Company Overview

Alok Industries is one of India’s prominent integrated textile manufacturers with a strong presence across cotton and polyester segments. The company’s operations span spinning, weaving, knitting, processing, home textiles, and garments, catering to both domestic and international markets. It is currently under the management support of Reliance Industries Ltd, which is leading its turnaround efforts to restore profitability and operational stability. Presenting below its Q2 FY26 Earnings Results.

Q2 FY26 Earnings Results

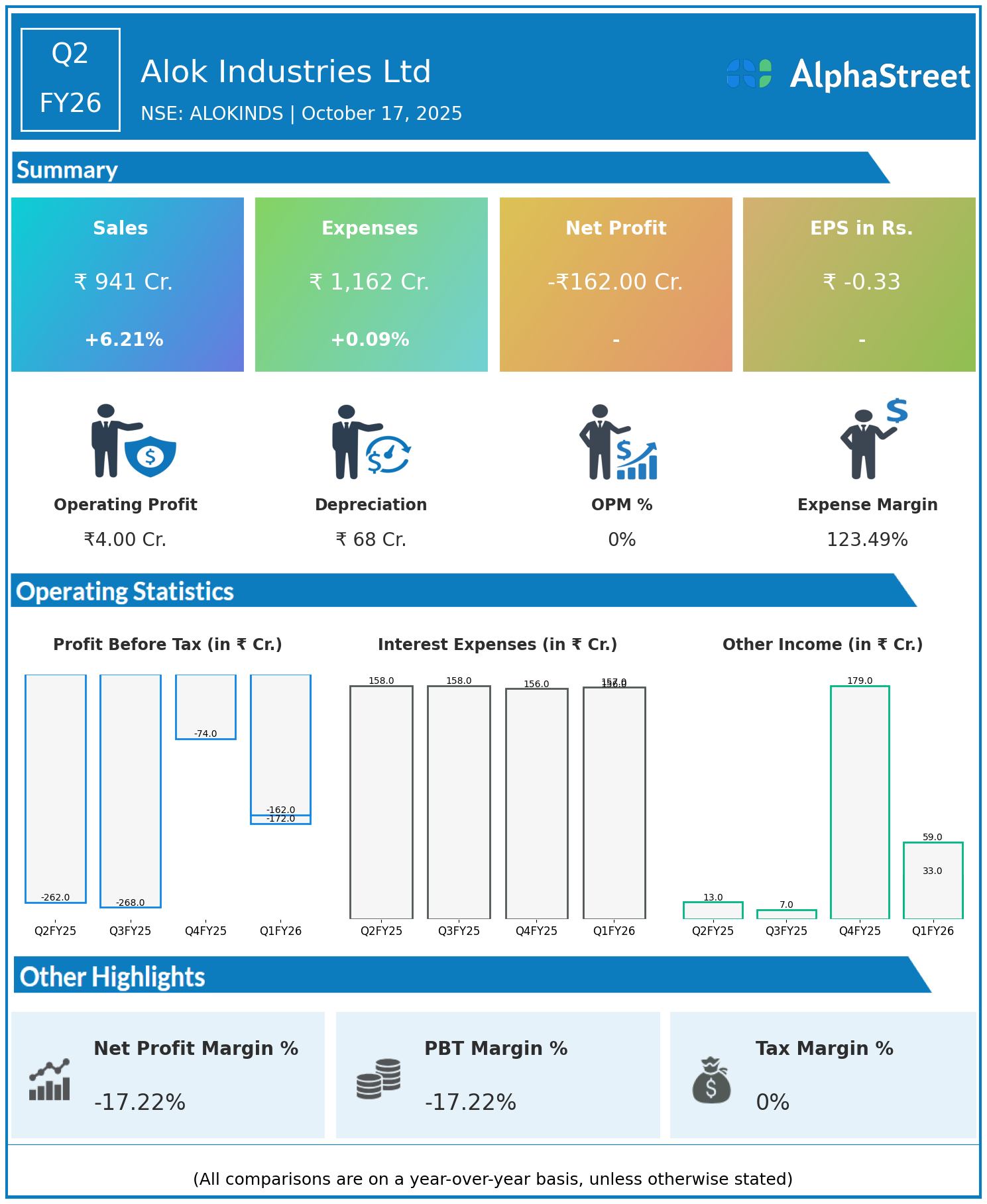

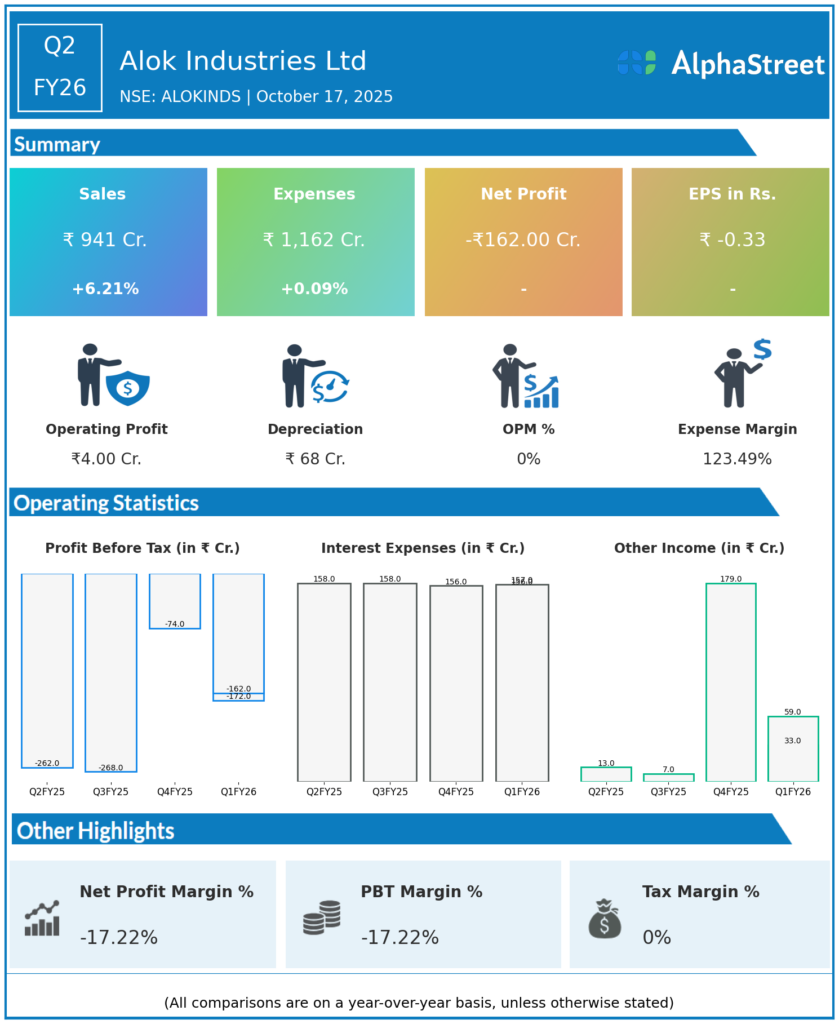

Alok Industries Ltd reported total revenue of ₹932.5 crore for Q2 FY26, reflecting a 6.2% increase year-on-year from ₹886 crore in Q1 FY25. Total expenses remained nearly unchanged at ₹1,162 crore versus ₹1,161 crore last year, as the company maintained cost discipline despite supply-side challenges.

The company’s consolidated net loss narrowed to ₹162 crore, a significant improvement from ₹262 crore in the same quarter last year. The earnings per share (EPS) improved to -₹0.33 from -₹0.53 YoY, indicating controlled losses amid revenue growth.

Operational & Strategic Update

- Revenue Growth and Cost Control: The company’s topline growth was underpinned by better capacity utilization and improved product realization in polyester and finished fabric categories.

- EBITDA Improvement: EBITDA stood at ₹42.8 crore, supported by controlled overheads and a gain from insurance proceeds (₹25.6 crore) related to the Silvassa plant incident. Margins, however, remained modest due to higher energy and logistics costs.

- Segmental Performance: The textile business continued to face global headwinds from subdued demand in the U.S. and Europe, though domestic demand trends improved sequentially.

- Debt & Finance Costs: Finance costs remained high at approximately ₹156 crore, which continued to impact profitability; management has outlined steps toward deleveraging and operational efficiency improvements.

Outlook

Alok Industries is steadily progressing toward stabilizing its operations, backed by Reliance Industries’ strategic support. The company’s focus remains on enhancing operational efficiency, product quality, and cost optimization while exploring growth in value-added technical textiles and export-focused apparel. With improving margins and narrowed losses, the company is inching closer to breakeven and aims for a gradual turnaround in FY26.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.