Company Overview:

Aditya Birla Sun Life AMC Limited (NSE: ABSLAMC) is a prominent player in India’s asset management industry, established in 1994. Co-owned by Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc, it manages Aditya Birla Sun Life Mutual Fund and offers diverse investment solutions. ABSLAMC boasts a pan-India presence across 290+ locations, serving approximately 8 million investor folios with a total AUM of Rs 3,115 billion. With a focus on financialization of household savings, expansion in B30 cities, and scaling up passive and alternate assets business, ABSLAMC aims to capture the underpenetrated market while navigating through competitive and regulatory challenges.

Latest Financial Result:

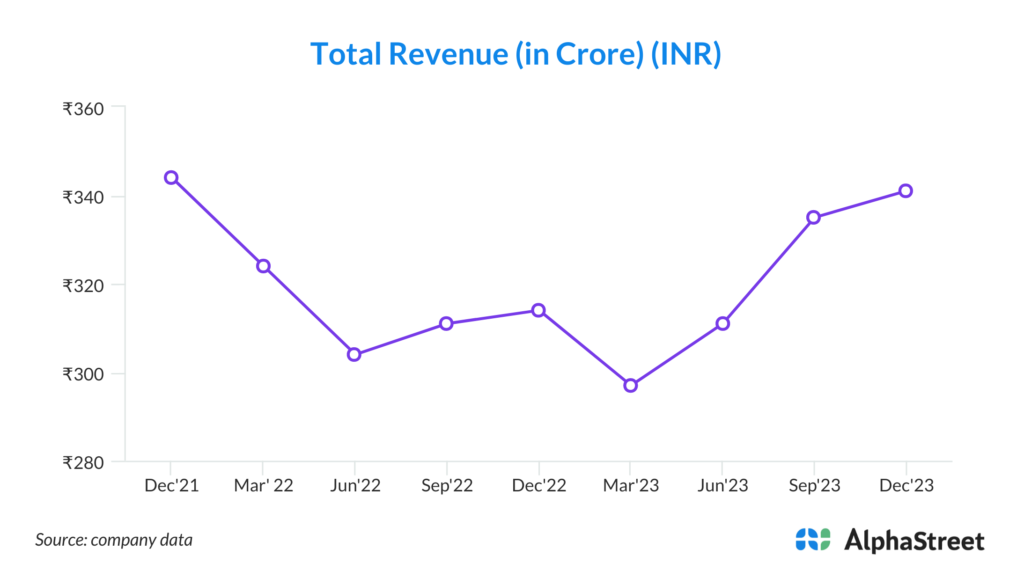

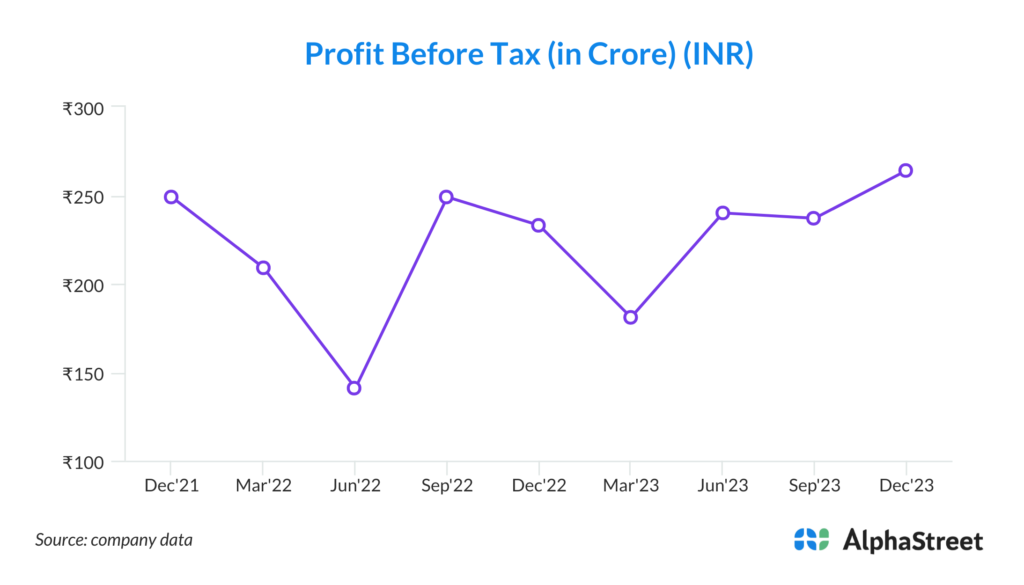

In Q3FY24, ABSLAMC showcased robust financial performance. Revenue from operations witnessed a notable 9% year-on-year growth, reaching Rs 341 crore, while other income surged impressively by 62% to Rs 80 crore, driven by mark-to-market gains. This led to a commendable 16% rise in total income, amounting to Rs 421 crore. ABSLAMC’s Quality Assets under Management (QAAUM) saw a healthy 11% YoY increase, reaching Rs 3.12 lakh crore by the end of Q3FY24. Notably, the equity QAAUM experienced a faster growth rate of 13% YoY, reaching Rs 1.36 lakh crore, resulting in the expansion of equity share to 43.7%. However, despite these positive strides, the overall mutual fund market share slightly slipped by 50 basis points in the first nine months of FY24 to 7.1%, with the equity market share declining to 5%. Nonetheless, ABSLAMC’s strategic focus on expanding its retail franchise, scaling up passive and alternate assets business, and maintaining a formidable distribution network positions it well to navigate through industry challenges and capitalize on emerging opportunities.

Key Strengths of the Company:

1. Robust Financial Performance: Aditya Birla Sun Life AMC Limited (ABSLAMC) demonstrates consistent growth and resilience in its financial performance, as evidenced by its strong revenue generation and profitability. With revenue from operations growing by 9% year-on-year and other income surging by an impressive 62% in Q3FY24, ABSLAMC showcases its ability to capitalize on market opportunities and deliver sustainable financial results amidst market fluctuations.

2. Diverse Product Portfolio: ABSLAMC boasts a comprehensive suite of investment products and services, catering to the diverse needs of its vast customer base. From mutual funds to portfolio management services, real estate investments, and alternative investment funds, the company offers a wide range of options for investors to choose from, providing flexibility and customization to meet varied investment objectives and risk profiles.

3. Expansive Distribution Network: With a formidable distribution network comprising over 69,000 Independent Financial Advisors (IFAs) and a presence in 290+ locations across India, ABSLAMC has established a strong foothold in the market. This extensive reach enables the company to effectively penetrate both urban and rural markets, tap into new customer segments, and capture a larger share of the growing asset management industry in the country.

4. Focus on Retail Franchise Expansion: ABSLAMC has strategically prioritized the expansion of its retail franchise, particularly in B30 cities, where it has over 80% of its presence. By targeting these emerging markets and catering to the investment needs of retail investors, the company aims to capture a larger market share and capitalize on the financialization of household savings, thereby driving sustainable growth and revenue expansion.

5. Strong Brand Recognition: With the backing of Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc, ABSLAMC benefits from strong brand recognition and reputation in the financial services industry. This brand strength instills trust and confidence among investors, enhances customer loyalty, and facilitates the acquisition of new clients, thereby contributing to the company’s competitive advantage and market leadership position.

6. Emphasis on Passive and Alternate Assets Business: ABSLAMC is strategically focused on scaling up its passive and alternate assets business, tapping into the growing demand for such investment products. With a 36% increase in AUM of passive products in Dec’23 and the introduction of differentiated products in categories like Alternative Investment Funds (AIFs) and Portfolio Management Services (PMS), the company is well-positioned to capitalize on evolving market trends and investor preferences.

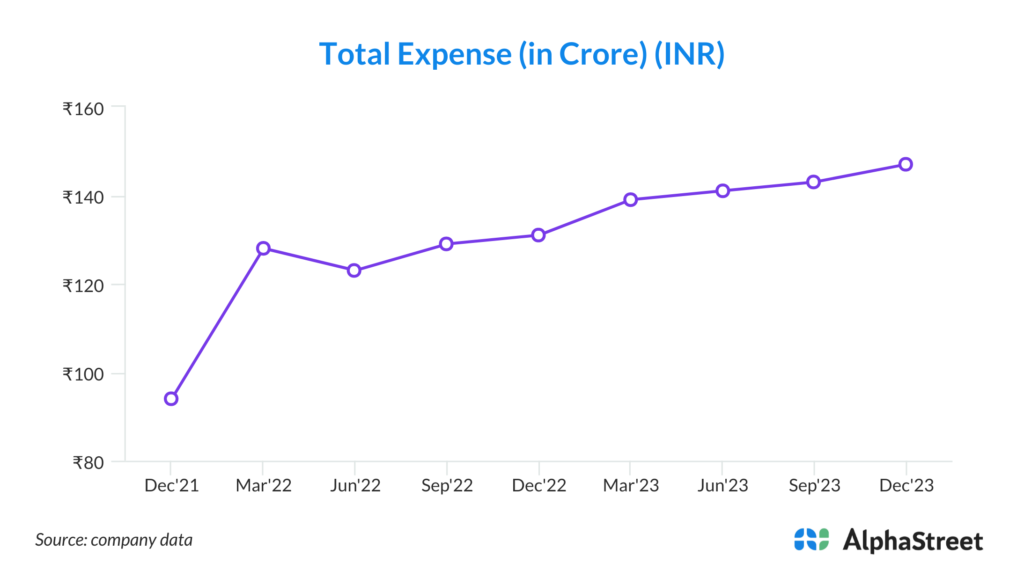

7. Lean and Scalable Operations: ABSLAMC operates with an asset-light and lean cost structure, characterized by low employee costs and efficient utilization of resources. This scalability allows the company to adapt swiftly to changing market conditions, optimize operational efficiencies, and maintain healthy profit margins. By continuously focusing on cost management and operational excellence, ABSLAMC ensures sustainable growth and long-term value creation for its stakeholders.

Key risks and concerns for the Company:

1. Market Volatility Impact: ABSLAMC faces inherent risks associated with market volatility, especially concerning downward trends. Fluctuations in asset prices and investor sentiment can significantly impact fund flows into ABSLAMC’s products, potentially leading to a decline in revenue and profitability.

2. Intense Competitive Landscape: The mutual fund industry is highly competitive, with numerous players vying for market share. ABSLAMC must contend with rivals possessing strong brand recognition, extensive distribution networks, and consistent fund performance. Any failure to maintain a competitive edge could result in a loss of market share and revenue erosion.

3. Regulatory Changes: Changes in regulatory frameworks governing the asset management industry pose a significant risk to ABSLAMC’s operations. Alterations in taxation policies, compliance requirements, or investment restrictions could impact product offerings, distribution channels, and profitability, necessitating agile adaptation to regulatory shifts.

4. Rise of Passive Funds: The increasing popularity of passive investment strategies, such as exchange-traded funds (ETFs) and index funds, presents a threat to ABSLAMC’s revenue streams. These passive funds typically charge lower fees than actively managed funds, potentially leading to fee compression and reduced profitability for ABSLAMC.

5. Execution Risks: ABSLAMC’s strategic initiatives, such as expanding its retail franchise and scaling up passive and alternate assets business, entail execution risks. Failure to effectively implement these strategies, manage operational challenges, or capitalize on market opportunities could hinder the company’s growth prospects and erode shareholder value.

6. Brand Perception: Negative publicity or reputational damage could adversely impact ABSLAMC’s brand perception and investor confidence. Any adverse news related to governance issues, regulatory violations, or underperformance of funds may lead to client attrition, redemption pressures, and diminished market trust in the company.

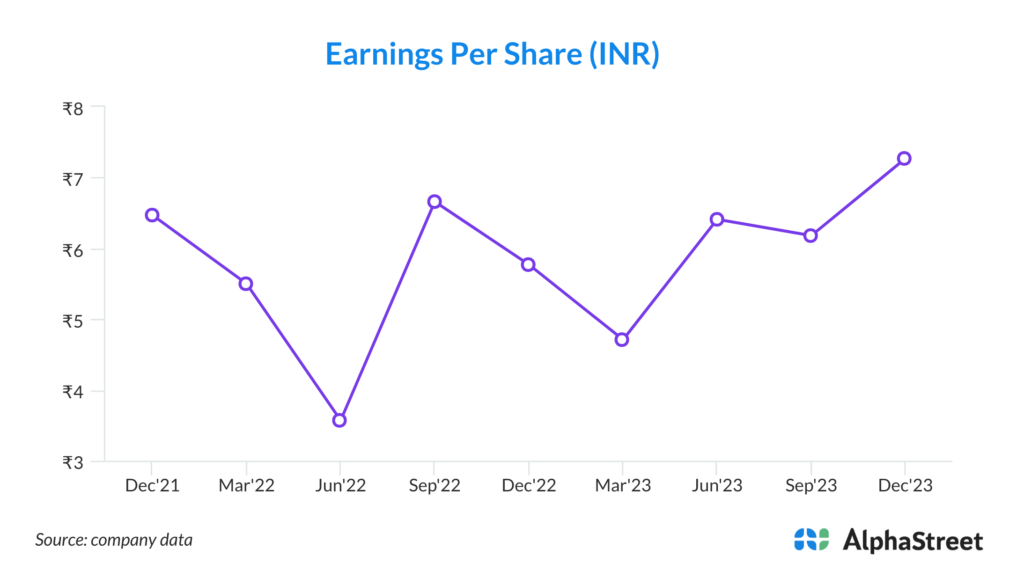

7. Dilution Concerns: ABSLAMC is required to achieve a 25% public float by October 2024, which may involve issuing additional shares through a public offering or Qualified Institutional Placement (QIP). Such dilution could temporarily depress stock prices and lead to investor apprehensions regarding ownership structure and future earnings per share.