Alkem Laboratories Ltd.(NSE:ALKEM) is a pharmaceutical company that specializes in developing, manufacturing, and marketing of pharmaceutical and nutraceutical products. The company operates in both the domestic and international markets. It offers a wide range of products in various therapeutic segments such as cardiology, gastroenterology, neurology, orthopedics, and more.

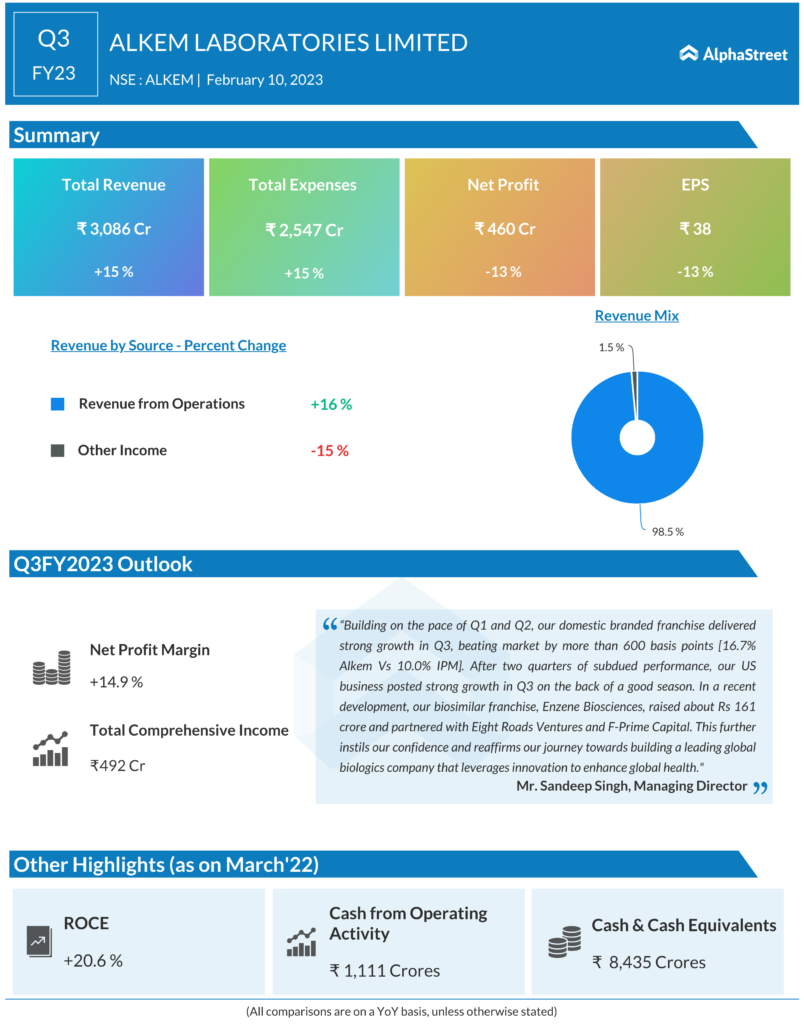

Alkem Laboratories Limited is an Indian pharmaceutical company with a focus on both domestic and international sales. During the 3rd quarter of the financial year 23 (Q3FY23), the company recorded a total revenue of Rs. 30,409 million with a YoY growth of 16.1%. India sales accounted for Rs. 19,922 million, a growth of 9.7%, while international sales were Rs. 9,928 million, a growth of 28.8%. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) was Rs. 5,990 million, resulting in an EBITDA margin of 19.7%. R&D expenses for the quarter were 4.3% of total revenue from operations. The Profit Before Tax (PBT) was Rs. 5,389 million, a growth of 16.2% compared to Q3FY22, while the Net Profit was Rs. 4,547 million, a YoY decline of 13.5%.

For the 9 months period ending December 31, 2022 (9MFY23), the company recorded total revenue from operations of Rs. 86,967 million with a YoY growth of 6.7%. India sales were Rs. 59,898 million, a YoY growth of 5.3%, while international sales were Rs. 25,823 million, a YoY growth of 9.1%. The EBITDA was Rs. 12,562 million, resulting in an EBITDA margin of 14.4%. The company’s R&D expenses for 9MFY23 were 4.5% of total revenue from operations. The Profit Before Tax (PBT) was Rs. 10,931 million, a decline of 31.7% compared to 9MFY22, while the Net Profit was Rs. 9,132 million, a YoY decline of 40.6%.

In conclusion, Alkem Laboratories reported a strong growth in Q3FY23, with a good performance from both domestic and international sales. The company’s EBITDA margin and R&D expenses were in line with expectations. The company also generated healthy cash flows and strengthened its balance sheet with a strong net cash position. The recent development of Alkem’s biosimilar franchise, Enzene Biosciences, further instills confidence in the company’s future growth.