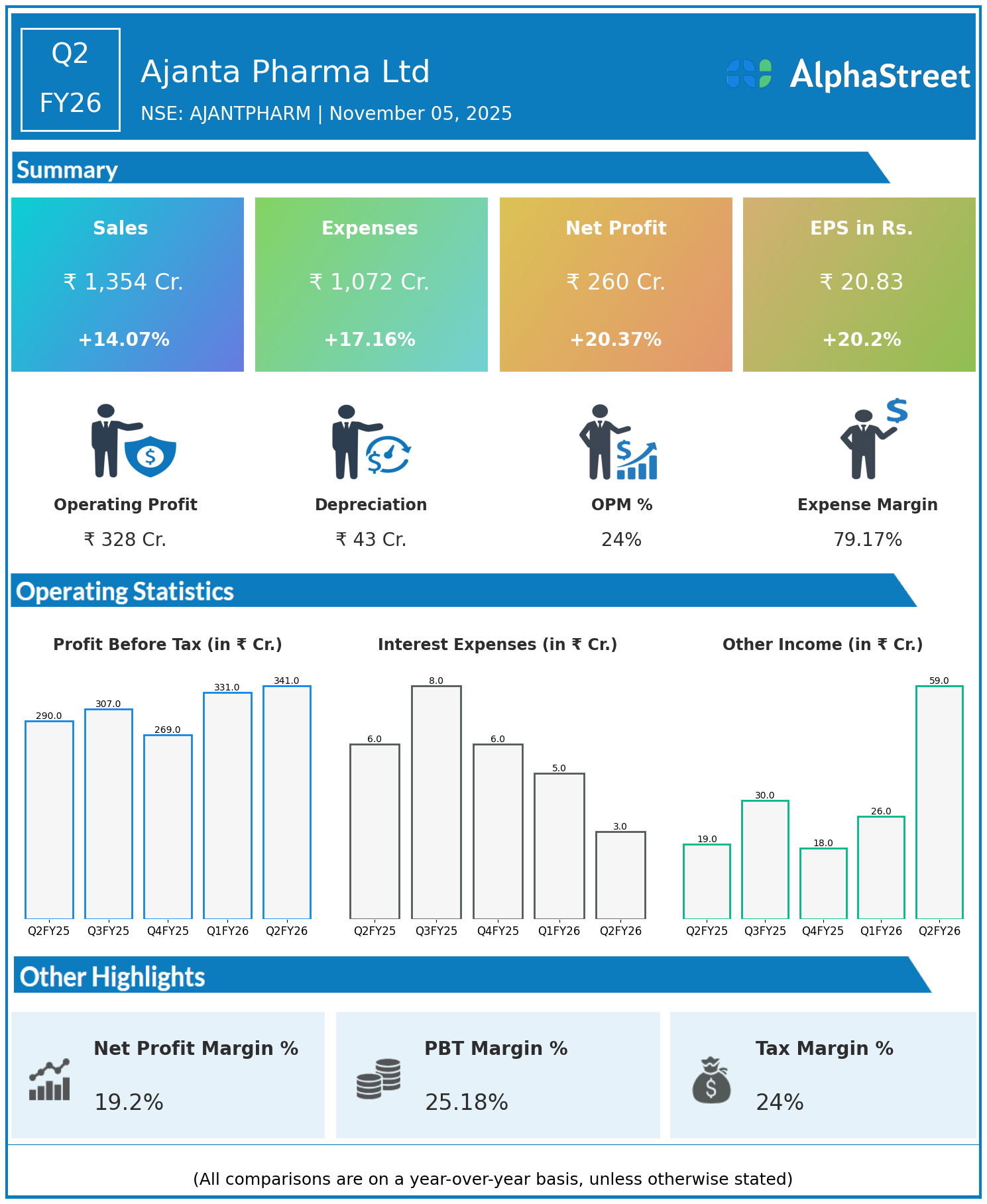

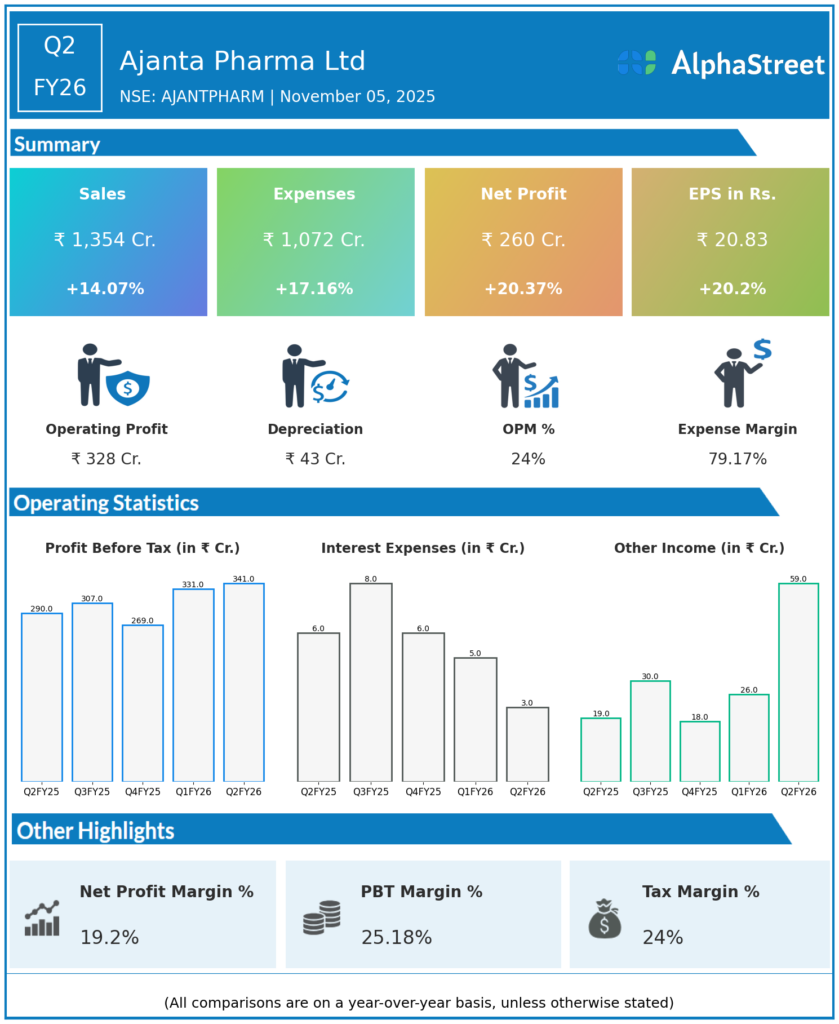

Ajanta Pharma, specializing in specialty pharmaceutical manufacturing and marketing, reported a solid Q2 FY26 performance.

Financial Overview:

- Revenues increased 14.07% to ₹1,354 crore from ₹1,187 crore.

- Total expenses rose 17.16% to ₹1,072 crore from ₹915 crore.

- Net profit increased 20.37% to ₹260 crore from ₹216 crore.

- Earnings per share grew 20.20% to ₹20.83 from ₹17.33.

Key Highlights:

- EBITDA rose 5.4% year on year with steady margins, excluding forex impact.

- India branded generics expanded with volume growth of 115% and contribution of 39% from new product launches.

- US operations showed continued momentum with 4-5 product launches and market share gains.

- Africa tender business exhibited variability, expected to persist.

Strategic Focus:

- Declared interim dividend of ₹28 per share.

- Reinforced R&D investments and pursued expansion in key markets.

- Forecasts sustained double-digit revenue growth supported by innovation and geographic growth.

Ajanta’s results reflect strong execution across markets and consistent financial growth.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.