“We are leaders in the transmission and distribution space and have consistently set new industry standards in efficiency, performance, and asset development. Adani Transmission is well positioned to deliver exponential growth, and we are working towards fulfilling our nation’s massive electricity needs and strengthening our position as a world class utility. We are accelerating the transition to a sustainable and reliable grid and are committed to our pursuit of energizing and ensuring continuous and reliable power supply across all regions through our assets in India.”

– Mr Gautam Adani, Chairman in Q4FY23 Concall

| Stock Data | |

| Ticker | ADANITRANS |

| Exchange | NSE |

| Industry | POWER |

| Price Performance | |

| Last 5 Days | +2.48% |

| YTD | -67.57% |

| Last 12 Months | -60.47% |

*As of 08.06.2023

Power transmission companies, such as Adani Transmission, have a significant role to play in India’s upcoming growth. They contribute by ensuring a reliable electricity supply, facilitating infrastructure development, supporting the integration of renewable energy, enabling industrial and commercial activities, promoting rural electrification, contributing to power sector reforms, and generating employment opportunities. Their contributions are crucial for powering India’s economic development and improving the quality of life for its citizens.

Company Description:

Adani Transmission Limited (ATL) is a leading Indian company engaged in the transmission and distribution of electricity. With its strong presence in the power sector, ATL plays a crucial role in India’s energy infrastructure.The company specializes in electricity transmission and distribution, operating and maintaining high-voltage transmission networks across India.

Adani Transmission operates through various business segments, including Transmission and Distribution (T&D), System Integration, and Consultancy. The T&D segment involves the operation, maintenance, and development of transmission systems, substations, and associated infrastructure. The System Integration segment focuses on the design, engineering, and construction of power transmission projects. The Consultancy segment offers expertise in power system planning, project management, and other related services.

Key Projects and Network:

Adani Transmission has an extensive network of transmission lines and substations across multiple Indian states. The company has successfully executed several key projects, including the acquisition of transmission assets from state-owned utilities and private entities. These projects have significantly expanded ATL’s transmission network, enhancing its operational capabilities and market presence.

Key Strengths:

- Infrastructure Expansion: Adani Transmission aims to strengthen and expand its transmission network across India. The company has been actively acquiring transmission assets from state-owned utilities and private entities, enabling it to enhance its market presence and operational capabilities. This expansion will contribute to increased revenue and further establish Adani Transmission as a key player in the industry.

- Renewable Energy Integration: With the Indian government’s strong focus on renewable energy, Adani Transmission is well-positioned to capitalize on this opportunity. The company has the expertise and infrastructure to support the integration of renewable energy sources into the grid, such as solar and wind power. As India continues to invest in renewable energy projects, Adani Transmission can play a crucial role in transmitting and distributing clean energy across the country.

- Government Initiatives: The Indian government’s initiatives and policies to improve the power transmission and distribution sector, such as the “One Nation, One Grid, One Frequency” concept and the Green Energy Corridor project, provide a favorable environment for Adani Transmission. These initiatives aim to establish a unified and robust transmission network and encourage the development of renewable energy. Adani Transmission’s expertise and experience position the company to benefit from these government-led initiatives.

- Strategic Partnerships and Acquisitions: Adani Transmission has a history of strategic partnerships and acquisitions, which has enabled the company to expand its presence and enter new geographies. By forging alliances with other industry players and identifying potential acquisition targets, Adani Transmission can further strengthen its market position and unlock growth opportunities.

- Rising Energy Demand: India’s growing population and expanding economy result in an increasing demand for electricity. Adani Transmission, as a key player in the power transmission sector, stands to benefit from this rising energy demand. The company’s focus on efficiently transmitting electricity across the country will support India’s development and economic growth.

Key Challenges:

- Regulatory Environment: The power transmission sector in India operates under regulations and guidelines set by the Central Electricity Regulatory Commission (CERC) and state electricity regulatory commissions. Adani Transmission must navigate through complex regulatory processes, including obtaining necessary approvals, complying with tariff regulations, and addressing regulatory uncertainties. Changes in regulations or delays in obtaining approvals could impact the company’s expansion plans and project timelines.

- Land Acquisition: The acquisition of land for setting up transmission infrastructure can be a significant challenge in India. Adani Transmission may face issues related to land acquisition, including negotiation with landowners, addressing legal and regulatory requirements, and dealing with potential community resistance. Delays or disputes in land acquisition can affect project timelines and increase costs.

- Environmental Considerations: Adani Transmission operates in an industry that is increasingly focused on sustainable practices and environmental considerations. The company must comply with environmental regulations and mitigate the potential impact of its transmission projects on the environment.

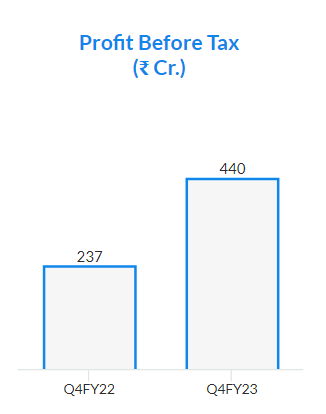

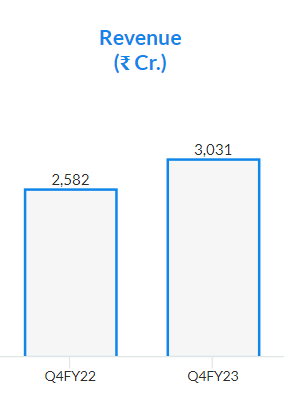

- Financing and Capital Expenditure: Expanding and maintaining a robust transmission network requires significant capital expenditure. Adani Transmission must secure adequate funding to support its growth plans, including debt financing and equity infusion. Changes in interest rates, availability of financing options, and investor sentiment towards the power sector can impact the company’s ability to fund its projects and meet its capital expenditure requirements. Despite that, the company has reported increased profitability.

The 85% Growth in Profits can be partly attributed to the 23% growth in revenues.