Executive Summary

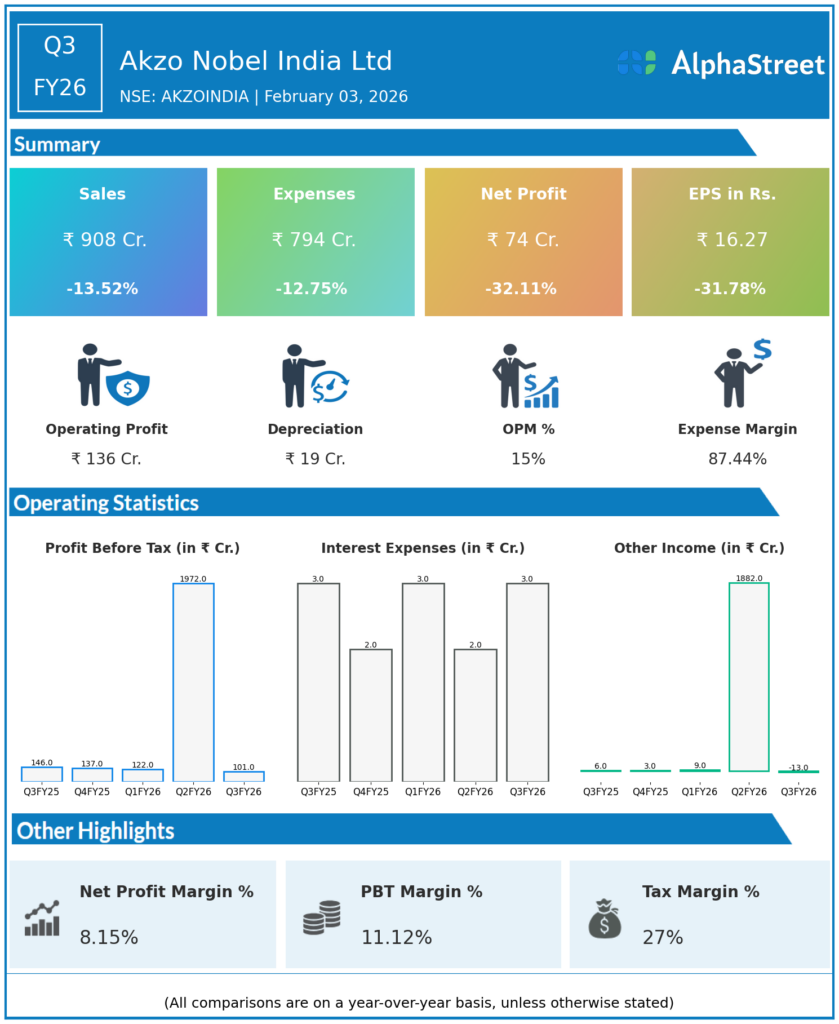

Akzo Nobel India Ltd reported Q3FY26 revenues of ₹908 crore, down 13.52% YoY, with consolidated net profit declining 32.11% to ₹74 crore despite 5.9% volume growth. Powder Coatings divestment and pricing pressures impacted topline, though core Paints business showed resilience ahead of JSW Paints integration.

Revenue & Growth

Revenues fell to ₹908 crore from ₹1,050 crore YoY due to discontinued powder coatings operations, though core revenue (ex-divested) declined only 1% to ₹907.7 crore with 5.9% volume gains. Total expenses dropped 12.75% YoY to ₹794 crore, aligning with reduced scale post-divestment.

Profitability & Margins

Consolidated net profit decreased 32.11% YoY to ₹74 crore from ₹109 crore; ex-divested PAT rose 5.9% to ₹94.6 crore. EBITDA (ex-divested) at ₹135.7 crore down 2% YoY with margins contracting 95 bps to 14.94%; EPS fell 31.78% to ₹16.27.

Balance-Sheet Highlights

The dataset lacks detailed balance sheet items such as assets, liabilities, equity, net debt, or current ratio for Q3FY26. JSW Paints acquired 61.2% stake on Dec 10, 2025, with name change to JSW Dulux approved.

Cash Flow / Liquidity

Operating cash flow, free cash flow, and liquidity metrics are not specified in the Q3FY26 dataset.

Key Ratios / Metrics

9M revenue (ex-divested) down 2.2% to ₹2,737.7 crore; PAT (ex-items) down 7.6% to ₹258.5 crore. Strategic focus shifts to innovation under new ownership amid resilient volume performance.