Ambuja Cements Limited, a member of the Adani Group, stands as one of India’s leading cement manufacturers. With an impressive cement capacity of 31 million tonnes, the company operates six integrated cement manufacturing plants and eight cement grinding units across the country, catering to robust infrastructure and construction sector demand.

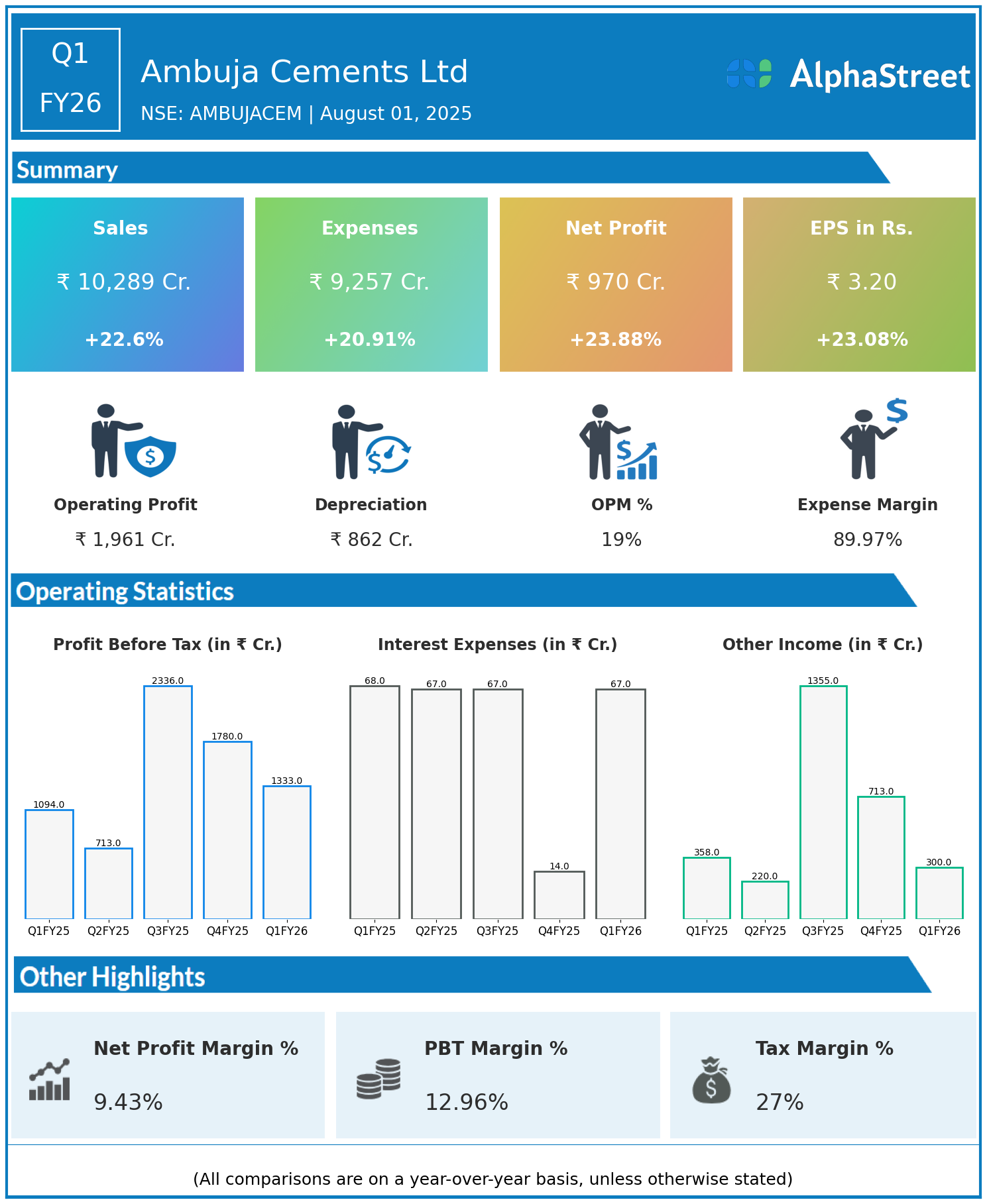

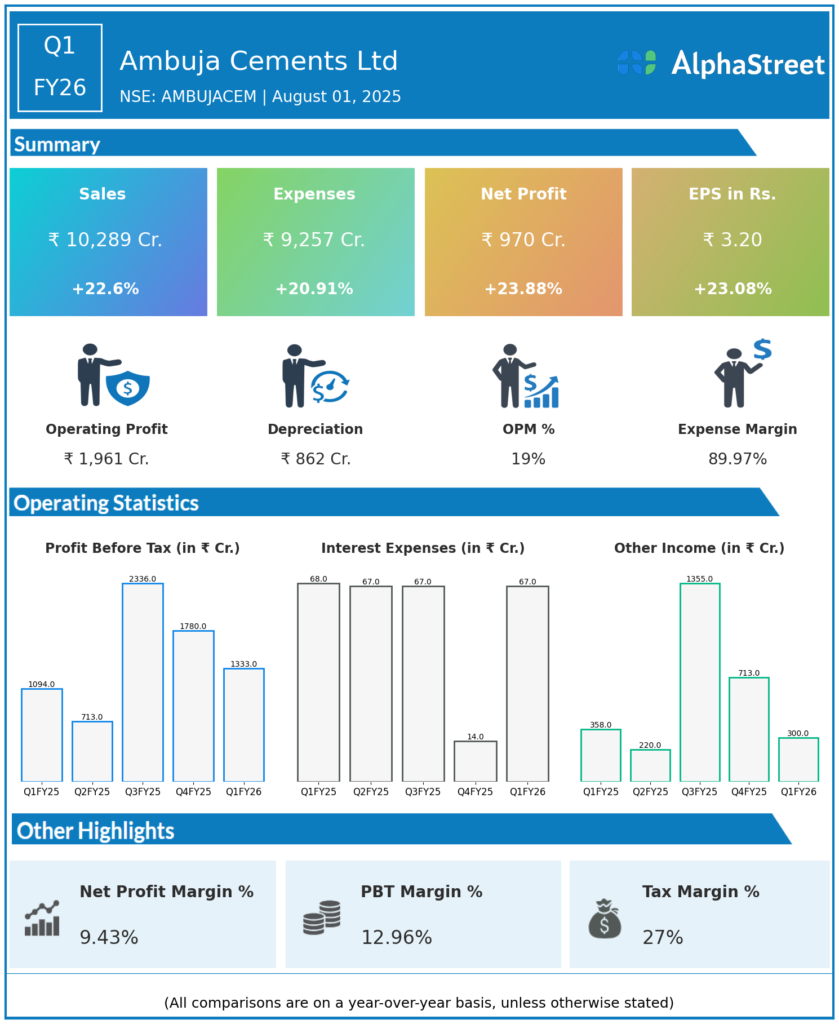

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹10,289 crore, up 22.6% year-on-year (YoY) from ₹8,392 crore in Q1 FY25.

- Total Expenses: ₹9,257 crore, up 20.91% YoY from ₹7,656 crore.

- Consolidated Net Profit (PAT): ₹970 crore, up 23.88% from ₹783 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹3.20, up 23.08% from ₹2.60 YoY.

Operational & Strategic Update

- Strong Revenue Growth: The notable revenue increase was driven by firm demand in the housing, infrastructure, and real estate sectors, supported by Ambuja’s pan-India distribution network and manufacturing strength.

- Expense Management: While total expenses grew given higher input and raw material costs, the increase remained lower than the revenue uptick, reflecting improved operational leverage and procurement efficiencies.

- Profitability Expansion: The double-digit jump in net profit and EPS points to disciplined margin management, cost optimization initiatives, and better realizations from premium product offerings.

- Capacity & Market Reach: As one of India’s largest cement players, Ambuja continues to invest in capacity expansions and technological upgrades, strengthening its market position in existing and new geographies.

- Sustainability Initiatives: Commitment to sustainable manufacturing remains at the core, with ongoing investments in renewable energy, waste heat recovery, and circular economy practices.

- Strategic Focus: Synergy with the Adani Group deepens operational integration, logistical efficiency, and access to adjacencies in construction materials and infrastructure segments.

Corporate Developments

Q1 FY26 demonstrates Ambuja Cements’ strong operational momentum, marked by robust revenue gains and a healthy expansion in profitability despite industry-wide challenges around cost inflation. The strategic focus on efficiency, capacity growth, and sustainability anchors its competitive advantage.

Looking Ahead

Ambuja Cements Ltd is poised to continue leveraging growing demand from infrastructure and real estate, with planned investments in manufacturing capacity and green initiatives. The company’s financial discipline, product innovation, and group synergies are likely to support further growth and long-term value creation for stakeholders through FY26 and beyond.