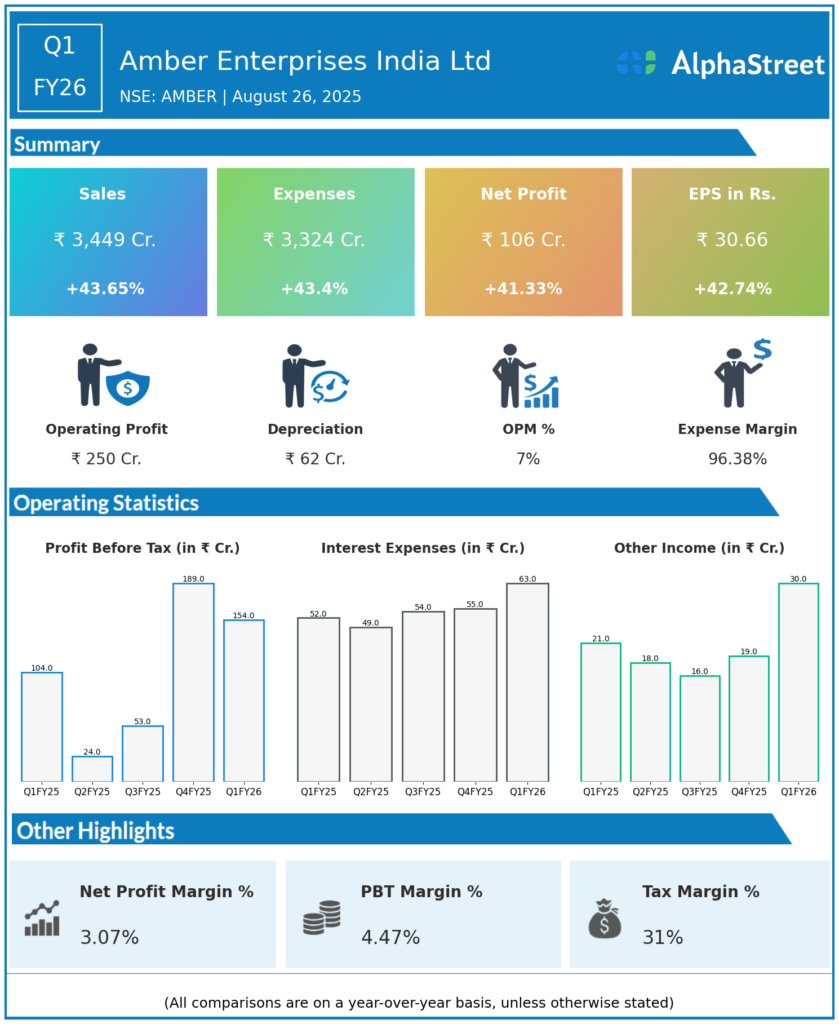

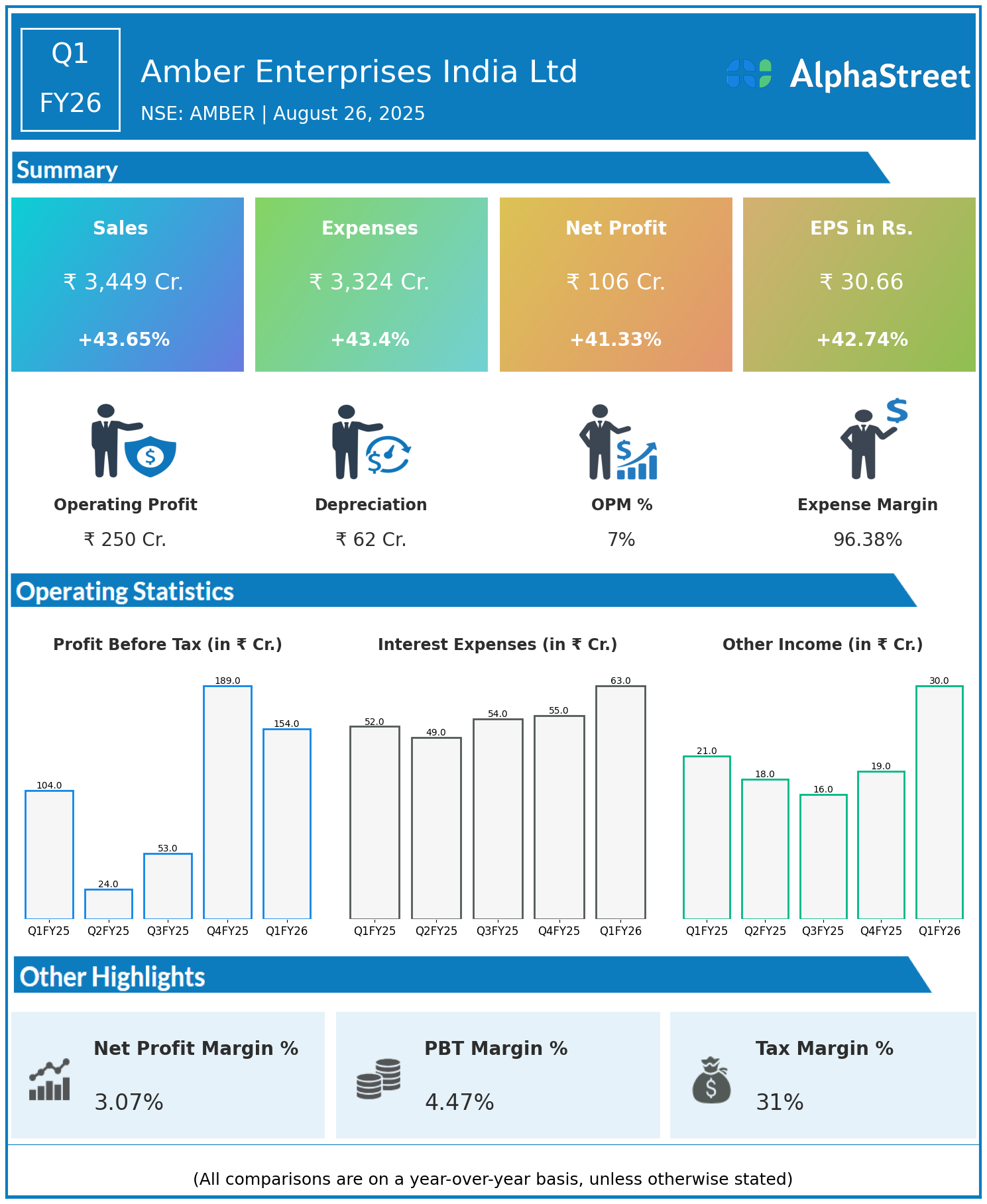

Amber Enterprises India Ltd, incorporated in 1956, holds a leading 23.6% market share in the Room Air Conditioner segment and is a prominent OEM/ODM solutions provider for the Indian air conditioning industry. Presenting below its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹3,449 crore, up 43.65% year-on-year (YoY) from ₹2,401 crore in Q1 FY25.

- Total Expenses: ₹3,324 crore, up 43.4% YoY from ₹2,318 crore.

- Consolidated Net Profit (PAT): ₹106 crore, up 41.33% from ₹75 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹30.66, up 42.74% from ₹21.48 YoY.

Operational & Strategic Update

- Exceptional Revenue Growth: Revenue increased by over 43%, indicating robust demand for air conditioner solutions and successful market expansion.

- Expense Increase: Expenses rose in tandem with revenues, reflecting scaling operations and input cost dynamics.

- Strong Profit Growth: Net profit and EPS increased by more than 41%, supported by solid topline growth and effective cost management.

- Market Position: Amber Enterprises strengthens its leadership in the Indian air conditioning OEM/ODM space, leveraging its broad capabilities and client relationships.

- Strategic Focus: The company focuses on technological innovation, capacity expansion, and enhancing value-added offerings to sustain growth momentum.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results demonstrate Amber Enterprises India Ltd’s strong operational execution, highlighted by high revenue and profit growth amidst sector expansion.

Looking Ahead

Amber Enterprises India Ltd aims to maintain growth through further innovation, capacity expansion, and strengthening its OEM/ODM partnerships. Focused investment in technology and process efficiencies will drive value creation in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.