Alembic Ltd, established in 1907, operates in the pharmaceuticals, real estate, and power assets sectors. It is the flagship company of the Alembic Group and holds significant stakes in Alembic Pharma Ltd and Paushak Limited. Presenting below its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

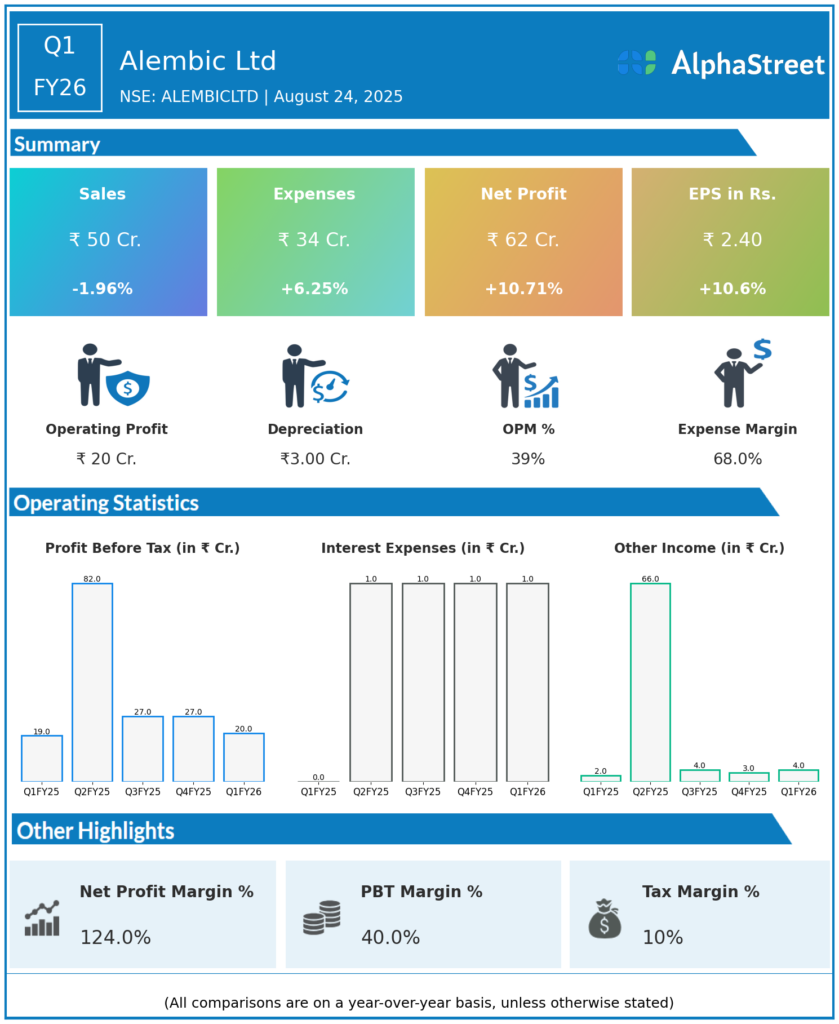

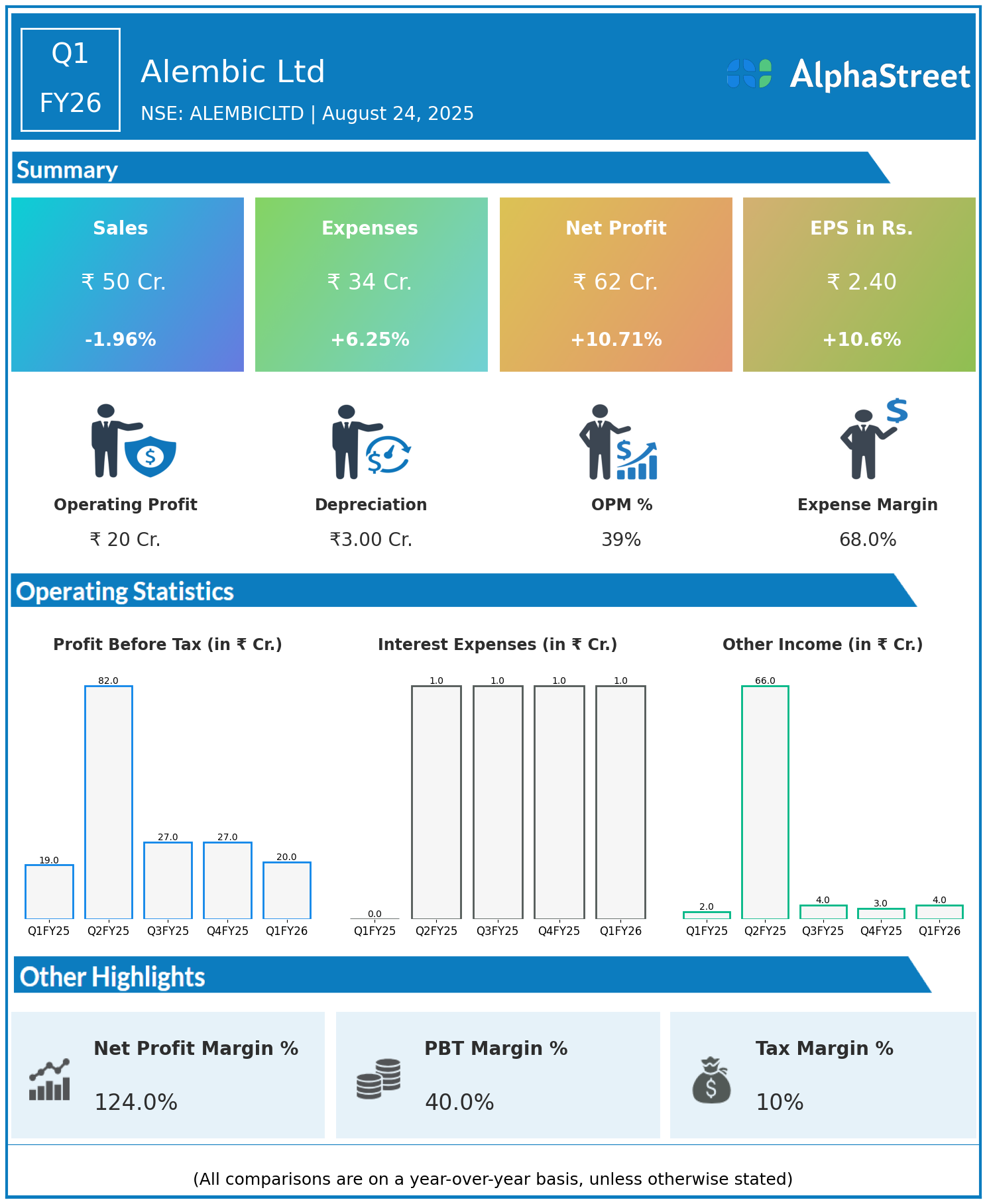

- Revenue: ₹50 crore, down 1.96% year-on-year (YoY) from ₹51 crore in Q1 FY25.

- Total Expenses: ₹34 crore, up 6.25% YoY from ₹32 crore.

- Consolidated Net Profit (PAT): ₹62 crore, up 10.71% from ₹56 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹2.40, up 10.60% from ₹2.17 YoY.

Operational & Strategic Update

- Slight Revenue Decline: Revenues fell marginally by approximately 2%, indicating stable but slightly soft business activity.

- Expense Increase: Total expenses rose by over 6%, reflecting higher operational or administrative costs.

- Profit Growth: Net profit and EPS increased by more than 10%, signaling improved profitability despite flat revenues, likely due to other income or operational efficiencies.

- Market Position: Alembic Ltd continues to maintain a strategic position in pharmaceuticals and real estate, backed by its stakes in key group entities.

- Strategic Focus: The company focuses on optimizing asset value, enhancing operational efficiency, and capitalizing on its diversified business portfolio.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results demonstrate Alembic Ltd’s ability to generate profit growth amid a stable revenue environment through effective cost management and value realization.

Looking Ahead

Alembic Ltd aims to sustain profitability by continuing operational improvements, maximizing group synergies, and leveraging its diverse business assets to drive long-term growth.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.