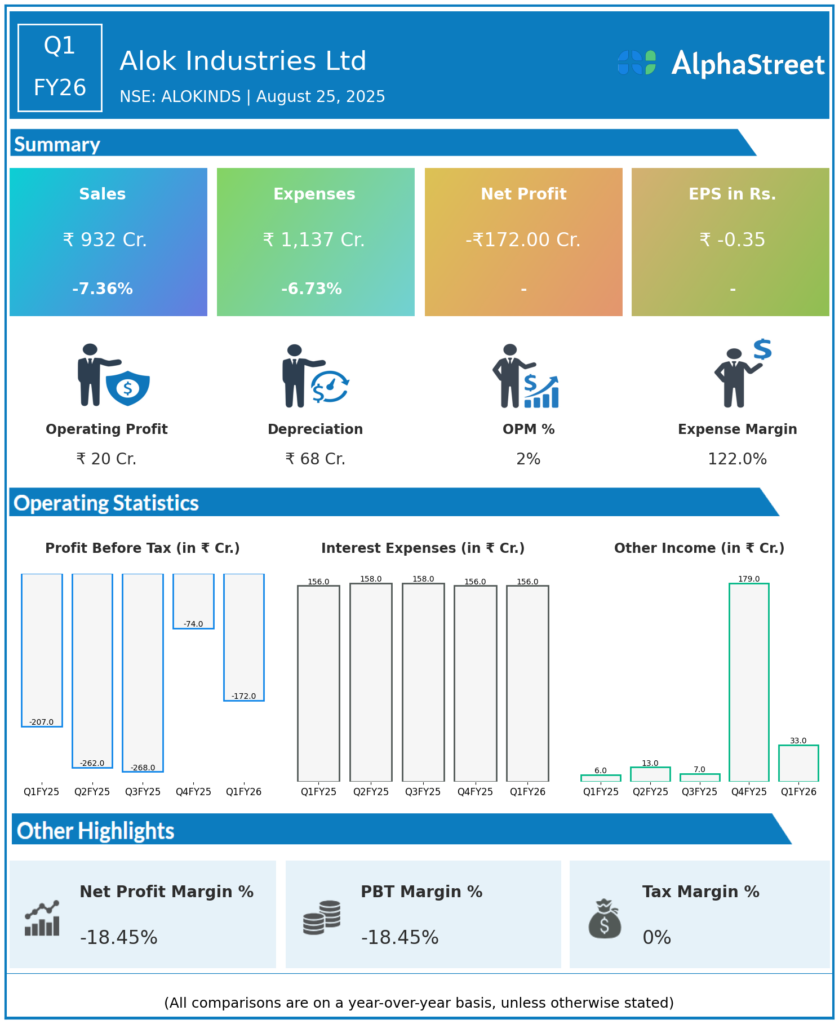

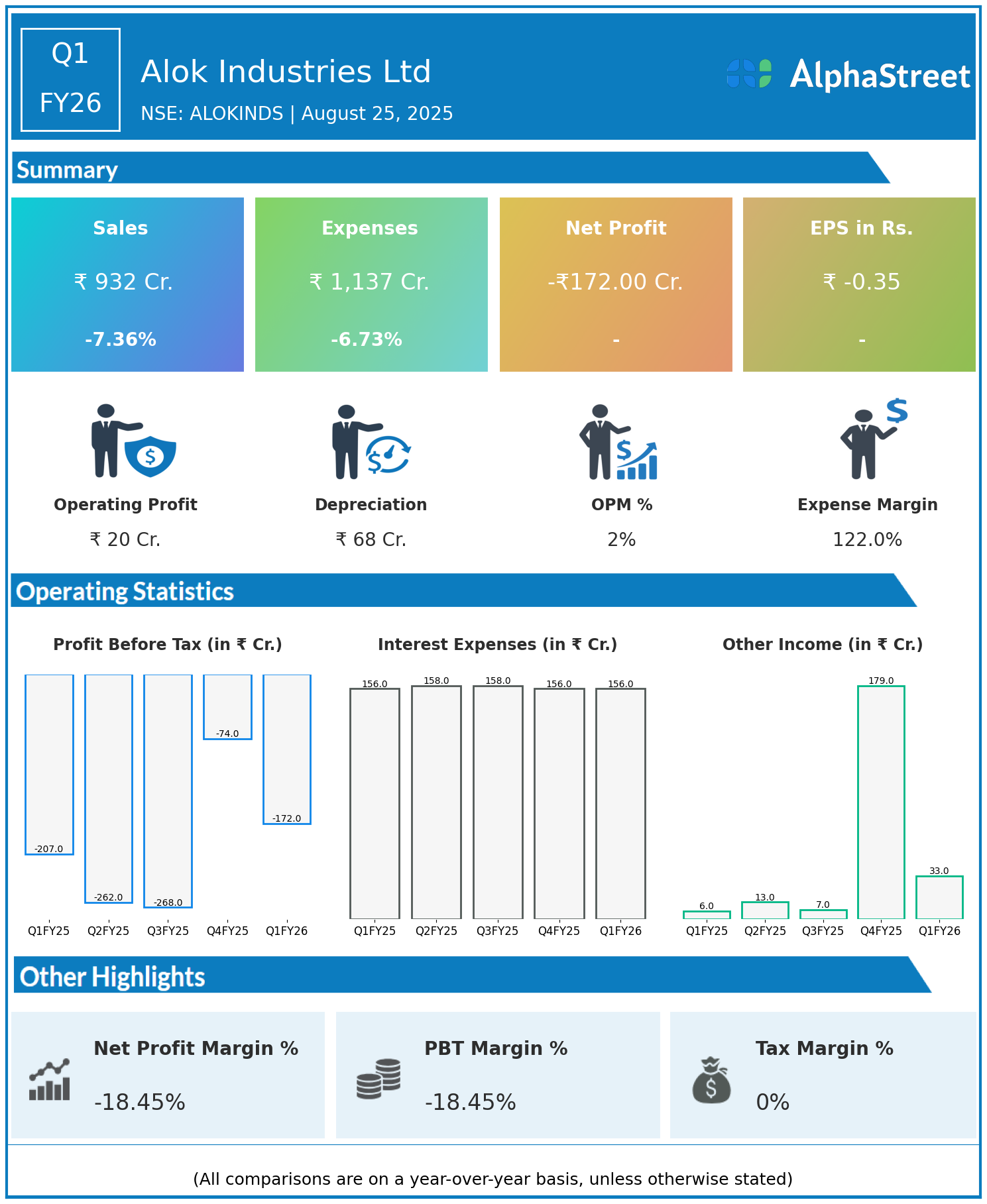

Alok Industries Ltd is a textile company active in the cotton and polyester segments, involved in manufacturing textiles as well as leather and other apparel products. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

- Revenue: ₹932 crore, down 7.36% year-on-year (YoY) from ₹1,006 crore in Q1 FY25.

- Total Expenses: ₹1,137 crore, down 6.73% YoY from ₹1,219 crore.

- Consolidated Net Profit (PAT): Loss of ₹172 crore, compared to a loss of ₹207 crore in the same quarter last year.

- Earnings Per Share (EPS): -₹0.35, improved from -₹0.42 in Q1 FY25.

Operational & Strategic Update

- Revenue Decline: Revenue dropped by over 7%, indicating continued challenges in textile demand and market conditions.

- Expense Management: Total expenses fell by 6.73%, reflecting ongoing cost control measures, though not enough to offset the top-line decline.

- Reduced Losses: Despite the loss, the company narrowed its net loss and improved EPS compared to the previous year, signaling progress in operational efficiency.

- Market Position: Alok Industries retains significant capacity in both cotton and polyester segments and continues to focus on optimizing operations.

- Strategic Focus: The company remains committed to enhancing product quality, streamlining costs, and targeting margin improvement amid market headwinds.

Corporate Developments in Q1 FY26 Earnings

The Q1 FY26 results show persistent revenue pressures but highlight reduced losses, pointing to steady efforts in cost management and gradual recovery.

Looking Ahead

Alok Industries Ltd will likely continue focusing on operational improvements, product diversification, and market expansion strategies to return to profitability in the coming quarters.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.