Aditya Birla Capital Limited (NSE: ABCAPITAL) closed at ₹347.80 on February 3, 2026, up 4.43% from the previous close of ₹333.05 on February 2. The move came as investors positioned ahead of the company’s Q3 FY26 results, following a steady improvement trend reported in earlier quarters.

Quarterly Results

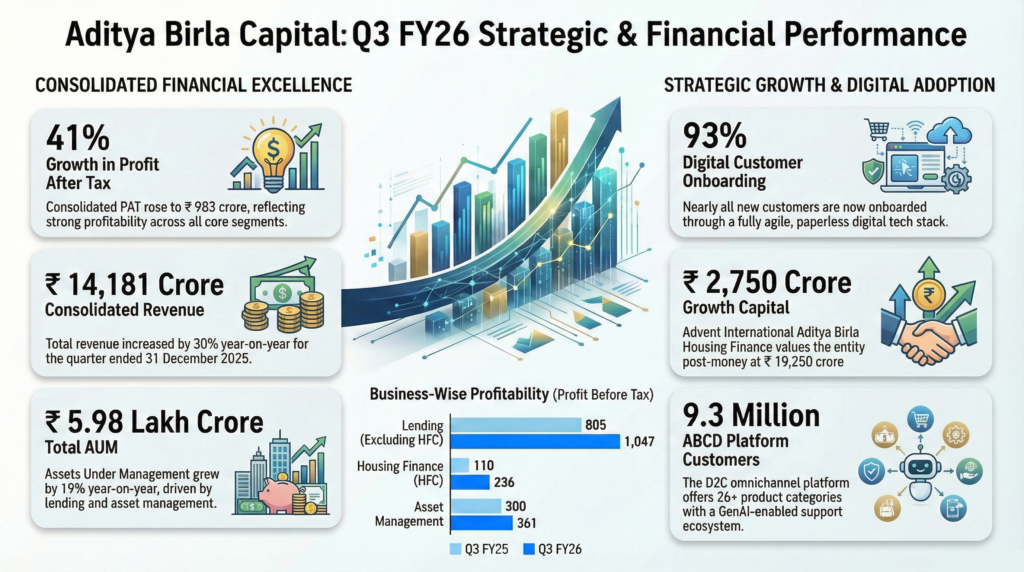

Aditya Birla Capital Limited achieved a 30% year-over-year increase in consolidated revenue for the period ending December 31, 2025. The company’s consolidated profit after tax grew by 41% compared to the third quarter of the previous fiscal year, excluding exceptional labor code impacts. Growth was driven by momentum across the lending, asset management, and insurance businesses. Standalone return on equity reached 15.2% during this quarter.

Annual Performance Context

During the first nine months of the current fiscal year, consolidated revenue and reported net profit showed upward trends compared to the prior year period. The total lending portfolio, comprising non-banking financial company (NBFC) and housing finance operations, expanded by 30% year-over-year. Platform-wide assets under management (AUM) grew by 19% to reach ₹5,98,166 crore as of the end of the third quarter.

Business and Operations Update

The NBFC segment saw its AUM increase by 24% to ₹1,48,182 crore, with average yields for the lending book at 12.69%. This business reported a quarterly profit before tax of ₹1,036 crore, while interest expense for the standalone entity was ₹2,322 crore. Asset quality improved as the gross stage 3 ratio declined to 1.51%.

In the housing finance segment, AUM rose by 58% year-over-year to ₹42,204 crore, and the business recorded a return on equity of 14.94%. This segment completed a growth capital raise of ₹2,750 crore from Advent International, valuing the business at ₹19,250 crore on a post-money basis. Asset management mutual fund quarterly average AUM (QAAUM) grew by 15% to ₹4,43,233 crore, with equity assets representing 45% of the mix.

The life insurance segment saw a 19% rise in individual first-year premiums for the nine-month period, maintained a solvency ratio of 210%, and reported an opex ratio of 22.9%. The health insurance business increased its gross written premiums by 39% through a retail distribution network of 163,000 agents. Digital operations expanded via Udyog Plus, which leverages 50-plus partner and 100-plus API integrations.

Forward Outlook

Management strategy focuses on expanding the prime and affordable housing segments by prioritizing average ticket sizes between ₹25 lakh and ₹30 lakh. Life insurance targets include a compound annual growth rate of 20% to 25% for individual first-year premiums over the next three years. Future efforts will focus on scaling alternative assets and enhancing digital delivery across the company’s 1,742 branches.

Performance Summary

Consolidated financial results featured a profit after tax of ₹983 crore on revenue of ₹14,181 crore. The aggregate lending portfolio and total assets under management ended the quarter at ₹1,90,386 crore and ₹5,98,166 crore, respectively. Key contributors included the NBFC arm with ₹772 crore in quarterly profit and the housing finance business, which received a ₹2,750 crore investment from Advent International.

Housing segment interest income, inclusive of fees, reached ₹472 crore. The asset management division reported a mutual fund QAAUM of ₹4,43,233 crore. Insurance operations showed total gross premiums of ₹6,530 crore in life and ₹4,651 crore in nine-month health premiums. Digital engagement reached 9.3 million customers, with Udyog Plus specifically contributing ₹5,010 crore to AUM. Standalone quarterly net interest income reached ₹2,113 crore, while the consolidated nine-month profit before tax stood at ₹3,712 crore.