Executive Summary

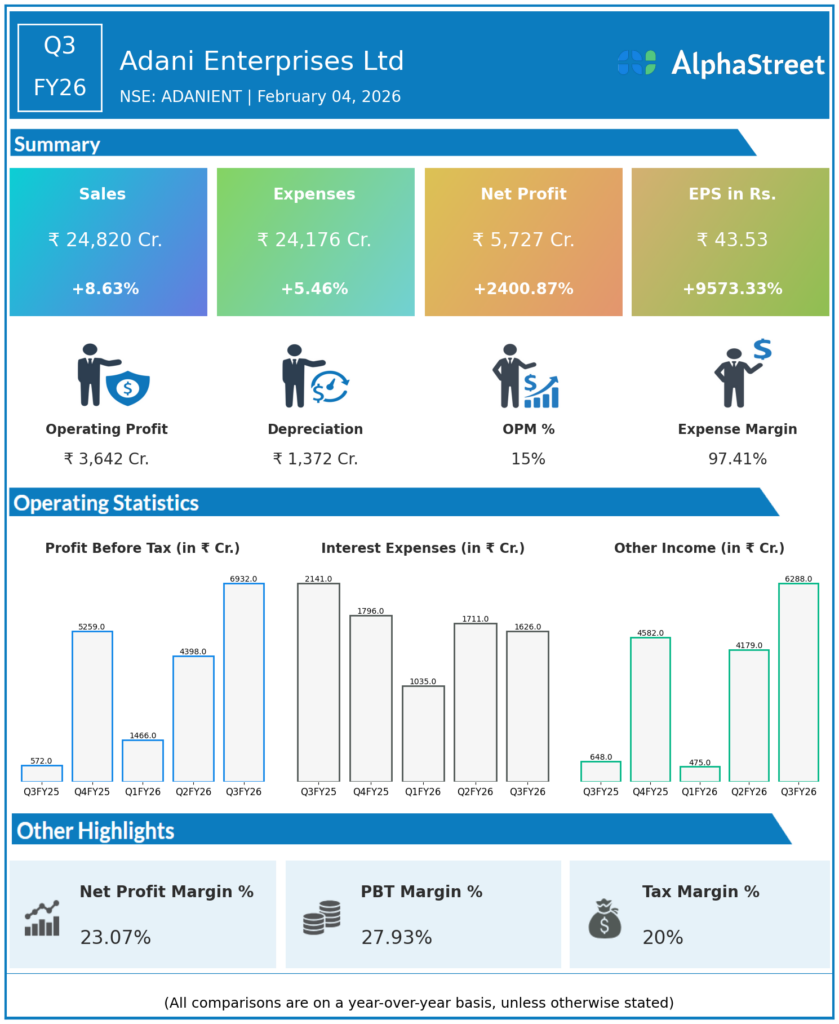

Adani Enterprises Ltd reported Q3FY26 revenues of ₹24,820 crore, up 8.63% YoY, with consolidated net profit exploding 2400.87% to ₹5,727 crore primarily from one-time exceptional gains. Strategic asset monetization across airports, new energy, and integrated resources drove the dramatic profitability leap despite modest operational growth.

Revenue & Growth

Revenues increased to ₹24,820 crore from ₹22,848 crore YoY, reflecting 8.63% expansion led by airports (+32%) and new energy ecosystem (+11%). Total expenses rose moderately 5.46% YoY to ₹24,176 crore, showcasing operational discipline across diversified infrastructure verticals.

Profitability & Margins

Consolidated net profit skyrocketed to ₹5,727 crore from ₹229 crore, fueled by ₹5,632 crore exceptional gains from strategic divestments. Basic EPS leaped to ₹43.53 from ₹0.45; underlying EBITDA grew 7% YoY to ₹8,224 crore across incubating businesses.

Balance-Sheet Highlights

Recent ₹24,930 crore rights issue strengthened liquidity; net debt sustained at manageable levels post-airport and green energy expansions. Balance sheet fortified for multi-year capex in data centers, solar manufacturing, and defence.

Cash Flow / Liquidity

Rights issue proceeds and divestment gains enhance liquidity; operational cash flows supported by airports (₹959 crore EBITDA) and new energy (₹749 crore EBITDA).

Key Ratios / Metrics

Exceptional gains masked core profitability; airports and new energy remain top EBITDA contributors at ₹3,842 crore and ₹3,124 crore revenue respectively. Strategic focus on energy transition and infrastructure incubation positions for sustained compounding.