Alembic Pharmaceuticals Limited is a leading player in the pharmaceutical industry, engaged in the development, manufacturing, and marketing of formulations and active pharmaceutical ingredients (APIs). The company operates 3 R&D centers and 5 advanced manufacturing facilities, supporting global exports and a robust domestic presence. Presenting below are its Q1 FY26 Earnings Results

Q1 FY26 Earnings Results

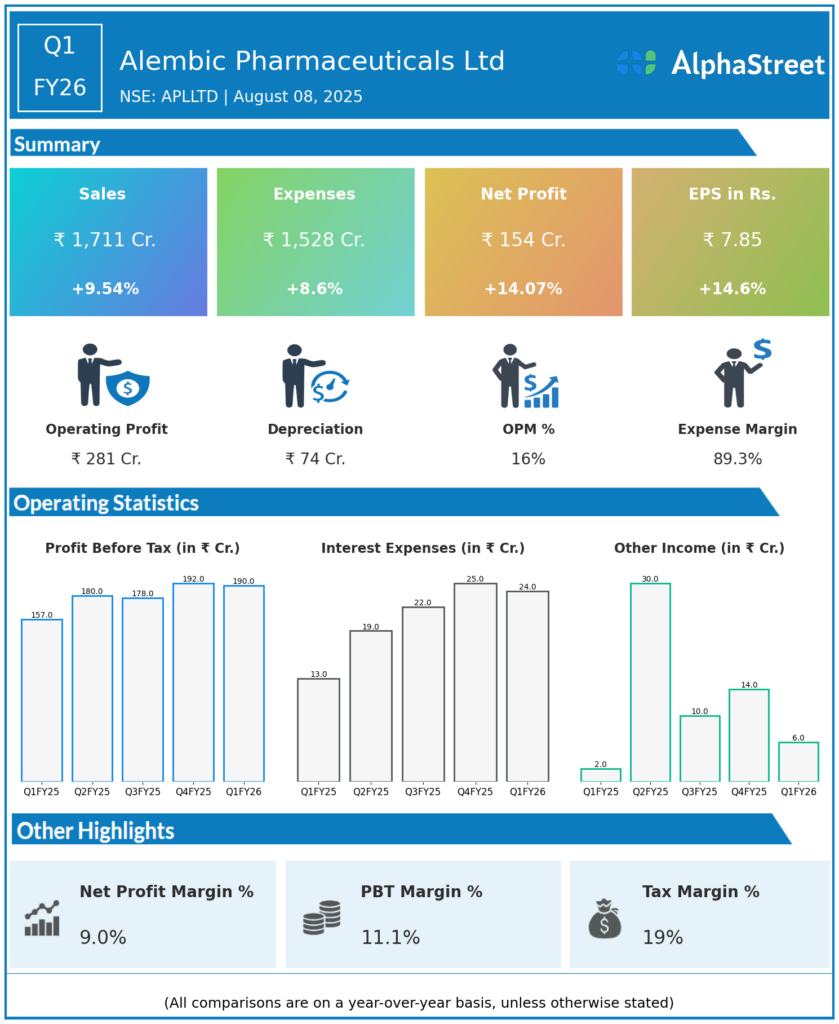

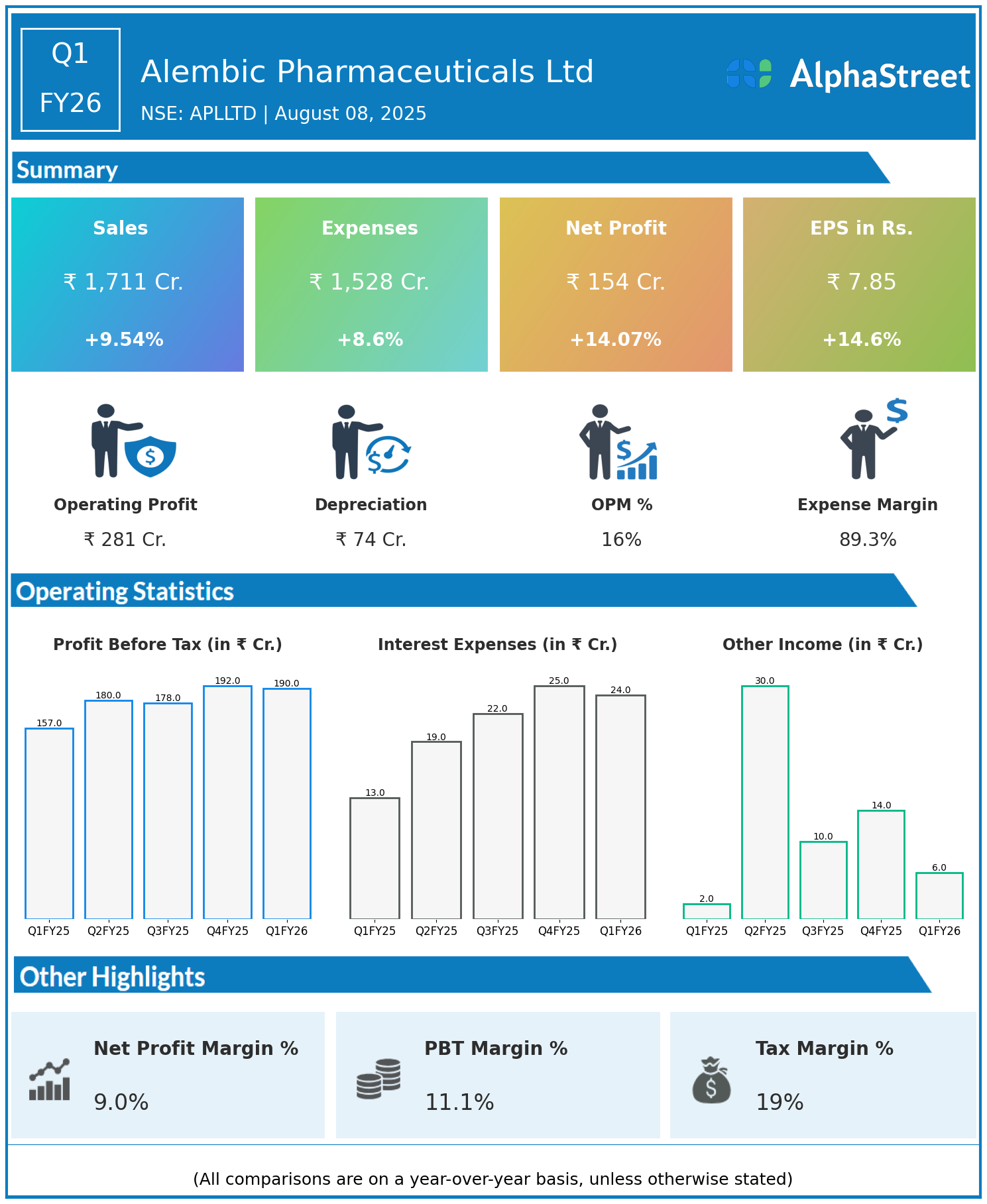

- Revenue: ₹1,711 crore, up 9.54% year-on-year (YoY) from ₹1,562 crore in Q1 FY25.

- Total Expenses: ₹1,528 crore, up 8.6% YoY from ₹1,407 crore.

- Consolidated Net Profit (PAT): ₹154 crore, up 14.07% from ₹135 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹7.85, up 14.60% from ₹6.85 YoY.

Operational & Strategic Update

- Healthy Revenue Growth: The 10% increase in revenue reflects strong sales performance in both domestic and international markets, driven by demand for key formulations and APIs.

- Effective Cost Management: Total expenses rose at a slower pace than revenue, highlighting cost discipline and operational efficiencies across manufacturing and R&D activities.

- Profitability Expansion: Net profit and EPS rose over 14%, outpacing revenue growth, which indicates margin expansion and better product mix or operational leverage.

- Innovation & Exports: Alembic continues to benefit from sustained investments in R&D, resulting in robust product pipelines, new launches, and regulatory approvals across multiple geographies.

- Business Focus: The diversified product portfolio, with a presence in chronic and acute therapies, supports defensive revenue streams and future growth aspirations.

- Strategic Initiatives: Continued focus on expanding international footprints, optimizing supply chains, and launching high-value products remains central to Alembic’s strategy.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 was a solid quarter for Alembic Pharmaceuticals, marked by double-digit profit growth, strong revenue momentum, and effective expense management. The company’s emphasis on R&D-led innovation and global expansion continues to drive its operational strength.

Looking Ahead

Alembic Pharmaceuticals is poised to leverage growth opportunities with new product launches, continued investments in R&D, and further expansion in key export markets. Focus on operational efficiency, pipeline enhancement, and regulatory compliance is expected to support sustained profitability and value creation through FY26 and beyond.

To view Alembic Pharmaceuticals ‘s previous results: Click Here