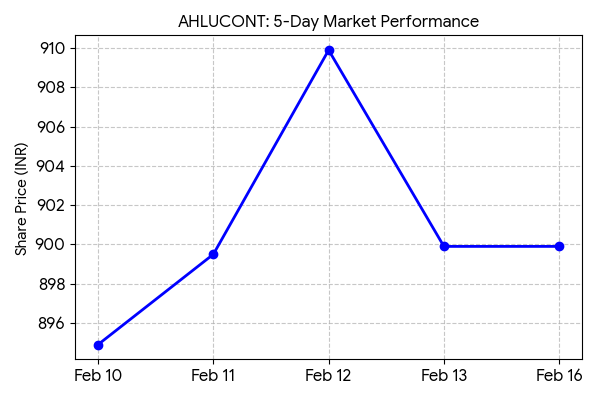

Ahluwalia Contracts (India) Limited (NSE: AHLUCONT; BSE: 532811) shares declined 1.10% to close at ₹899.90 on the National Stock Exchange on Monday. The price movement follows the disclosure of the company’s third-quarter financial results for the 2026 fiscal year.

Market Capitalization

As of the market close on February 16, 2026, the market capitalization of Ahluwalia Contracts (India) Limited stands at ₹6,052.33 crores.

Latest Quarterly Results

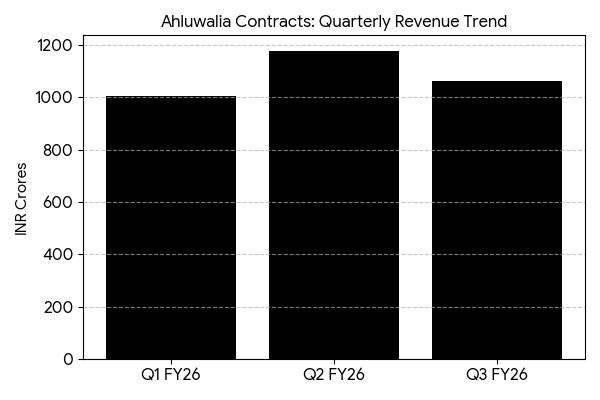

For the quarter ended December 31, 2025, consolidated revenue from operations reached ₹1,060.70 crores, an 11.4% increase from ₹952 crores in the same period last year. Consolidated net profit after tax rose to ₹54 crores, representing a 9.3% year-over-year growth.

Segment performance within the unexecuted order book is categorized as follows:

- Residential: ₹8,342.5 crores (44.7% of total).

- Infrastructure: ₹3,679.9 crores (19.7% of total).

- Commercial: ₹3,585.9 crores (19.2% of total).

- Hospitals/Institutional: ₹2,054.7 crores (11.0% of total).

Financial Trends

Full Year Results Context

In the previous full fiscal year ended March 31, 2025, the company reported annual revenue of ₹4,098.62 crores and a net profit of ₹202.08 crores. The current quarterly results indicate a continuation of the revenue growth trend observed in the prior fiscal period.

Business & Operations Update

The company reported an unexecuted order book of ₹18,679.5 crores as of December 31, 2025. Major projects under execution include the Mumbai CSMT redevelopment (₹2,450 crores) and the India Jewelry Park (₹2,157 crores). Operations span 48 projects across 15 Indian states.

M&A or Strategic Moves

No major acquisitions were reported for the quarter. Official filings dated February 14, 2026, indicate ongoing internal discussions regarding potential amalgamation matters currently under review by the Board of Directors.

Equity Analyst Commentary

Reports from JM Financial and Edelweiss Securities highlight the visibility provided by the company’s current order backlog. Institutional analysis attributes performance to the asset-light business model and consistent project execution in the infrastructure and residential sectors.

Guidance & Outlook

The company has issued revenue growth guidance of 15% to 20% for the full fiscal year 2026. Key monitoring factors include the execution pace of high-value infrastructure projects and the government’s capital expenditure pipeline.

Performance Summary

The stock closed 1.10% lower today. Revenue increased 11.4% to ₹1,060.70 crores. The order book stands at ₹18,679.5 crores. Residential and infrastructure projects remain the primary contributors to the portfolio. Neutral close.