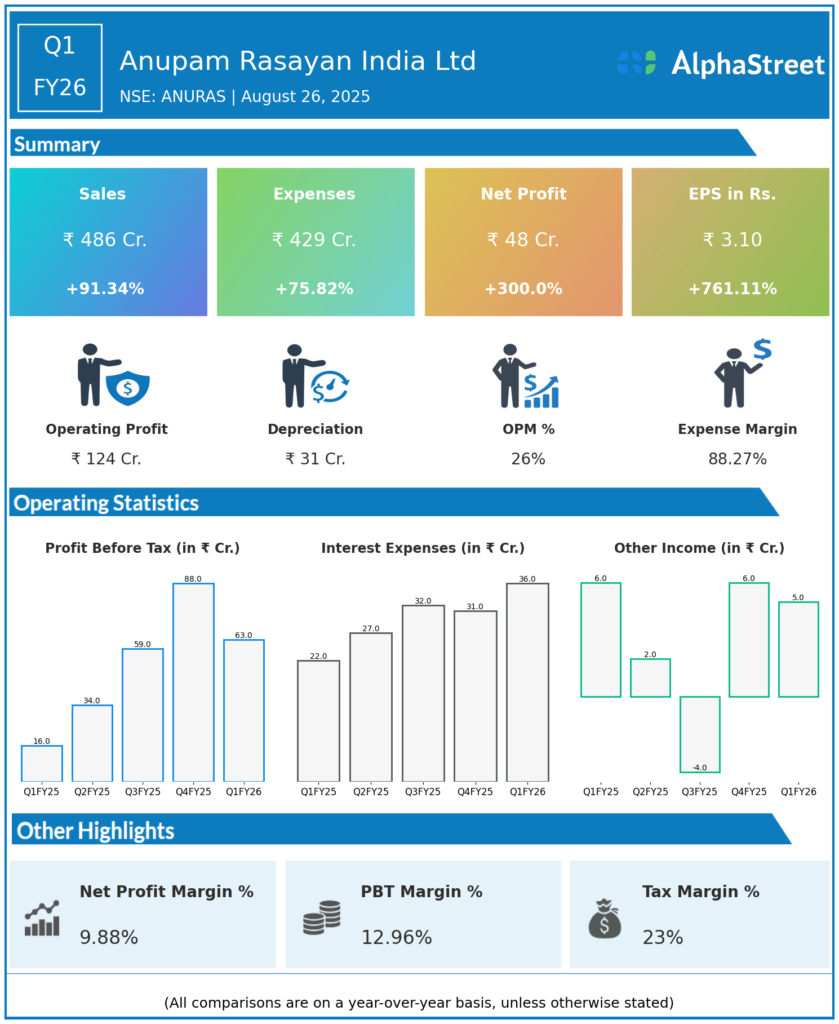

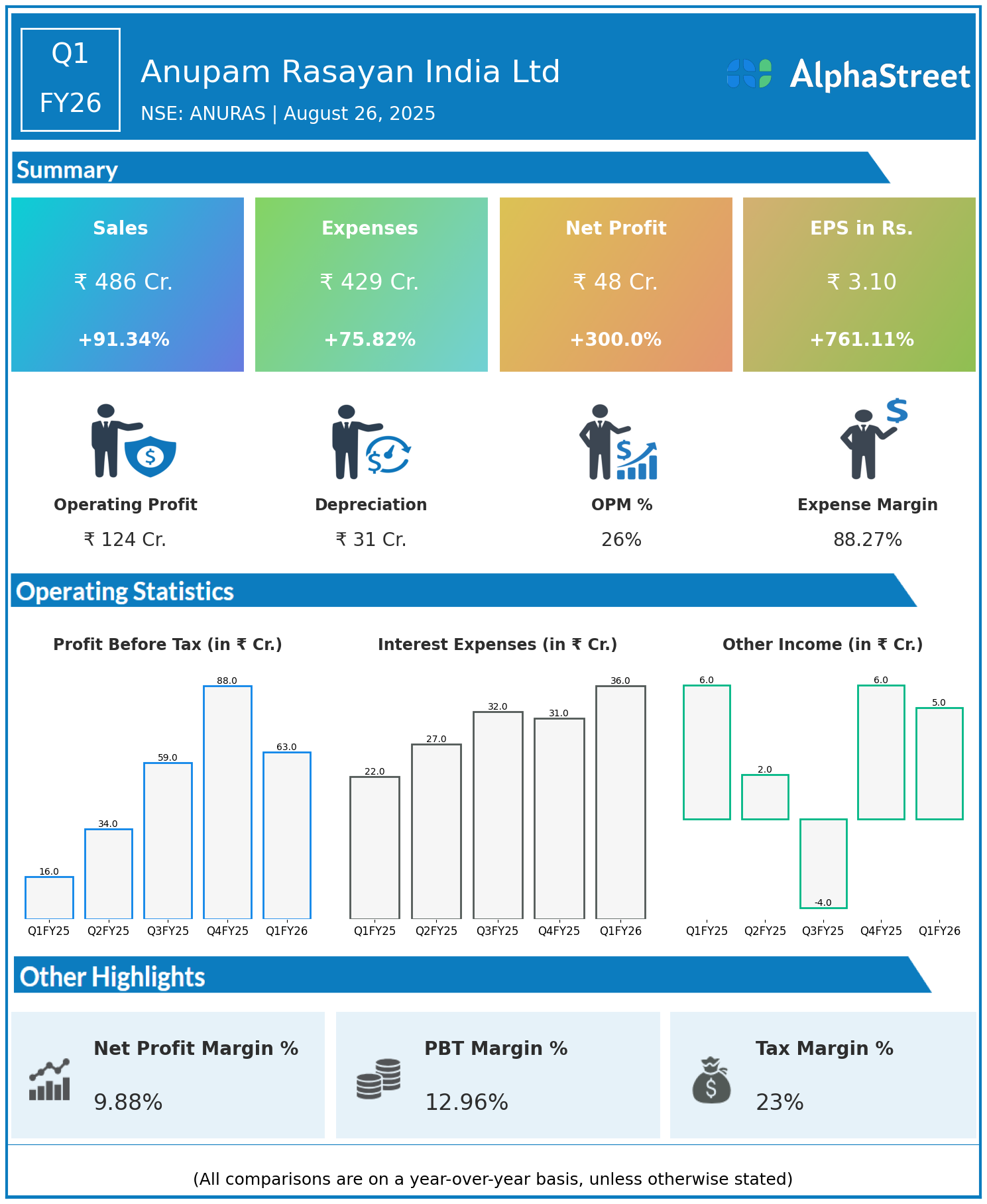

Anupam Rasayan India Ltd is a specialty chemicals manufacturer with both domestic sales and exports to international markets. Presenting below its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹486 crore, up 91.34% year-on-year (YoY) from ₹254 crore in Q1 FY25.

- Total Expenses: ₹429 crore, up 75.82% YoY from ₹244 crore.

- Consolidated Net Profit (PAT): ₹48 crore, up 300% from ₹12 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹3.10, up 761.11% from ₹0.36 YoY.

Operational & Strategic Update

- Exceptional Revenue Growth: Revenues nearly doubled, driven by strong domestic demand and expanded exports of specialty chemicals.

- Significant Expense Increase: Expenses grew by nearly 76%, below revenue growth rate, reflecting operational scaling with focus on cost control.

- Massive Profit Surge: Net profit and EPS surged by 300% and over 760% respectively, indicating significant margin expansion and improved profitability.

- Market Position: Anupam Rasayan India strengthens its standing as a key player in specialty chemicals with growing footprint in global markets.

- Strategic Focus: The company continues to focus on product innovation, capacity enhancement, and expanding export markets.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results highlight Anupam Rasayan India Ltd’s strong operational performance and robust profitability growth fueled by revenue momentum and efficient cost management.

Looking Ahead

The company plans to leverage its technological capabilities and market reach to sustain growth and profitability. Expansion in specialty chemicals exports and enhanced product development are key priorities for FY26.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.