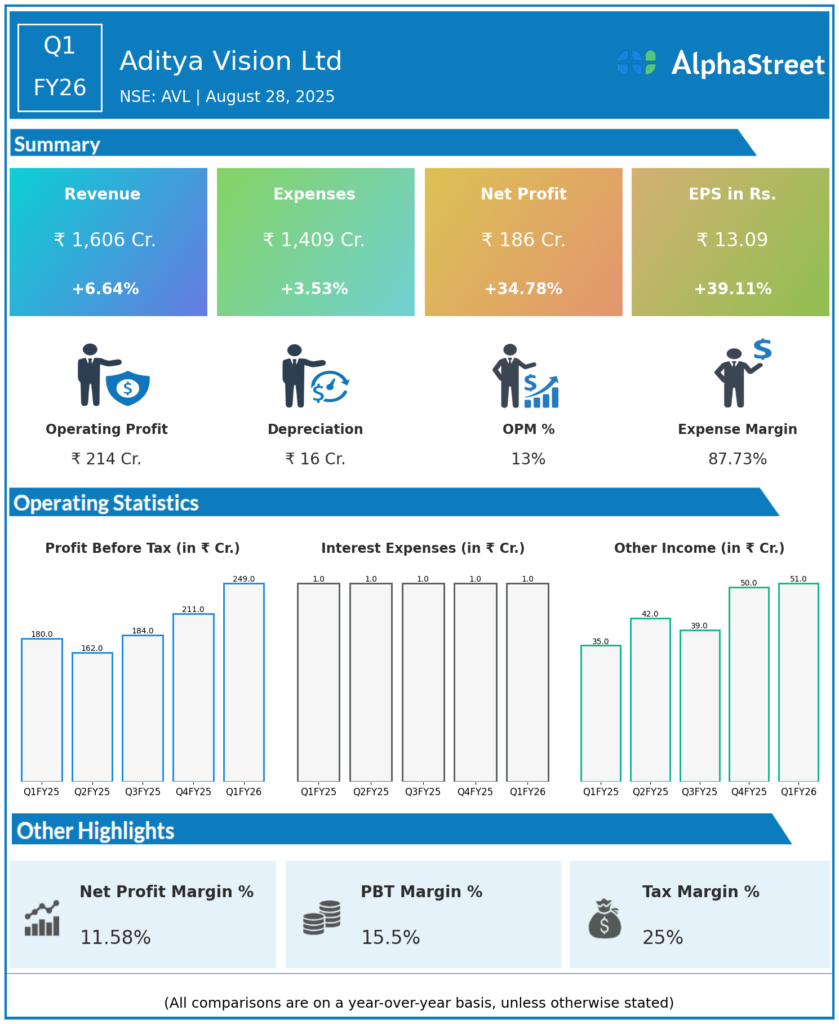

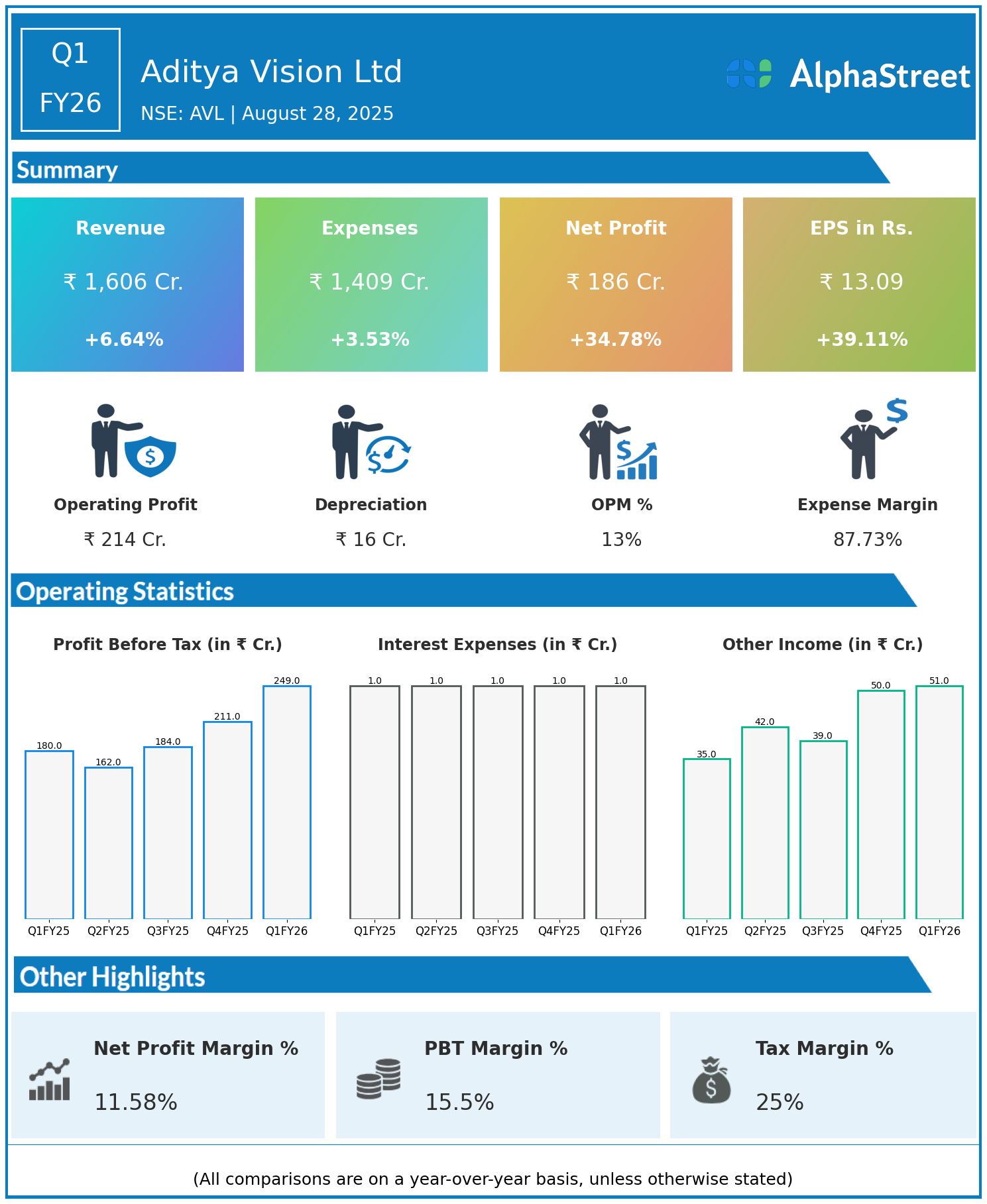

Aditya Vision Ltd, incorporated in 1999, operates as a trading and retail chain for electronic consumer durables in Bihar, providing a range of electronic items and services. Presenting below its Q1 FY26 Earnings Results.

Q1 FY26 Earnings Results

- Revenue: ₹1,606 crore, up 6.64% year-on-year (YoY) from ₹1,506 crore in Q1 FY25.

- Total Expenses: ₹1,409 crore, up 3.53% YoY from ₹1,361 crore.

- Consolidated Net Profit (PAT): ₹186 crore, up 34.78% from ₹138 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹13.09, up 39.11% from ₹9.41 YoY.

Operational & Strategic Update

- Moderate Revenue Growth: Revenues increased by 6.64%, driven by steady demand in consumer electronics retail.

- Controlled Expense Growth: Expenses rose by 3.53%, less than revenue growth, helping to boost profitability.

- Strong Profit Expansion: Net profit and EPS surged by approximately 35% and 39% respectively, reflecting improved margins and efficient cost management.

- Market Position: Aditya Vision Ltd remains a key player in Bihar’s consumer durables retail market with a focus on service orientation.

- Strategic Focus: The company is focusing on expanding retail footprint, enhancing customer experience, and broadening product offerings.

Corporate Developments in Q1 FY26 Earnings

Q1 FY26 results indicate robust profit growth supported by steady revenue and disciplined expense control.

Looking Ahead

Aditya Vision Ltd plans to accelerate growth through increased market penetration, optimizing retail operations, and enhancing product and service portfolios to capture rising consumer demand.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.