Antony Waste Handling Cell Ltd (NSE: AWHCL; BSE: 543254) shares fell on Monday, closing around ₹499 on the National Stock Exchange, down approximately 3.4% on the session as of mid-day trading data on February 2, 2026. The intraday move followed the company’s quarterly business update for the period ended December 31, 2025. As of the latest available exchange pricing, the stock traded below the prior close, reflecting intraday pressure in Mumbai trade.

Market Capitalization

At the latest price levels, Antony Waste Handling Cell’s market capitalization was near ₹1,416 crore.

Q3 FY26 Financial Results

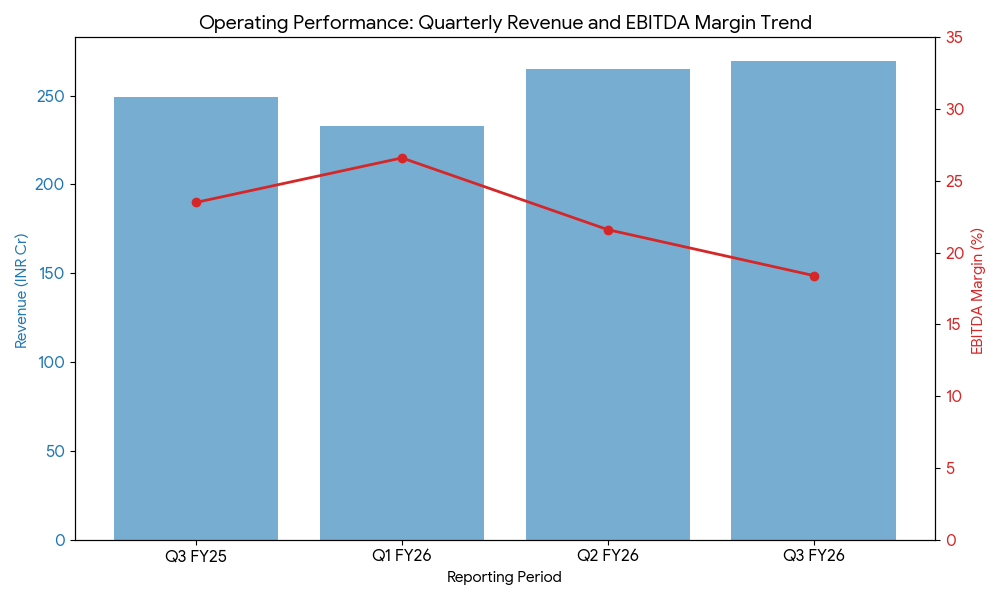

For the quarter ended December 31, 2025 (Q3 FY26), the company reported a consolidated total revenue of ₹269.3 crore, an increase of 8% compared to ₹249.2 crore in Q3 FY25. Consolidated net profit for the period stood at ₹14.6 crore, a decrease of 19% from ₹18.1 crore in Q3 FY25.

EBITDA for the quarter was ₹49.6 crore, down 15% from ₹58.5 crore in the year-ago period. The EBITDA margin compressed to 18.4% from 23.5% year-over-year. Management attributed the margin pressure primarily to higher employee costs following annual appraisals and incremental manpower additions.

Segment and Operational Highlights

Revenue from Municipal Solid Waste (MSW) Collection and Transportation grew 7% year-on-year to ₹174.5 crore. MSW Processing revenue increased by 12% year-on-year to ₹65.5 crore.

Operational volumes for the quarter included approximately 1.42 million metric tonnes (MMT) of waste managed. Resource recovery sales reached 37,840 tonnes of Refuse Derived Fuel (RDF) and 4,359 tonnes of compost during the three-month period.

Contracts and Project Wins

In the Q3 FY26 business update, the company disclosed awards of new contracts and project wins:

A consortium including a wholly-owned subsidiary secured two collection & transportation contracts from the Brihanmumbai Municipal Corporation (BMC) covering seven wards with an estimated combined revenue potential of about ₹1,330 crore over seven years.

Antony Lara Enviro Solutions Private Limited, a subsidiary, was awarded a 600-800 TPD municipal solid waste pre-processing and stabilization facility concession in Thane, with capital outlay of approximately ₹67 crore, reimbursable by the Thane Municipal Corporation.

These developments were reported to form part of the company’s strategy to expand its core waste management service footprint and deepening presence in integrated operations.

Business and Operations Update

The National Company Law Tribunal (NCLT), Mumbai, approved the merger of AG Enviro Infra Projects Private Limited with Antony Waste Handling Cell Ltd effective December 31, 2025. The merger is aimed at consolidating assets and cash flows, and it has been reflected in the business update filings.

In addition, the company confirmed compliance with SEBI regulations concerning dematerialization of its securities, noting that all of its securities were held in dematerialized form during the quarter without dematerialization requests.

Performance Summary

Antony Waste Handling Cell Ltd’s shares traded lower on February 2, 2026, with the price around ₹499, representing a session decline of about 3.4%.

Q3 FY26 consolidated revenue rose around 8% year-on-year to approximately ₹269.3 crore, while net profit was quieter compared with the year-ago quarter.

Key segment developments included expanded municipal contracts in Mumbai and a DBOT facility award in Thane, and the company completed a merger with AG Enviro Infra Projects during the quarter.

The company’s business update and stock movement underscore its ongoing operational developments and market response following the latest quarterly disclosures.