Adani Power Limited (APL), part of the diversified Adani Group, is India’s largest private sector thermal power producer. The company and its subsidiaries sell power generated from their fleet of plants through a mix of long-term Power Purchase Agreements (PPAs), short-term contracts, and merchant sales, powering millions of homes and businesses across the nation.

Q1 FY26 Earnings Summary (Apr–Jun 2025)

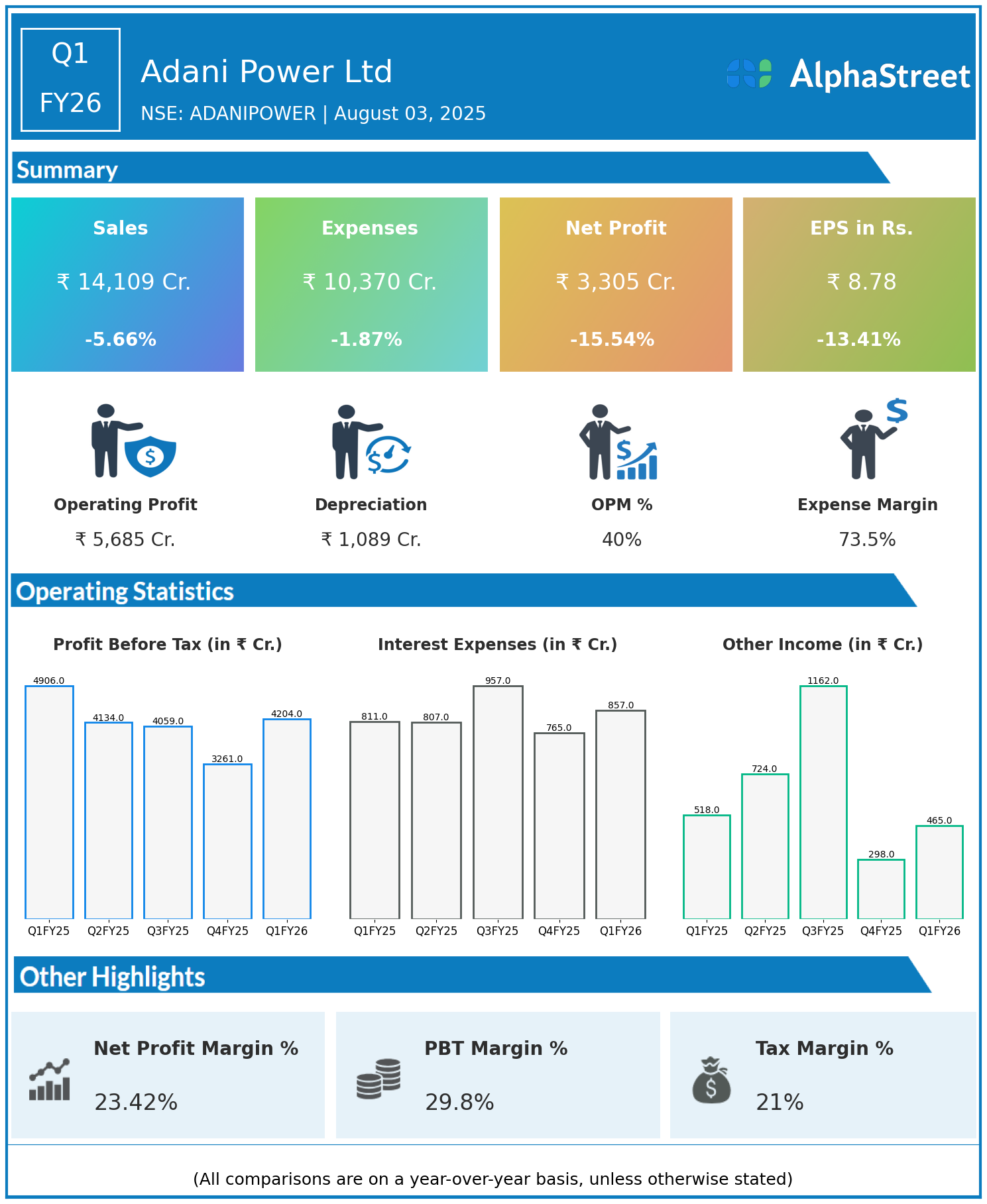

- Revenue: ₹14,109 crore, down 5.66% year-on-year (YoY) from ₹14,956 crore in Q1 FY25.

- Total Expenses: ₹10,370 crore, down 1.87% YoY from ₹10,568 crore.

- Consolidated Net Profit (PAT): ₹3,305 crore, down 15.54% from ₹3,913 crore in the same quarter last year.

- Earnings Per Share (EPS): ₹8.78, down 13.41% from ₹10.14 YoY.

Operational & Strategic Update

- Revenue & Market Dynamics: The decrease in revenue signals softer demand and/or lower realizations in both long-term and merchant markets, highlighting ongoing challenges faced by the thermal power sector such as subdued spot rates and changing power offtake patterns.

- Expense Management: While expenses also decreased, the reduction was less than the revenue decline, reflecting continued fixed and operational costs inherent in running large-scale power assets.

- Profitability Trends: Net profit and EPS contracted more sharply than revenue, pointing to margin compression driven by persistent input and operating costs despite cost control initiatives.

- Portfolio Performance: Adani Power maintains a diverse sales mix, balancing long-term contracted capacity with exposure to short-term and merchant segments, allowing risk mitigation but also introducing some variability in earnings.

- Operational Focus: The company continues to concentrate on maximizing plant efficiency, plant load factor (PLF), and supply reliability to optimize commercial performance across its thermal fleet.

- Strategic Direction: Adani Power is progressively exploring integration with greener generation sources and leveraging digital solutions to improve plant uptime, cost management, and compliance with evolving sustainability norms.

Corporate Developments

Q1 FY26 was a tough quarter for Adani Power, with reductions in both revenue and profits underscoring headwinds from weaker market demand and cost pressures. Nevertheless, APL’s leadership position, operational scale, and strategic focus on diversified offtake and plant flexibility continue to anchor its market presence.

Looking Ahead

Adani Power Ltd is committed to strengthening operational efficiencies, exploring diversification into cleaner and more flexible power generation, and capturing value from merchant opportunities when market conditions allow. As India continues to transition its energy landscape, APL will focus on sustainable profit recovery, digital transformation, and building long-term stakeholder value through FY26 and beyond.