Ajanta Pharma Limited is a specialty pharmaceutical company primarily engaged in the development, manufacturing, and marketing of high-quality finished dosage formulations. The company focuses on delivering innovative and affordable medicines across multiple therapeutic segments, strengthening its presence in domestic and international markets.

Q1 FY26 Earnings Summary (Apr–Jun 2025)

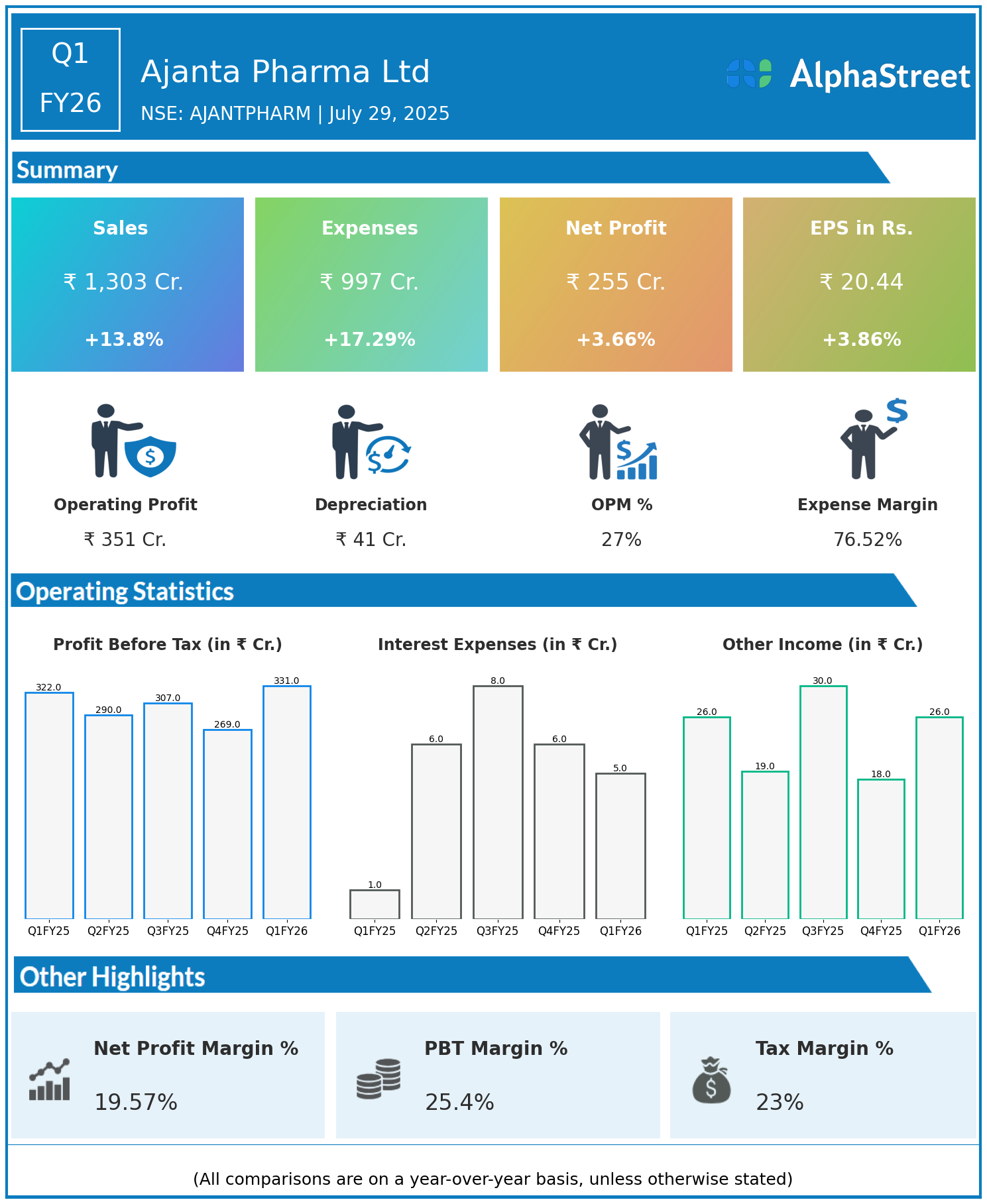

- Revenue: ₹1,303 crore, up 13.8% year-on-year (YoY) from ₹1,145 crore in Q1 FY25.

- Total Expenses: ₹997 crore, up 17.29% YoY from ₹850 crore.

- Consolidated Net Profit (PAT): ₹255 crore, up 3.66% from ₹246 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹20.44, up 3.86% from ₹19.68 YoY.

Operational & Strategic Update

- Robust Revenue Growth: The healthy increase in revenue was driven by strong demand across key specialty formulations and strategic expansion in both emerging and regulated international markets.

- Expense Growth: Expenses rose at a higher rate compared to revenue, mainly due to increased investments in R&D, marketing, regulatory compliance, and scaling operational capacities to support growth.

- Profitability: Despite a relatively smaller rise in net profit compared to revenue, Ajanta Pharma maintained steady profitability with improved EPS, reflecting operational resilience amid margin pressures.

- Product & Market Focus: Continued emphasis on specialty therapeutic segments such as dermatology, ophthalmology, and cardio-metabolic diseases, supported by new product launches and increased market penetration.

- Research & Development: Ongoing focus on innovation and pipeline development to enhance the product portfolio and sustain competitive advantage.

- Geographic Expansion: Strengthened foothold in overseas markets including Africa, Asia, and Latin America, leveraging regulatory approvals and partnerships.

- Sustainability & Compliance: Commitment to quality, regulatory compliance, and sustainable manufacturing practices remains a core priority.

Corporate Developments

Ajanta Pharma’s Q1 FY26 results indicate strong topline growth supported by product innovation and market expansion, though profitability experienced moderate pressure due to higher expenses. The company’s strategic investments in R&D and overseas operations position it well for future growth.

Looking Ahead

With a focus on driving specialty product innovation, expanding global reach, and optimizing operational efficiencies, Ajanta Pharma Ltd is poised to sustain growth momentum and enhance shareholder value in FY26 and beyond.