Advanced Enzyme Technologies Limited is a leading player in the manufacturing and sales of enzymes, serving industries such as human and animal health, food processing, textiles, and biofuels. The company is recognized for its innovation-driven approach and wide portfolio of specialty enzyme solutions.

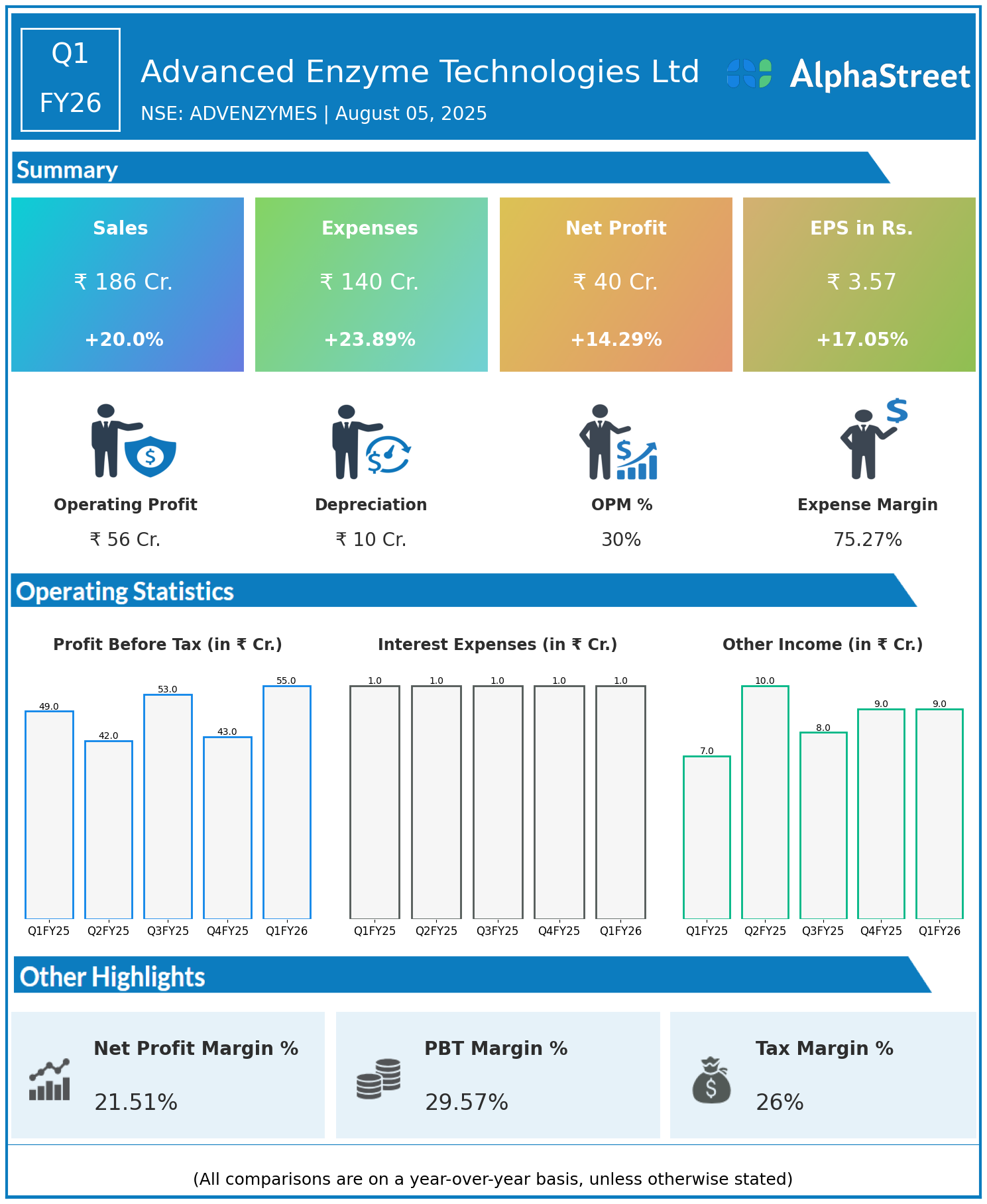

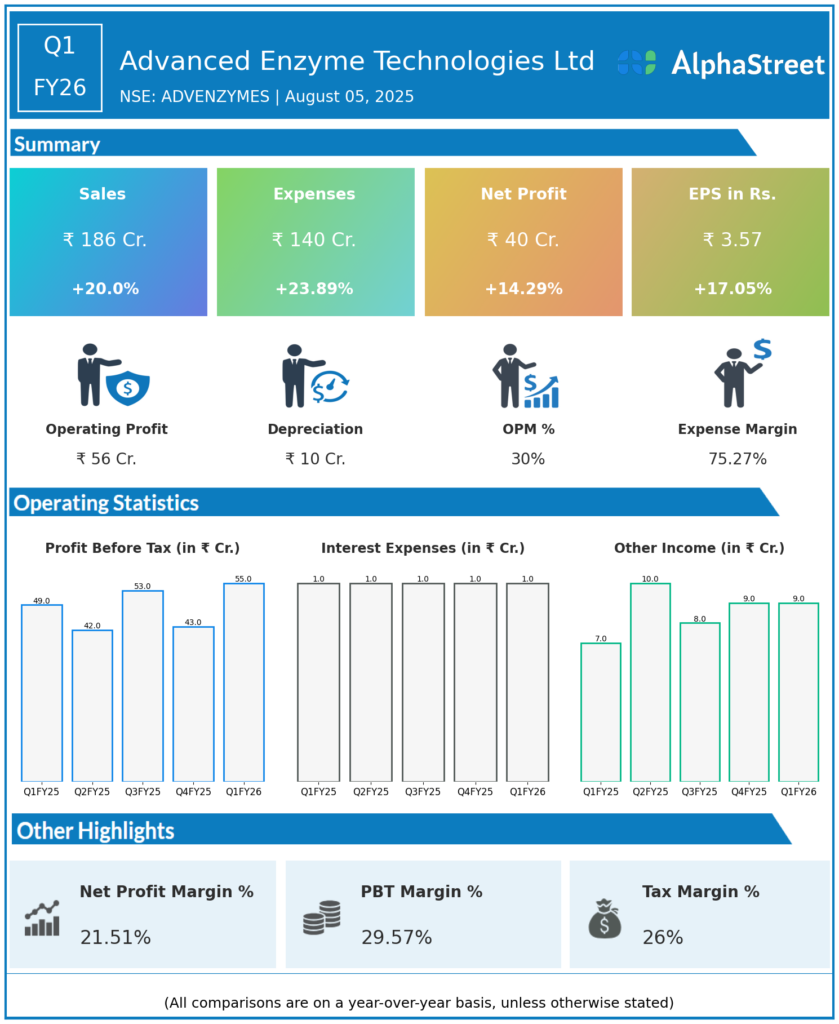

Q1 FY26 Earnings Summary (Apr–Jun 2025)

- Revenue: ₹186 crore, up 20.0% year-on-year (YoY) from ₹155 crore in Q1 FY25.

- Total Expenses: ₹140 crore, up 23.89% YoY from ₹113 crore.

- Consolidated Net Profit (PAT): ₹40 crore, up 14.29% from ₹35 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹3.57, up 17.05% from ₹3.05 YoY.

Operational & Strategic Update

- Strong Revenue Growth: The significant topline increase reflects robust demand across key enzyme application segments, driven by expansion in both domestic and international markets.

- Expense Growth: Total expenses rose at a faster pace than revenue growth, mainly due to increased input costs, higher R&D spend, and expanded manufacturing activities.

- Profitability: Despite higher expenses, Advanced Enzyme delivered healthy profit and EPS growth, underscoring strong operational leverage and continued cost discipline.

- Product & Market Focus: The company continues to diversify its product mix, strengthen its presence in human and animal health verticals, and emphasize customized enzyme solutions for emerging industries.

- Innovation Drive: Ongoing investments in research and product innovation have enabled new launches and improved existing product performance, further boosting competitiveness.

- Global Expansion: Strategic efforts to expand international footprints, particularly in nutraceuticals and bioprocessing, are paying off with rising export revenues.

Corporate Developments

Q1 FY26 was a period of solid growth for Advanced Enzyme Technologies, combining double-digit revenue expansion with strong profitability amid a rising cost environment. The company’s innovation-led business model and continued focus on market diversification position it well for long-term growth.

Looking Ahead

Advanced Enzyme Technologies Ltd is well-positioned to capitalize on increasing demand for specialty enzymes in health, wellness, and sustainable industries. Further investments in R&D, global sales, and customized solutions are expected to sustain growth momentum and margin resilience through FY26 and beyond.