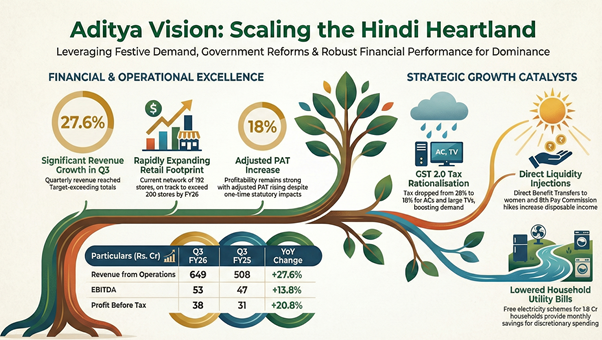

Aditya Vision Limited (NSE: AVL) announced a 12.8% year-over-year increase in net profit for the third quarter ended December 31, 2025, reaching ₹27 crore. The performance was underpinned by a 27.6% surge in revenue from operations, driven by strong festive season demand and positive volume pick-up following GST rationalization. Despite a marginal contraction in EBITDA margins, the company continued its aggressive retail expansion, ending the quarter with a footprint of 192 stores.

Strong execution during the festive season and post-GST reform tailwinds propelled Aditya Vision Limited to a robust third-quarter performance. The consumer electronics retailer reported double-digit growth in top-line revenue and maintained steady expansion across its core Hindi heartland markets.

Demand Tailwinds

The primary driver for the quarter’s growth was a significant uptick in consumer demand during the festive period, further aided by “GST 2.0” reforms that reduced input taxes on several consumer durable categories. Management noted that the rationalization of GST from 28% to 18% for products like air conditioners and large televisions supported a retail price drop of approximately 7-8%, improving channel liquidity and consumer sentiment. Additionally, the company added four new stores during the quarter as part of its “cluster discipline” strategy.

Financial performance

Revenue Growth: Revenue from operations rose to ₹649 crore in Q3 FY26 from ₹508 crore in the prior-year period. For the nine-month period, revenue totaled ₹2,047 crore, a 15.4% increase.

Margins: Gross margins improved by 20 basis points to 15.8%. However, the EBITDA margin moderated to 8.2% from 9.2% in Q3 FY25, largely due to a 51.3% increase in other expenses.

Profitability: Profit Before Tax (before exceptional items) grew 20.8% to ₹38 crore. Adjusted PAT, which excludes a one-time ₹1.5 crore statutory impact from new labor codes, increased by 18% year-over-year.

Operational Metrics: Diluted earnings per share (EPS) for the quarter stood at ₹2.11, compared to ₹1.88 in the same period last year.

Network Expansion

Aditya Vision remains on track to surpass 200 stores within fiscal year 2026, focusing on focused cluster expansion across Bihar, Jharkhand, and Uttar Pradesh. The company’s growth strategy centers on reinvesting capital into high ROIC (Return on Invested Capital) opportunities within the “Hindi Heartland”. For the current calendar year, management has signaled readiness for further expansion into Chhattisgarh and Madhya Pradesh. The company is also prioritizing the scaling of premium and “sunrise” product categories to enhance store-level economics.

Sector Tailwinds

India’s consumer durables sector continues to benefit from supportive macro conditions, including rising personal loan penetration and direct benefit transfers that have lifted rural disposable incomes. In the Hindi heartland, electricity consumption growth is outpacing the national average, supporting demand for cooling appliances and refrigerators. Aditya Vision retains a dominant position in Bihar with a market share exceeding 50% and is positioned to gain from the ongoing shift from unorganized to organized retail.