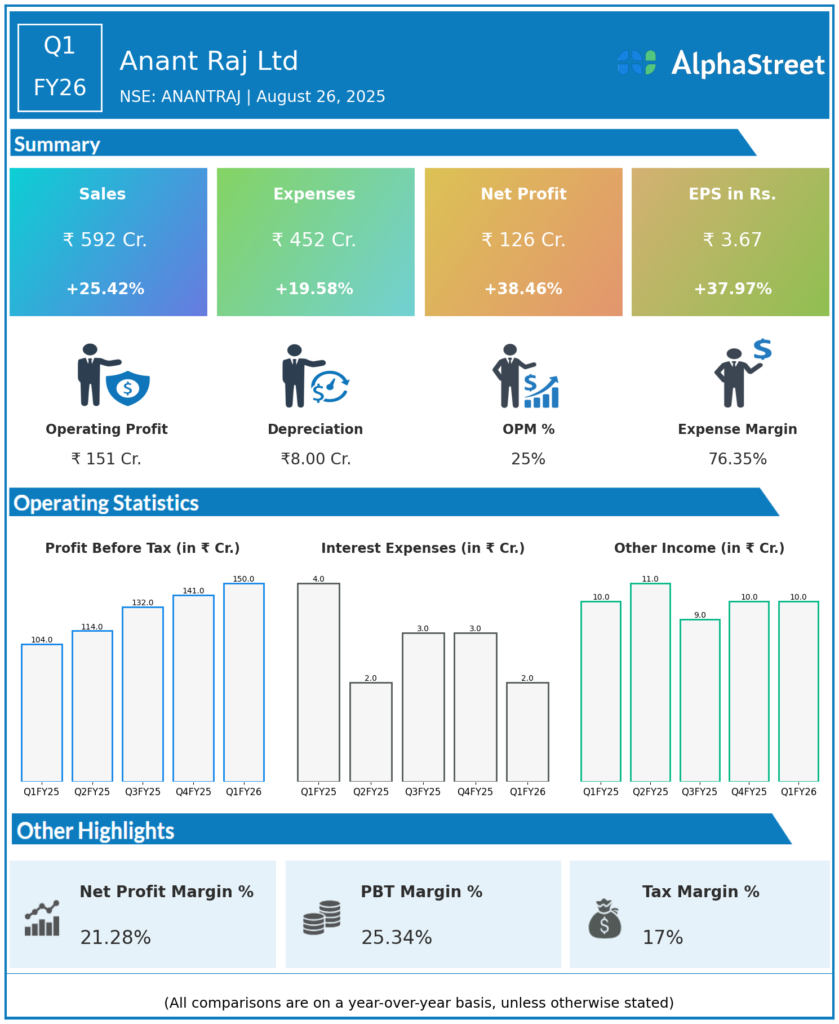

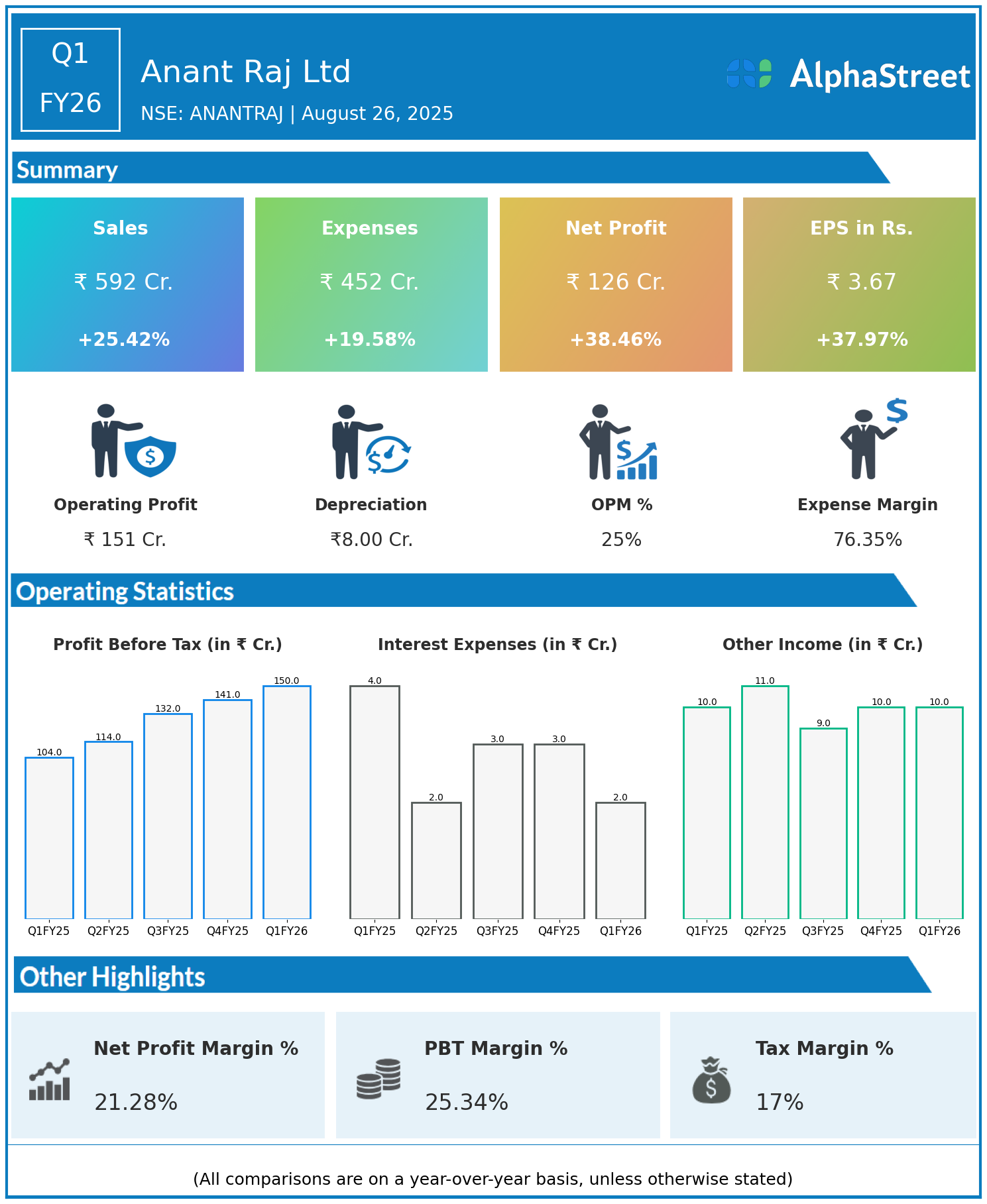

Anant Raj Ltd, incorporated in 1985, is a leading real estate developer active in IT parks, hospitality projects, SEZs, office complexes, shopping malls, and residential projects across Delhi, Haryana, Andhra Pradesh, Rajasthan, and the NCR. The company has developed over 20 million square feet of real estate in various sub-segments. Presenting below are its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹592 crore, up 25.42% year-on-year (YoY) from ₹472 crore in Q1 FY25.

- Total Expenses: ₹452 crore, up 19.58% YoY from ₹378 crore.

- Consolidated Net Profit (PAT): ₹126 crore, up 38.46% from ₹91 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹3.67, up 37.97% from ₹2.66 YoY.

Operational & Strategic Update

- Robust Revenue Growth: Revenue rose by over 25%, driven by strong project completions and sales momentum across commercial, residential, and hospitality sectors.

- Disciplined Expense Management: Expenses increased by under 20%, lower than revenue growth, supporting improved margins and operational efficiency.

- Significant Profit Expansion: Net profit and EPS soared by about 38%, reflecting better cost controls, high sales realization, and margin enhancement.

- Market Position: Anant Raj Ltd maintains a strong presence in North India’s real estate market with diversified project offerings and a history of successful project deliveries.

- Strategic Focus: The company continues to focus on project execution, portfolio diversification, and expansion into affordable housing to drive future growth.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results demonstrate Anant Raj Ltd’s ability to leverage market opportunities, highlighted by significant profit growth and sustained sales momentum.

Looking Ahead

Anant Raj Ltd plans to further scale up development activities, enhance value offerings, and capture opportunities in residential and commercial segments. Operational excellence and strategic investments are expected to support continued profitability in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.